Lending money to a friend can sometimes feel like navigating a minefield. On one hand, you want to help someone you care about, especially when they are in a tight spot. On the other hand, mixing money with friendship often leads to uncomfortable situations, misunderstandings, and sometimes, the unfortunate end of a cherished relationship. It’s a delicate balance that many of us face at some point.

That’s why, even with the best intentions and the strongest bonds, having a clear understanding is absolutely vital. While a verbal agreement might seem sufficient at the moment, memories can fade, interpretations can differ, and circumstances can change. This is where a formal agreement, even for a casual loan between buddies, becomes an indispensable tool for preserving both your money and your friendship.

Why a Formal Agreement Is Crucial, Even for Your Best Buddy

It might feel a little awkward to suggest a written agreement when a friend asks for financial help. After all, aren’t friends supposed to trust each other implicitly? While trust is fundamental, money has a unique way of testing even the most resilient relationships. What starts as a simple act of generosity can quickly turn sour if expectations aren’t clearly defined from the outset. Imagine the discomfort when repayment dates are missed, or the amount being paid back isn’t what you remembered agreeing upon.

Without a written record, these situations often spiral into hurt feelings, unspoken resentments, and ultimately, a breakdown in communication. It’s not about distrusting your friend; it’s about being responsible and protecting both of you from potential misunderstandings down the line. A formal agreement provides clarity, removes ambiguity, and ensures both parties are on the same page regarding the terms of the loan. It acts as a safety net for your friendship, allowing you to help your friend without putting your bond at risk.

Think of it as setting clear boundaries that benefit everyone involved. It allows the borrower to understand their obligations fully, and it gives the lender peace of mind, knowing that the terms are documented and agreed upon. This proactive step can prevent countless headaches and heartaches, proving that taking a little extra time upfront can save a lot of stress in the future. It’s about being pragmatic and ensuring that goodwill doesn’t get lost in translation.

Key Elements to Include in Your Agreement

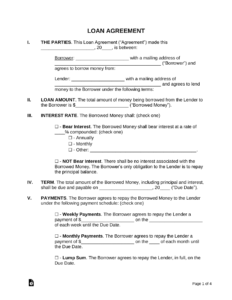

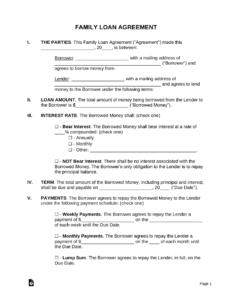

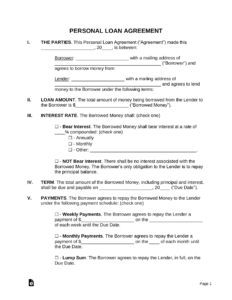

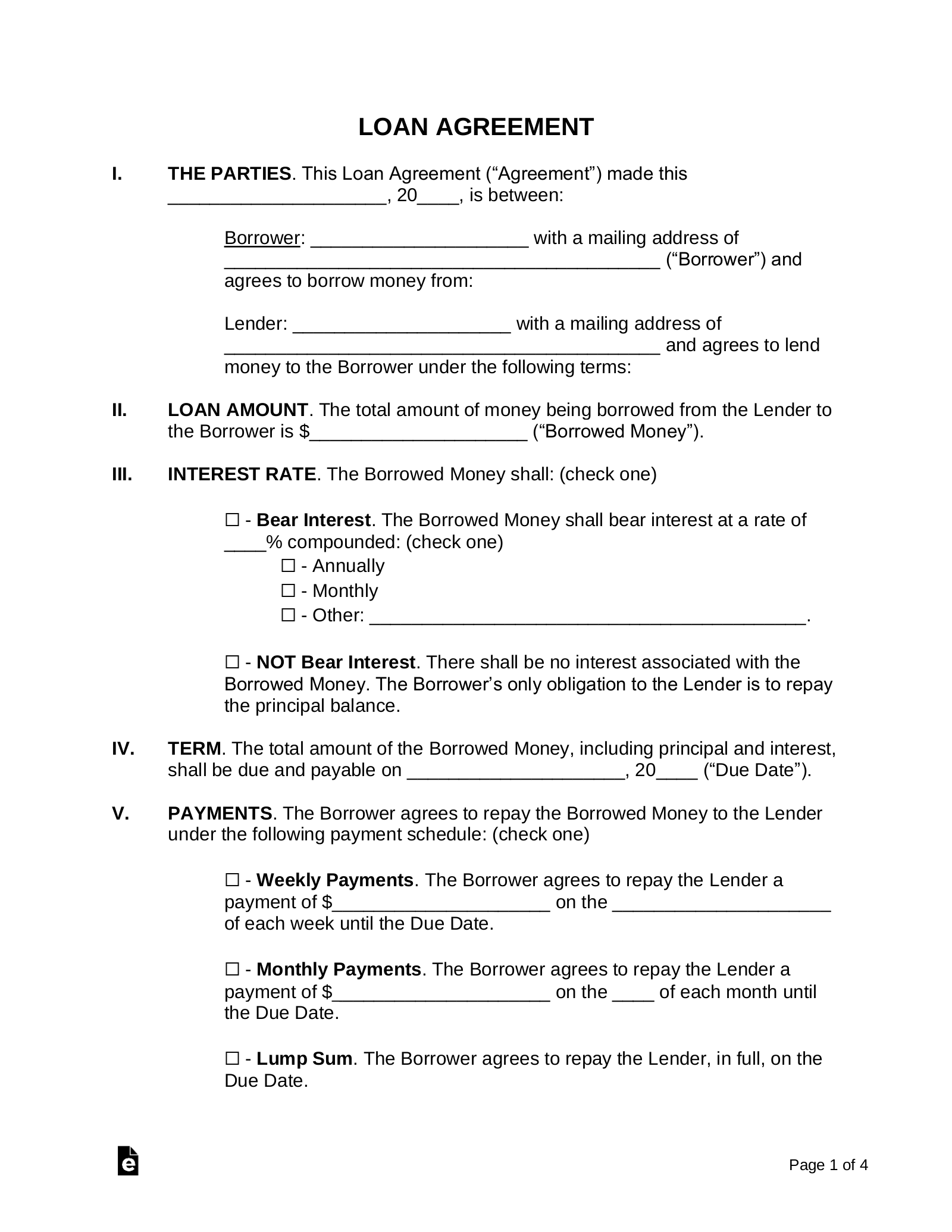

When you’re looking for a loan contract between friends template, it’s important to know what crucial details should never be left out. These components ensure that your agreement is comprehensive and leaves no room for doubt:

-

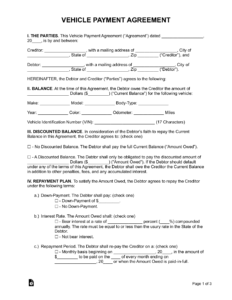

Names and Contact Information of Both Parties: Clearly identify who the lender is and who the borrower is, along with their current addresses and phone numbers. This ensures there’s no confusion about who is involved in the agreement.

-

The Exact Loan Amount: State the precise sum of money being lent. Be specific and use both numerical and written forms (e.g., “$1,000.00 One Thousand US Dollars”) to avoid any discrepancies.

-

Repayment Schedule: This is perhaps the most critical part. Outline how and when the money will be repaid. Will it be a single lump sum on a specific date? Or will it be in installments? If installments, specify the amount of each payment and the exact due date for each one (e.g., “$100 on the 1st of each month”).

-

Interest Rates (or lack thereof): Clearly state whether interest will be charged on the loan. If yes, specify the annual percentage rate (APR) and how it will be calculated. If no interest, explicitly state that the loan is interest-free. This detail is crucial for financial transparency.

-

Late Payment Penalties: What happens if a payment is missed or delayed? Include a clause outlining any late fees or consequences for defaulting on the repayment schedule. This encourages timely repayment and provides a clear course of action if issues arise.

-

Signatures and Date: Both the lender and the borrower must sign and date the agreement. This signifies their mutual understanding and acceptance of all the terms. Consider having a witness or even a notary public for larger amounts, though for friends, just signatures might suffice.

How to Discuss and Implement Your Loan Agreement

Bringing up the topic of a formal loan agreement with a friend can feel like walking on eggshells. You want to be helpful, but you also need to be prudent. The best approach is to be upfront, honest, and frame it as a protective measure for both your finances and your friendship. You can start by saying something like, “I’d love to help you out, and to make sure there are no misunderstandings between us, I think it’s a good idea to put the terms in writing, just like any other agreement.” This sets a professional yet caring tone.

When you’ve found a suitable loan contract between friends template, sit down together to review it. Don’t just hand it over and expect them to sign. Go through each section, explaining what it means and why it’s there. This collaborative process ensures that both parties fully understand and agree to every single clause. It’s an opportunity to clarify any questions and make adjustments if necessary, fostering an environment of trust and mutual respect around the financial arrangement.

Emphasize that the document is there to provide clarity and peace of mind for both of you. It’s not about implying a lack of trust, but rather about ensuring that your friendship remains strong by preventing money matters from becoming a source of stress or disagreement. Once everyone is in agreement, sign the document, and ensure both you and your friend have a copy for your records. This small act of formalization can save your friendship from a future fraught with potential financial discord.

For larger sums, you might even consider having a neutral third party witness the signing, or for ultimate peace of mind, getting it notarized. While this might seem overly formal for a friend, it adds an extra layer of legal validity and demonstrates the seriousness of the commitment, protecting both parties should any unforeseen issues arise. Remember, taking these practical steps can solidify your agreement and, more importantly, safeguard your invaluable friendship.

Ultimately, helping a friend financially is a generous act, and it’s one that should ideally strengthen your bond, not strain it. By taking the sensible step of documenting the terms of a loan, you’re not just protecting your money; you’re actively preserving the integrity of your friendship.

Embrace the clarity and peace of mind that come with a well-defined agreement. It’s a testament to responsible friendship, ensuring that your kind gesture remains a positive memory for everyone involved, free from the shadow of financial ambiguity.