Have you ever wondered what happens to forgotten bank accounts, uncashed utility refunds, or even old stock dividends that simply sit untouched for years? These financial assets, often overlooked or simply forgotten by their rightful owners, become what is known as “unclaimed property.” Every year, billions of dollars worth of property end up in state treasuries because companies are legally obligated to report and eventually transfer these assets if the owner cannot be located after a certain period of inactivity.

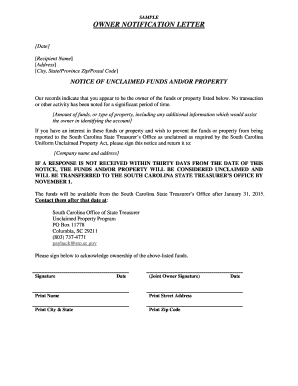

For businesses and organizations that hold these assets, managing unclaimed property is a significant responsibility, carrying strict legal obligations. Before any property can be turned over to the state, there’s a crucial step: attempting to notify the owner. This is where a well-crafted communication becomes indispensable. Many find themselves needing to discover unclaimed property notice template solutions to streamline this essential, often complex, process.

Developing and sending accurate, compliant notices is not just good practice; it’s a legal requirement that helps reunite owners with their assets and protects your organization from potential penalties. A clear, comprehensive template can save time, reduce errors, and ensure your communication meets all necessary standards, making the entire unclaimed property management process much smoother.

What Exactly is Unclaimed Property and Why Do You Need a Notice?

Unclaimed property encompasses a vast array of financial assets that are due to an individual or entity but have gone dormant or remain outstanding for a statutorily defined period. This isn’t just about loose change; it can involve substantial sums held by financial institutions, insurance companies, corporations, and even government agencies. Think about those old savings accounts you opened as a child and forgot about, a security deposit from a past rental that was never returned, or an inheritance check that got lost in the mail.

States have established robust unclaimed property laws, often referred to as escheat laws, to protect consumers. These laws mandate that companies holding these dormant assets must make diligent efforts to locate the owners. If the owners cannot be found after a “dormancy period” (which varies by asset type and state, typically 3-5 years), the property must then be reported and remitted, or “escheated,” to the state. The state then holds these assets indefinitely for the rightful owners to claim.

The Importance of Timely Communication

Before a company can escheat property to the state, it is almost universally required to send a “due diligence” notice to the apparent owner at their last known address. This notice serves as a critical last attempt to reunite the owner with their property. It’s a moment of truth, offering the owner a final chance to claim their assets directly from the holder before the state takes possession. Failing to send these notices, or sending inaccurate ones, can lead to compliance issues and potential fines for the holder.

Different entities find themselves holding various types of unclaimed property. Banks might hold dormant checking or savings accounts, safe deposit box contents, or uncashed cashier’s checks. Insurance companies often have unpaid life insurance proceeds or uncashed benefit checks. Corporations could be holding uncashed dividend checks, stock certificates, or customer refunds. Utilities might have unreturned deposits, and even payroll departments could have uncashed paychecks.

Sending out these pre-escheatment notices ensures transparency and demonstrates your organization’s commitment to compliance and customer care. It’s a proactive step that can prevent property from being escheated, ultimately reducing administrative burden for both your company and the state, and fostering goodwill with your customers.

Key Elements of an Effective Unclaimed Property Notice Template

Creating a notice that is both legally compliant and easy for the recipient to understand is paramount. An effective unclaimed property notice template needs to be clear, concise, and contain all the necessary information for the owner to take action. It should remove any ambiguity and guide the recipient through the claiming process effortlessly. The language should be straightforward, avoiding legal jargon where possible, to ensure maximum comprehension by a diverse audience.

The content of your notice is crucial. It must accurately describe the unclaimed property, explain what steps the owner needs to take, and clearly state any deadlines. Missing essential details can lead to confusion, delay claims, or even invalidate the notice in the eyes of state regulators. Think of it as a helpful guide for someone who might be surprised or confused by receiving such a letter.

When you discover unclaimed property notice template solutions that truly work, you’ll find they often incorporate the following vital components to ensure clarity and compliance:

- Your company’s official name, address, and contact information, including a phone number and email for inquiries.

- The owner’s full name and their last known address on record.

- A clear description of the specific type of property (e.g., “dormant savings account,” “unclaimed dividend check,” “utility deposit”).

- The approximate value of the property, if known and permissible to disclose.

- The date of last activity or the dormancy date that triggered the notice.

- Explicit, step-by-step instructions on how the owner can claim their property directly from your company.

- A specific deadline by which the owner must respond before the property is escheated to the state.

- Information about what will happen if the property is not claimed by the deadline (i.e., it will be sent to the state’s unclaimed property division).

- Any relevant legal disclaimers or state-specific language required by law.

Having a standardized, robust template for your unclaimed property notices can significantly streamline your compliance efforts. It ensures consistency across all communications, reduces the risk of overlooking critical information, and helps your organization meet its regulatory obligations efficiently. This proactive approach not only protects your business but also reinforces trust with your customers by demonstrating your commitment to returning their rightful assets.

Navigating the complexities of unclaimed property can be challenging, but a well-designed notice template acts as an indispensable tool. It empowers your organization to manage these assets responsibly, ensuring that every effort is made to connect owners with their forgotten funds before they are remitted to the state. This diligence in communication is fundamental to good corporate governance and customer relations.

By adopting a clear and comprehensive approach to pre-escheatment notices, businesses can effectively meet their legal obligations while also fostering stronger relationships with their clientele. It’s an investment in efficiency, compliance, and ultimately, in the peace of mind that comes from knowing you’ve done everything possible to return what rightfully belongs to someone else.