Lending money to a family member often comes from a place of love and a desire to help, but it can also be a minefield for relationships if not handled carefully. What starts as a simple act of generosity can quickly become a source of stress, resentment, and misunderstanding when repayment terms are unclear or expectations diverge. While the thought of a formal agreement with a loved one might seem unnecessary or even cold, it’s precisely this formality that can protect both the lender and the borrower, ensuring the relationship remains intact.

This is where having a clear, written agreement becomes not just helpful, but essential. It’s about setting clear boundaries and expectations in a way that is respectful and transparent for everyone involved. Instead of awkward conversations and unspoken assumptions, a well-structured agreement provides a roadmap for repayment, preventing potential conflicts down the line and transforming a potentially risky family loan into a clear and manageable arrangement. Using a proper loan contract template for family situations can make all the difference.

Why a Formal Loan Agreement is Essential, Even for Family

The idea of drafting a formal document for a family loan might seem like overkill, or even a sign of distrust. However, it’s quite the opposite. A well-defined loan agreement is a sign of respect and foresight. It acknowledges that even with the best intentions, memories can fade, circumstances can change, and interpretations of verbal agreements can differ significantly. Without a clear document, a simple loan can easily morph into a complex emotional burden, leading to strained relationships and potentially irreconcilable disputes.

Think of it as a blueprint for a shared understanding. It eliminates ambiguity regarding the amount borrowed, the repayment schedule, and any agreed-upon interest. This clarity protects the lender from the uncomfortable position of having to repeatedly ask for their money back, and it protects the borrower from feeling harassed or unclear about their obligations. It transforms a favor into a structured financial agreement, preserving the emotional goodwill that is so vital in family bonds.

Moreover, a written agreement provides a degree of legal protection, should the worst-case scenario arise. While no one wants to envision taking legal action against a family member, having a document outlining the terms offers a basis for resolution if communication breaks down completely. It can also be crucial for tax purposes, as the Internal Revenue Service might view large informal family loans as gifts, potentially triggering gift taxes for the lender if not properly documented as a loan with intent for repayment.

Key Elements to Include in Your Family Loan Contract

When putting together your family loan contract, certain details are non-negotiable to ensure its effectiveness and clarity. These elements form the backbone of your agreement, leaving no room for misinterpretation and ensuring both parties understand their roles and responsibilities. Having a solid framework means you’re covering all your bases without making the process overly complicated.

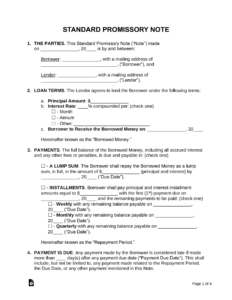

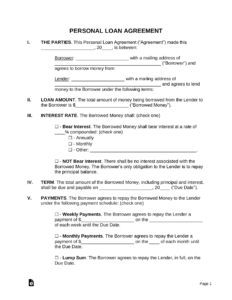

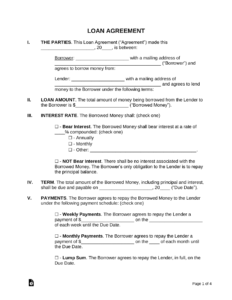

* Names and contact information of both the lender and the borrower.

* The exact principal amount of the loan.

* The interest rate, if any, applied to the loan.

* The repayment schedule, including the frequency and amount of each payment.

* The total number of payments and the final repayment date.

* Details regarding any collateral offered by the borrower, if applicable.

* What constitutes a default on the loan and the consequences of such a default.

* A clause allowing for early repayment without penalty, if desired.

* The date the agreement is signed and the signatures of both parties and any witnesses.

Including these specific details ensures that the agreement is comprehensive and leaves no stone unturned. It moves beyond a simple “I owe you” to a professional-grade understanding that is both thorough and considerate of the unique family dynamic. The more precise the document, the less room there is for future disagreements or misunderstandings.

Ultimately, the goal is to create a sense of security and fairness for everyone involved. By clearly outlining all the terms upfront, you are not just safeguarding your money; you are safeguarding your relationship. This proactive approach helps maintain trust and open communication, which are priceless in any family.

Navigating Sensitive Conversations and Getting Started

Broaching the topic of a formal loan agreement with a family member can feel awkward, even intimidating. It requires a delicate touch and a clear explanation of why such a document is beneficial for everyone, not just the lender. The key is to frame the conversation around protecting the relationship and ensuring clarity, rather than implying a lack of trust. You can start by explaining that you want to set clear expectations so there are no misunderstandings that could damage your bond in the future.

Approach the discussion with empathy and transparency. Explain that a written agreement helps both parties remember the terms and reduces stress by eliminating guesswork. You might say something like, “I’d love to help you out, and to make sure this works smoothly for both of us and doesn’t put a strain on our relationship, I think it’s a good idea to put the details down in writing, just like any other agreement.” This sets a professional yet caring tone, emphasizing mutual benefit.

When introducing the idea of a loan contract template for family use, highlight its simplicity and how it provides a ready-made framework, so you don’t have to start from scratch. Many templates are designed to be user-friendly, allowing you to easily fill in the specific details of your agreement. This makes the process less daunting and more accessible for both parties, moving the conversation from a general idea to a concrete plan of action.

Remember that while a template provides an excellent starting point, every family situation is unique. Feel free to customize the template to fit your specific needs and comfort levels. For more complex loans or significant amounts, considering a brief consultation with a legal professional might be a wise step to ensure all legalities are covered and the agreement is fully enforceable, adding an extra layer of reassurance.

Formalizing a family loan through a written contract might seem like an extra step, but it is an investment in the health of your relationships. It prevents small financial issues from becoming large emotional burdens, ensuring that generosity remains a positive force rather than a source of discord. By setting clear boundaries and expectations from the outset, you empower both the lender and the borrower to manage the loan responsibly, fostering an environment of trust and mutual respect. This careful approach helps to preserve the invaluable bonds of family, allowing everyone to focus on what truly matters.