So, you’re thinking about lending money to a friend or family member, or maybe you’re on the other side of the coin and borrowing some cash. That’s fantastic! But before you shake hands and call it a deal, it’s crucial to get everything in writing. Trust me, a simple agreement can save you a whole lot of headaches and heartache down the road. That’s where a personal loan documentation template comes in handy. It’s like a safety net for your relationship and your finances.

Think of it this way: even the friendliest loan can turn sour if expectations aren’t crystal clear. What happens if your friend loses their job and can’t make payments? What if you suddenly need that money back sooner than expected? A well-crafted personal loan documentation template can address these “what if” scenarios, providing a framework for communication and resolution if things get bumpy.

Using a template isn’t about distrusting the other person; it’s about being responsible and protecting both of you. It shows that you’re taking the loan seriously and that you’ve thought through the details. Plus, having everything written down makes it easier to track payments and avoid misunderstandings. Let’s dive into why these templates are so important and how to use them effectively.

Why Using a Personal Loan Documentation Template is Essential

Imagine lending a significant amount of money to a friend based solely on a verbal agreement. Sounds risky, right? Without a formal agreement, you’re relying entirely on memory and good faith, which can be shaky foundations, especially if disagreements arise. A personal loan documentation template provides a tangible record of the loan terms, preventing ambiguity and ensuring everyone is on the same page.

The template serves as a comprehensive guide, outlining key details such as the loan amount, interest rate (if any), repayment schedule, and any collateral involved. This clarity helps avoid future disputes related to these critical aspects. For example, a clearly defined repayment schedule eliminates confusion about when payments are due and the amount of each installment.

Moreover, a template can specify what happens in case of default. What are the consequences if the borrower fails to make payments as agreed? Does the lender have the right to seize collateral? Addressing these potential issues upfront helps protect the lender’s interests and provides a framework for resolving conflicts if they occur.

Consider the peace of mind that comes with knowing you have a legally sound document in place. In the unfortunate event that legal action becomes necessary, a properly executed personal loan documentation template serves as crucial evidence to support your claim. It demonstrates that you took the necessary steps to formalize the loan agreement and protect your investment.

Ultimately, using a personal loan documentation template is about promoting transparency, fostering trust, and mitigating risk. It’s a responsible approach to lending and borrowing that benefits both parties involved by setting clear expectations and providing a safety net in case of unforeseen circumstances.

Key Elements of an Effective Personal Loan Agreement

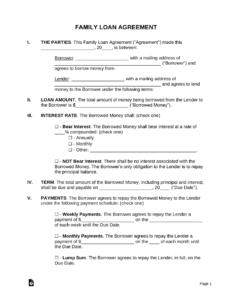

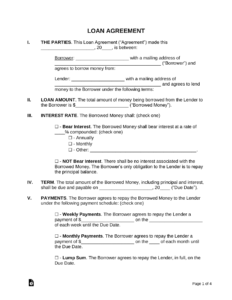

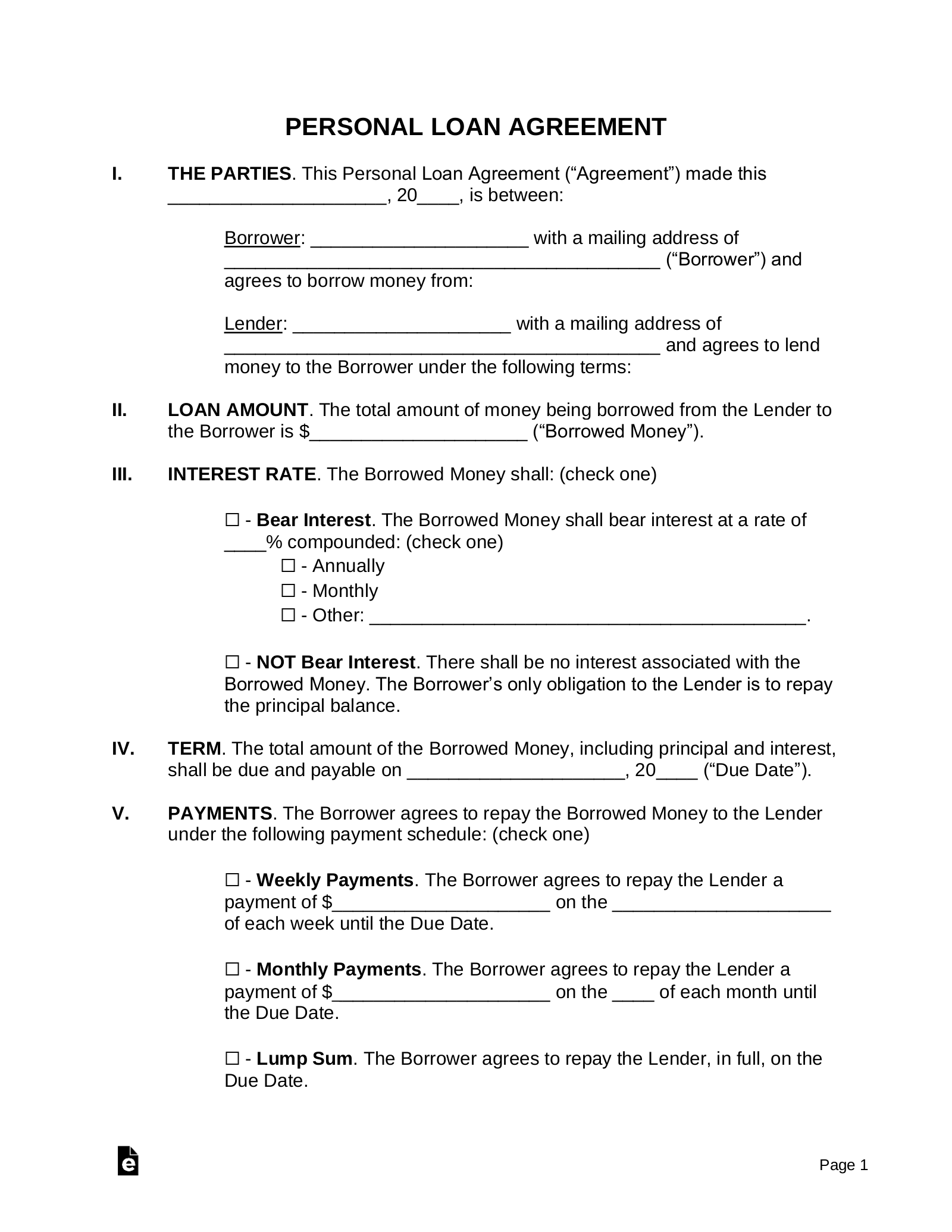

A robust personal loan documentation template should cover several essential elements to ensure clarity and legal soundness. First and foremost, it needs to clearly identify the parties involved: the lender and the borrower, including their full names and addresses. This seemingly simple step is crucial for establishing the legal identity of those bound by the agreement.

Next, the template must specify the loan amount with absolute precision. State the principal amount being loaned in both numerical and written form (e.g., “$5,000” and “Five Thousand Dollars”). This eliminates any potential ambiguity about the exact amount of money being transferred.

Another vital element is the interest rate, if applicable. If you’re charging interest, clearly state the annual percentage rate (APR). Also, detail how the interest is calculated and when it’s accrued. Even if the loan is interest-free, it’s important to explicitly state “0% interest” to avoid any misunderstandings.

The repayment schedule is arguably one of the most critical sections. Outline the frequency of payments (e.g., monthly, quarterly), the due date for each payment, and the method of payment (e.g., check, electronic transfer). Be specific about late payment penalties, if any, and the grace period allowed before a late fee is assessed. Including an amortization table can be helpful for visualizing the repayment schedule.

Finally, the agreement should address default and remedies. Specify what constitutes a default (e.g., missing multiple payments) and the lender’s recourse in such a situation. This might include the right to accelerate the loan (demand immediate repayment of the entire outstanding balance), seize collateral (if applicable), or pursue legal action. Including a section on governing law specifies which jurisdiction’s laws will apply to the agreement.

Life throws curveballs, and sometimes financial situations change unexpectedly. Documenting a loan ensures everyone is protected should a situation like this happen.

By using a solid personal loan documentation template, you’re setting the stage for a smooth and mutually beneficial lending experience.