Getting the right people into your focus group is like finding the perfect ingredients for a delicious meal; it’s absolutely crucial for the final outcome. You can have the best moderator and the most insightful questions, but if your participants do not truly represent your target audience or lack the experiences you need to explore, your research findings might miss the mark entirely. This is where a well-designed focus group recruitment survey template comes in handy, acting as your primary filter to ensure every participant brings value to the discussion. It streamlines the screening process, making sure you are speaking with individuals who can offer genuine, relevant insights for your project.

Think of this template as your gatekeeper, allowing you to efficiently filter through potential candidates to identify those who perfectly match your research criteria. It moves beyond just basic demographics, delving into behaviors, attitudes, and experiences that are essential for a productive focus group session. By using a structured survey, you save valuable time, reduce recruitment costs, and significantly improve the quality of your qualitative data. It is a systematic approach that turns the often chaotic task of recruitment into a smooth and manageable operation, setting the stage for rich, meaningful discussions that genuinely address your research objectives.

Crafting the Perfect Focus Group Recruitment Survey

Developing an effective focus group recruitment survey involves more than just throwing together a few questions. It requires a strategic approach to ensure you capture all necessary information without overwhelming potential participants. The core purpose of this survey is twofold: to identify individuals who meet your specific demographic and psychographic criteria, and to assess their suitability and willingness to participate in a group discussion. You want to ask questions that not only qualify them but also give you a glimpse into their potential contribution, ensuring a diverse yet relevant range of perspectives in your group.

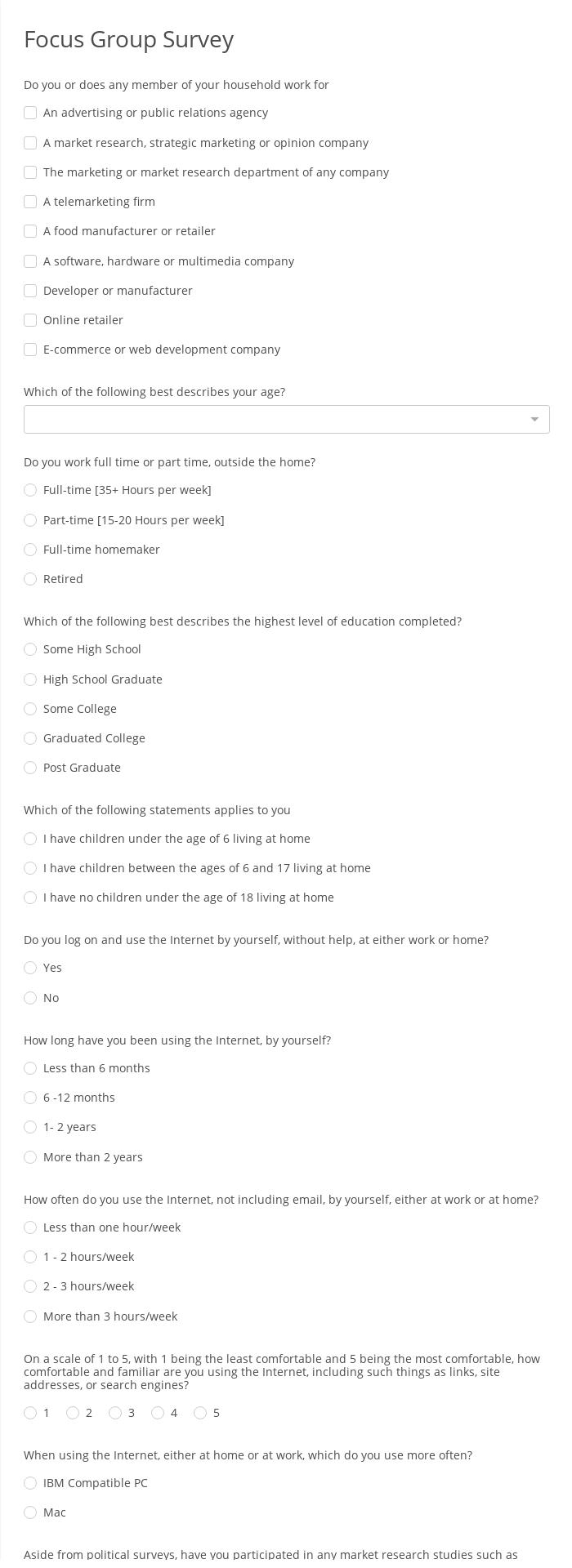

Your survey should begin with simple, non-sensitive questions to ease participants into the process, gradually moving towards more detailed and qualifying questions. Remember, the goal is to gently guide them through the screening process, not interrogate them. Questions about age, gender, geographic location, and income level are often standard starting points. Following these, you will introduce screening questions directly related to your research topic. For example, if you are researching a new smartphone app, you might ask about current smartphone usage, familiarity with similar apps, and general tech savviness.

It is crucial to include disqualification questions designed to weed out unsuitable candidates early on. These are often phrased in a way that allows a direct “yes” or “no” answer, making the screening process efficient. For instance, if you are targeting non-users of a specific product, you would ask “Are you a current user of [Product X]?” with a “Yes” answer leading to disqualification. Ensure these questions are clear and unambiguous to avoid misinterpretations that could lead to recruiting the wrong individuals.

Beyond demographics and screening, consider including a few open-ended questions that allow potential participants to elaborate on their experiences or opinions related to your topic. While these are not always strictly for disqualification, they can provide valuable qualitative insights even before the focus group begins and help you gauge a candidate’s articulation and willingness to share. This helps in forming a well-rounded group where participants are not only qualified but also genuinely engaged and articulate.

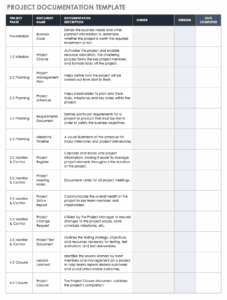

Key Sections to Include

- Demographic Information: Age, gender, location, income, education level, occupation.

- Screening Questions: Specific questions designed to qualify or disqualify based on behaviors, attitudes, or experiences relevant to the research topic.

- Product or Service Usage: Questions about familiarity with or usage of specific products, services, or brands.

- Participation Criteria: Questions to ensure they have the time, technology (if applicable for online groups), and willingness to participate fully.

- Contact Information and Consent: Collecting necessary details for follow-up and obtaining their agreement to participate and have their data used.

Always keep your survey concise. Respecting the respondent’s time encourages completion and yields better data. A lengthy, complicated survey can lead to high drop-off rates, meaning you miss out on potential valuable participants.

Beyond the Basics: Advanced Tips for Effective Recruitment

Once you have a solid focus group recruitment survey template in place, you can enhance its effectiveness by incorporating a few advanced strategies. One critical aspect is pilot testing your survey before full deployment. This involves administering the survey to a small sample of individuals who are representative of your target audience but who will not be part of the actual focus group. Pilot testing helps you identify any confusing questions, technical glitches, or areas where the survey might be too long or repetitive, allowing you to refine it for optimal performance.

Another tip is to think about the order and flow of your questions strategically. Start with broader, easier questions and gradually narrow down to more specific, sensitive, or qualifying ones. This creates a smoother experience for the respondent and reduces the likelihood of them abandoning the survey midway. Consider branching logic as well, where answers to certain questions lead respondents down different paths, ensuring they only see questions relevant to their previous responses, making the survey more personalized and efficient.

It is also beneficial to consider how you will manage and track responses. Using a robust survey platform allows you to automate the data collection process, easily filter responses, and keep track of your recruitment quotas. This automation frees up your time to focus on analyzing the incoming data and making informed decisions about whom to invite. Remember to clearly state the incentive for participation early in the survey, as this can significantly boost response rates and attract more committed individuals.

Finally, think about your communication strategy once candidates complete the survey. A prompt and professional follow-up, whether it is an invitation, a “thank you for your interest” message, or a gentle reminder, maintains a positive impression and ensures you secure the best candidates. Provide clear instructions for the next steps, whether it is a phone screening or a direct invitation to the focus group. A seamless recruitment process from start to finish not only builds trust but also contributes to a smoother and more successful focus group experience overall.

A thoughtfully constructed focus group recruitment survey is the cornerstone of any successful qualitative research endeavor. It acts as your primary tool for filtering through countless potential participants to identify those gems who truly align with your research objectives. By investing time and effort into creating a robust, clear, and efficient survey, you are setting the stage for insightful discussions and reliable data that will genuinely inform your strategic decisions.

Ultimately, the quality of your focus group findings directly correlates with the quality of your participants. By leveraging a comprehensive survey template, you are not just gathering names; you are building a foundation of relevant, articulate voices ready to contribute meaningful insights. This diligent approach ensures that your research truly resonates with the experiences and perspectives of your target audience, leading to stronger, more actionable outcomes for your project.