Dealing with returned checks is an unfortunate but common reality for many businesses, regardless of their size. It can be frustrating and costly, leading to administrative burdens and unexpected financial setbacks. However, how you handle these situations can significantly impact your business’s financial health and customer relationships. Clear communication is absolutely paramount during these challenging times.

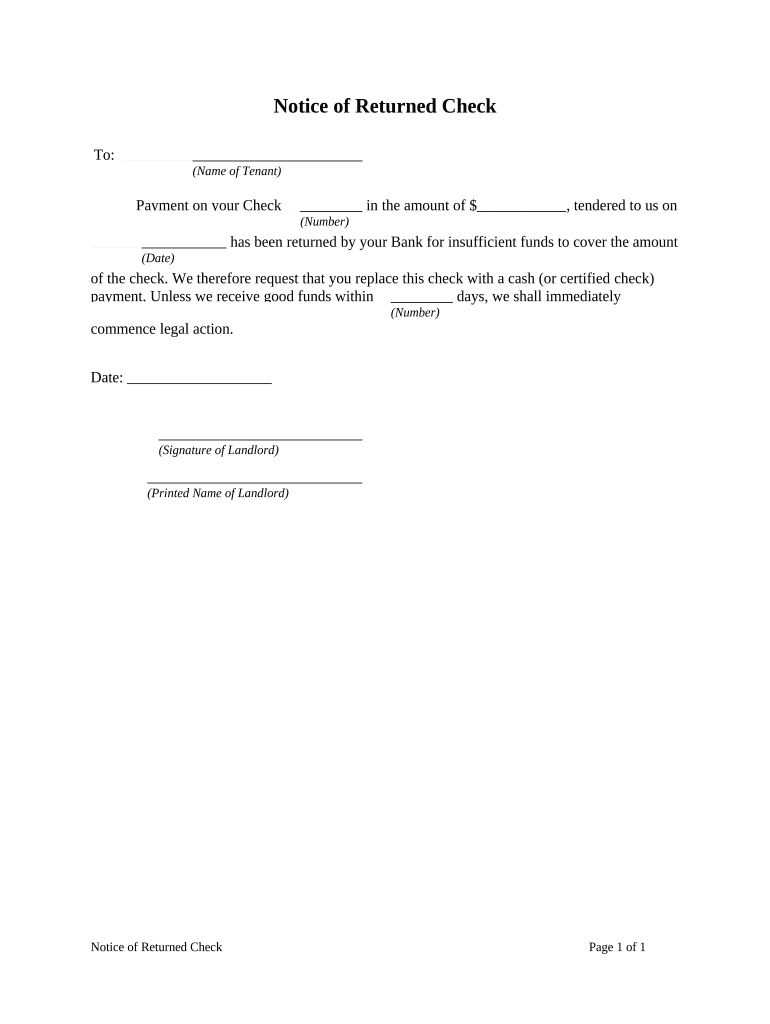

When a check bounces, it’s not enough to simply note the issue internally. You need a structured and professional way to inform the customer about the problem, the associated fees, and the next steps they need to take. This is where a well-crafted returned check fee notice template becomes an invaluable tool, ensuring consistency, clarity, and legal compliance in your communication.

Having a standardized template not only saves you time and effort each time a check is returned but also helps you maintain a professional image and clearly outline the consequences. It acts as a formal record of your communication and ensures that all necessary information is conveyed to the payee promptly and accurately, helping you recover funds more efficiently.

Understanding the Why and What of a Returned Check Notice

Sending a formal notice when a check is returned is not just good practice; it’s often a necessary step for financial recovery and maintaining proper legal and accounting records. Businesses incur fees from their banks when checks bounce, and these costs, along with the original amount due, need to be recovered from the customer. A clear notice helps to mitigate your losses and sets the expectation for timely resolution.

From a customer relationship perspective, while it’s an uncomfortable conversation, a professional notice ensures there are no misunderstandings. It provides all the facts upfront, allowing the customer to understand the situation and rectify it. Without a formal notice, customers might be unaware of the issue or the fees involved, leading to further delays or disputes.

The financial implications for a business can accumulate quickly if returned checks are not managed systematically. Each returned check can result in multiple charges: the original bank’s fee for the returned item, your bank’s fee for processing the returned item, and the potential loss of the original payment. A robust notice system, ideally built around a solid returned check fee notice template, is crucial for mitigating these costs.

Key Information Your Notice Must Include

- Date of Notice: When the letter was created and sent.

- Recipient’s Name and Address: Clear identification of the party responsible.

- Original Check Details: The check number, the date it was issued, and the original amount.

- Reason for Return: Commonly “Insufficient Funds” (NSF), “Account Closed,” or “Stop Payment.”

- Original Amount Due: The amount of the bounced check.

- Returned Check Fee: The specific fee your business charges for handling the returned check, clearly stated.

- Total Amount Due: The sum of the original amount and the returned check fee.

- Payment Instructions: How and where the customer can make the payment (e.g., online, mail, in person) and the acceptable forms of payment.

- Payment Deadline: A reasonable date by which the payment must be received to avoid further action.

- Consequences of Non-Payment: What will happen if the total amount due is not paid by the deadline (e.g., collections, additional fees, legal action).

- Contact Information: Who the customer can reach out to for questions or to discuss the matter.

Ensuring that your payment instructions are explicit and offer multiple convenient options can significantly speed up the recovery process. A firm but polite tone that emphasizes resolution rather than accusation is usually the most effective approach. Providing a clear deadline also creates a sense of urgency without being overly aggressive.

Finally, always be mindful of local and state laws regarding returned check fees and collection practices. These regulations can vary significantly and dictate how much you can charge as a fee, the language you can use, and the steps you must follow before pursuing further legal action. Consulting with legal counsel can ensure your returned check fee notice template is fully compliant.

Tips for Customizing Your Returned Check Fee Notice Template

While a template provides a solid foundation, customizing it to reflect your business’s specific policies and tone is essential. The language should be professional, firm, and clear, avoiding jargon that might confuse the recipient. Remember, the goal is to inform and facilitate payment, not to intimidate. Your notice should align with your brand’s overall communication style while delivering a serious message.

Think about the various scenarios that might lead to a returned check. While "insufficient funds" is common, others like "account closed" or "stop payment" require slightly different considerations. Your template should be flexible enough to incorporate these specific reasons clearly. Additionally, consider how your original terms of service or contracts address returned checks and ensure your notice references these agreements where appropriate.

Creating a standardized process around your returned check fee notice template helps ensure that every instance is handled consistently. This includes not only the content of the notice but also how and when it is sent, who is responsible for follow-up, and how payments are recorded. Consistency protects your business and provides a fair and predictable experience for your customers, even in difficult circumstances.

- Be prompt: Send the notice as soon as possible after receiving notification of the returned check.

- Keep records: Maintain copies of all notices sent, along with proof of mailing or delivery.

- Review periodically: Update your template to reflect any changes in company policy, banking fees, or legal requirements.

Effectively managing returned checks is a critical component of maintaining good cash flow and minimizing financial losses. A comprehensive and compliant notice system is your first line of defense.

By proactively addressing returned checks with a professional and detailed notice, businesses can streamline their recovery efforts and maintain financial stability. It’s about more than just recovering funds; it’s about upholding your business’s policies and ensuring fair practice for all parties involved.