Ever wonder why some customers stick around while others disappear without a trace? Often, it boils down to their experience, especially when money is involved. Billing interactions, while seemingly transactional, are actually crucial touchpoints that can make or break a customer relationship. A smooth, transparent, and helpful billing process can build immense trust and loyalty, turning what could be a point of friction into an opportunity to shine.

That’s where gathering feedback becomes incredibly powerful. Understanding how your customers perceive your billing support and processes isn’t just good practice; it’s essential for sustained growth and customer retention. By proactively asking for their thoughts, you not only identify areas for improvement but also demonstrate that you genuinely value their experience. It’s about turning potential frustrations into positive interactions and ensuring your financial dealings are as seamless as possible for everyone involved.

Why Understanding Billing Customer Experience is Non-Negotiable

In today’s competitive landscape, simply providing a service isn’t enough; the entire customer journey, including billing, must be exceptional. Neglecting the billing experience can lead to customer churn, negative reviews, and a damaged reputation. Imagine a customer who loves your product but constantly struggles with confusing invoices or unhelpful support when they have a billing query. This friction can quickly erode goodwill, regardless of how good your core offering is. A well-designed billing customer service survey template helps you pinpoint these pain points before they escalate.

The insights gained from these surveys are invaluable. They allow you to move beyond assumptions and base your improvements on actual customer feedback. Are your bills clear? Is your payment portal user-friendly? Are your billing support agents knowledgeable and empathetic? These are the kinds of questions that a targeted survey can answer, giving you actionable data to refine your operations. It’s not just about fixing problems; it’s about optimizing an often-overlooked aspect of customer service that directly impacts your bottom line.

Furthermore, by consistently seeking feedback, you build a culture of continuous improvement within your organization. Your customer service team, especially those handling billing inquiries, gains a clearer understanding of what’s working and what needs attention. This empowers them to provide better support, feeling more connected to the customer experience. Ultimately, an improved billing experience translates to fewer complaints, reduced support load, and happier customers who are more likely to stay with you and recommend your services to others.

Key Benefits of Soliciting Billing Feedback

- Enhanced Customer Retention: Addressing billing issues promptly and effectively prevents customers from leaving due to financial frustrations.

- Improved Operational Efficiency: Identifying common problems helps streamline billing processes, reducing errors and support tickets.

- Stronger Customer Loyalty: Showing customers their feedback matters builds trust and fosters a sense of being valued.

- Positive Word-of-Mouth: Happy customers become advocates, sharing their positive experiences, including smooth billing interactions.

- Data-Driven Decision Making: Quantitative and qualitative data from surveys provides clear guidance for strategic improvements.

Utilizing a comprehensive billing customer service survey template ensures you cover all the bases, from invoice clarity to the helpfulness of your support staff, giving you a holistic view of this critical customer touchpoint.

Crafting an Effective Billing Customer Service Survey Template

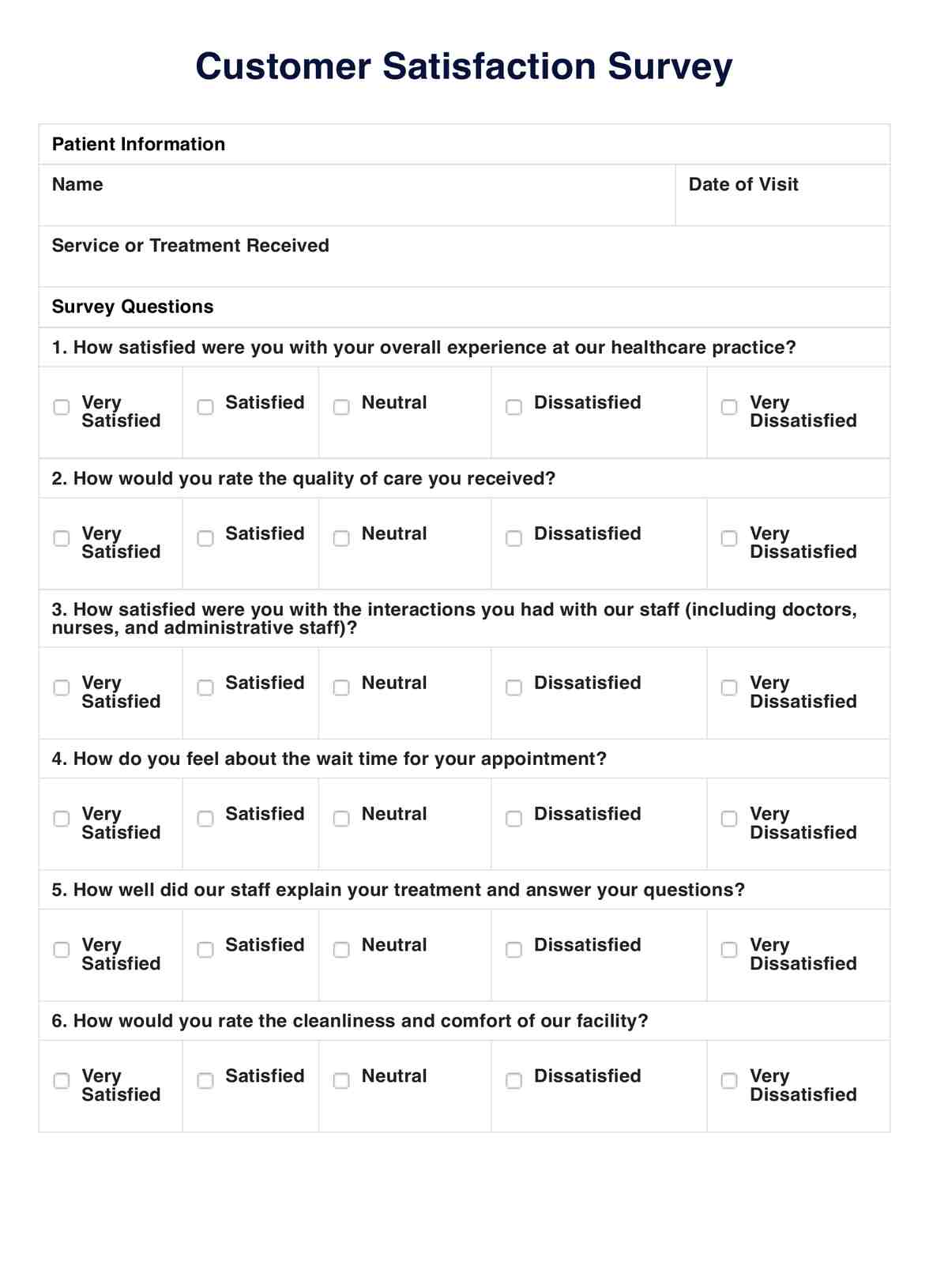

When it comes to designing your survey, thoughtful construction is key. You want to ask questions that elicit useful, actionable responses without overwhelming the customer. Start by defining your objectives: are you looking to improve invoice clarity, gauge support agent performance, or assess the ease of your payment system? Your goals will shape the types of questions you include and the overall structure of your billing customer service survey template.

Consider a mix of question types to gather both quantitative and qualitative data. Rating scales (e.g., “On a scale of 1-5, how clear was your recent invoice?”) are great for tracking trends and benchmarking. Open-ended questions (e.g., “What could we do to make your billing experience even better?”) provide rich, nuanced insights that often reveal underlying issues you might not have anticipated. Remember to keep the survey concise to maximize completion rates, respecting your customers’ time while still gathering sufficient information.

Think about the timing and distribution of your survey too. Sending a survey immediately after a billing interaction or a payment due date can yield the most accurate feedback, as the experience is still fresh in the customer’s mind. Utilize various channels like email, in-app notifications, or even a QR code on physical invoices to reach a wider audience. Make it easy for customers to respond, ensuring the survey is mobile-friendly and accessible from any device.

Finally, don’t just collect the data and let it sit there. The real value comes from analyzing the responses and implementing changes based on your findings. Share the insights with relevant teams, whether it’s the customer service department, accounting, or product development. Close the feedback loop by communicating to your customers about the improvements you’ve made as a direct result of their input. This reinforces that their voice matters and encourages continued engagement, transforming your billing processes from a potential pain point into a genuine strength for your business.

Ultimately, investing in a robust feedback mechanism for your billing operations is a proactive step towards building stronger, more enduring customer relationships. It’s about ensuring every interaction, including the financial ones, contributes positively to their overall perception of your brand.

By actively listening and responding to what your customers tell you about their financial dealings, you not only fix problems but also discover opportunities to innovate and exceed expectations. This diligent approach fosters a virtuous cycle of improvement, leading to greater customer satisfaction, reduced churn, and a healthier bottom line for your business.