Navigating the aftermath of a loved one’s passing is never easy. Amidst the grief, there are practical matters that need to be addressed, and one of the most important is managing the deceased’s estate. In Pennsylvania, this involves gathering and organizing a significant amount of paperwork. The process can feel overwhelming, especially during an already emotionally challenging time. That’s where a comprehensive pa estate documentation template can be a lifesaver.

Think of a pa estate documentation template as a roadmap, guiding you through the necessary steps and ensuring you don’t miss any crucial details. It’s essentially a pre-designed framework that helps you compile all the essential information required for administering the estate, whether it’s for probate purposes or simply for settling the deceased’s affairs. Using a template can save you valuable time and reduce the risk of errors, helping you manage the estate efficiently and effectively.

This article will delve into the specifics of what a pa estate documentation template should include, how to use it effectively, and where you can find reliable resources to help you through the estate administration process in Pennsylvania. We’ll break down the complex legal jargon into simpler terms, so you can confidently navigate this challenging time with clarity and peace of mind.

Understanding the Importance of Proper Estate Documentation in Pennsylvania

Proper estate documentation is absolutely critical in Pennsylvania for several reasons. First and foremost, it’s legally required. The Orphans’ Court, which oversees estate administration in Pennsylvania, requires specific forms and documents to be filed at various stages of the process. Failing to provide accurate and complete documentation can lead to delays, legal complications, and even potential penalties.

Beyond the legal requirements, accurate documentation also ensures fairness and transparency for all interested parties. Beneficiaries, creditors, and other stakeholders have a right to know how the estate is being managed and how assets are being distributed. Clear and comprehensive documentation provides a verifiable record of all transactions, minimizing the risk of disputes and ensuring that everyone is treated equitably.

Furthermore, good documentation simplifies the tax filing process. Estates are often subject to both federal and Pennsylvania estate taxes, and accurate records are essential for calculating the tax liability and filing the necessary returns. Without proper documentation, you could face audits, penalties, and even legal action from tax authorities.

Think about it – imagine trying to sell a property belonging to the estate without clear ownership records or trying to distribute assets to beneficiaries without a proper accounting of the estate’s finances. It would be a nightmare! Proper documentation prevents these problems and allows for a smooth and efficient administration of the estate.

In essence, comprehensive estate documentation is not just about filling out forms; it’s about ensuring legal compliance, promoting transparency, simplifying tax matters, and protecting the interests of all involved. It is also important in identifying all estate property and determining proper ownership and/or title. A pa estate documentation template will help you organize and prioritize all of these tasks.

Key Components of a Comprehensive PA Estate Documentation Template

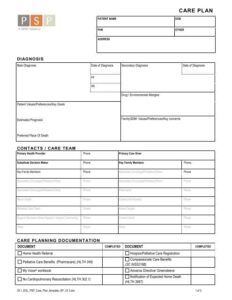

A well-designed pa estate documentation template should include several key components to ensure that you capture all the necessary information for estate administration in Pennsylvania. Here are some of the essential elements:

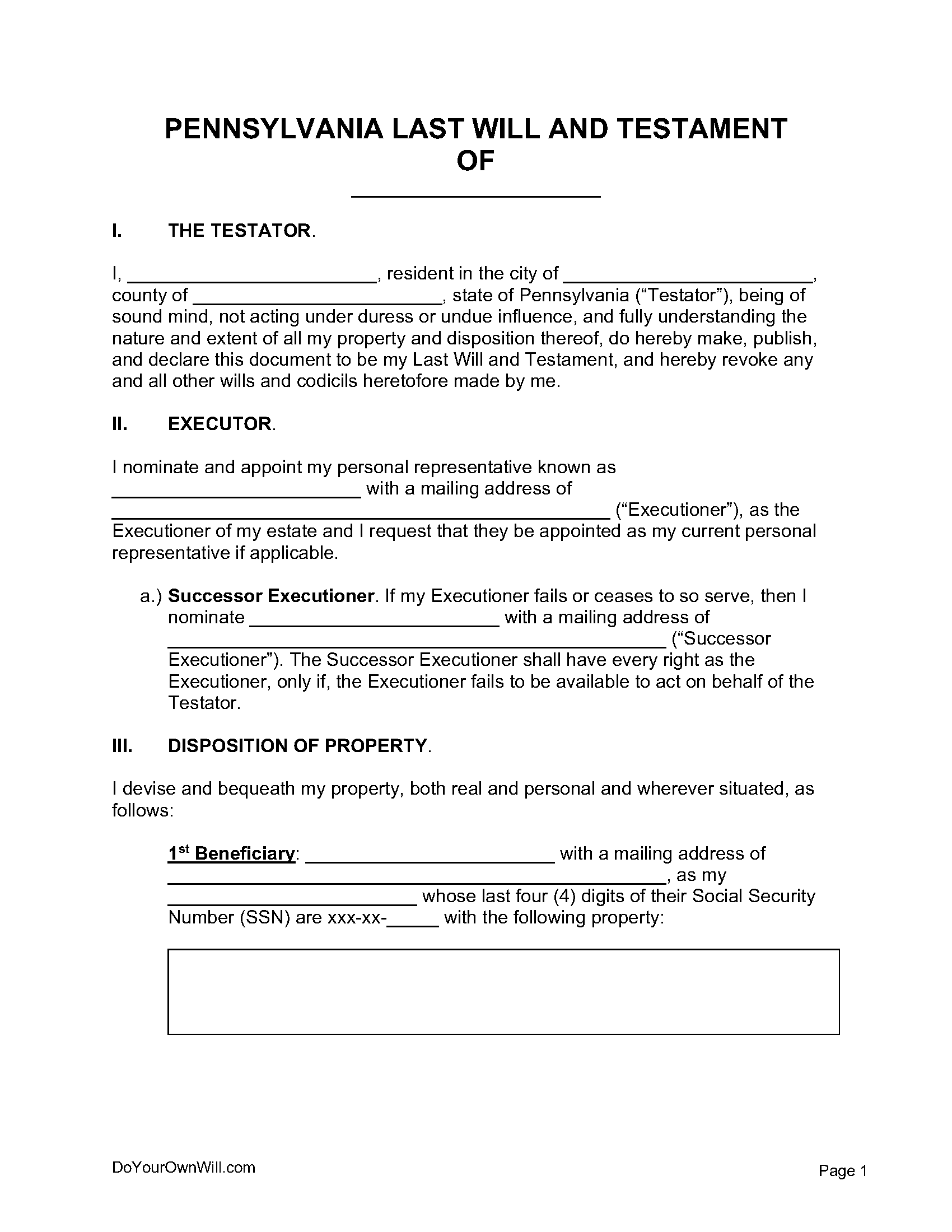

First, you’ll need a section for the deceased’s personal information, including their full name, date of birth, date of death, Social Security number, and address. This information is fundamental for identifying the deceased and establishing their residency in Pennsylvania.

Next, the template should include a detailed inventory of all estate assets. This includes real estate, bank accounts, investment accounts, vehicles, personal property, and any other assets owned by the deceased at the time of their death. For each asset, you should record its value, location, and any relevant account numbers or identifying information.

The template should also have a section for listing all liabilities of the estate, such as debts, loans, mortgages, and outstanding bills. It’s important to gather documentation supporting each liability, such as invoices, statements, and loan agreements.

Another crucial component is a record of all income and expenses related to the estate. This includes income generated by the estate assets, such as rent or dividends, as well as expenses incurred during the administration process, such as legal fees, accounting fees, and funeral expenses. Maintaining accurate records of income and expenses is essential for accounting purposes and tax reporting.

Finally, the template should include a section for documenting all distributions made to beneficiaries. This includes the date of each distribution, the amount distributed, and the recipient’s name and contact information. Keeping a detailed record of distributions is essential for ensuring that all beneficiaries receive their rightful share of the estate.

Think of this template as a comprehensive guide that organizes the entire estate picture. Without this thorough documentation, it is virtually impossible to properly settle an estate according to Pennsylvania law.

This is a difficult time and proper pa estate documentation template can help you navigate the process.

Remember, each estate is unique, and you may need to adapt the template to fit the specific circumstances of the case. However, by including these key components, you can create a comprehensive documentation system that will help you manage the estate efficiently and effectively.