Navigating the world of real estate can be complex, especially when family is involved. A “gift of equity” is a fantastic way for a homeowner to sell their property to a family member or close acquaintance for less than its market value, effectively gifting the difference in equity. To ensure such a transaction is legally sound and smooth for all parties, having a robust gift of equity purchase contract template is absolutely essential. This unique approach to home buying can significantly reduce the financial burden on the buyer, often minimizing the need for a large down payment.

This arrangement is particularly appealing in today’s housing market, offering a practical solution for passing on property within a family. It’s not just about saving money; it’s about providing a tangible head start in homeownership for a loved one. The seller benefits from a straightforward sale, often avoiding agent commissions and the uncertainties of the open market, while the buyer gains immediate equity.

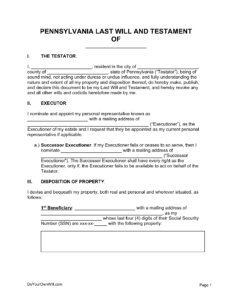

However, despite its seemingly simple premise, a gift of equity transaction involves specific legal and financial considerations that must be handled with care. Without proper documentation, what seems like a generous act could lead to future complications with lenders, tax authorities, or even disputes between family members. This is where a well-drafted contract becomes your most reliable guide, clarifying every aspect of the agreement.

Understanding the Gift of Equity: More Than Just a Handshake

A gift of equity is a specific type of real estate transaction where the seller, often a parent or other close relative, agrees to sell their home to a buyer for a price lower than its appraised market value. The difference between the appraised value and the agreed-upon selling price is considered the “gift” and can be used by the buyer as part of their down payment. This means the buyer effectively starts with immediate equity in the home, which can be a huge advantage. It’s not just a casual agreement; it’s a formal declaration of value transfer.

This method is incredibly beneficial for helping family members achieve homeownership, especially those who might struggle to save for a traditional down payment. For the seller, it can be a way to quickly and easily transfer property without the lengthy process of listing it on the open market, while also providing a significant financial benefit to a loved one. It bridges the gap between aspiration and affordability, making homeownership a reality for many.

Practically, here’s how it usually works: the home is appraised at its current market value. Let’s say it’s appraised at $300,000. The seller agrees to sell it to their family member for $250,000. The $50,000 difference is the gift of equity. This $50,000 can then be credited towards the buyer’s down payment or simply reduce the amount the buyer needs to borrow from a lender. The lender will use the appraised value, not the reduced sale price, to determine the loan-to-value ratio, allowing the buyer to borrow less relative to the true worth of the home.

For the giver, the gift of equity needs to be reported to the IRS via Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, if the amount exceeds the annual gift tax exclusion. Even if no tax is due (which is often the case due to lifetime exemptions), reporting is crucial. Failing to report could lead to issues down the line. It’s a formal financial gesture with formal reporting requirements.

The receiver generally does not pay income tax on the gift of equity. Instead, the gift simply reduces the buyer’s cost basis in the property. This is an important distinction to understand for future capital gains calculations if the home is later sold. Both parties should consult with a tax professional to fully understand their individual obligations and benefits.

Given these financial and legal intricacies, relying solely on verbal agreements or informal notes is a recipe for disaster. A comprehensive contract provides clarity, protects all parties involved, and ensures that the transaction adheres to all legal requirements. It prevents misunderstandings and potential disputes that could strain family relationships and lead to costly legal battles.

Essential Components for Your Gift of Equity Purchase Contract Template

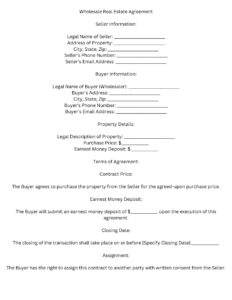

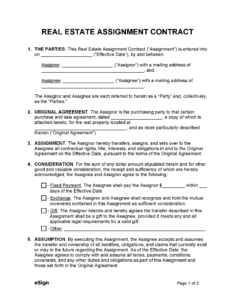

When putting together a robust contract for a gift of equity transaction, several key elements must be explicitly included. This document serves as the foundation of your agreement, ensuring every detail is clear and legally binding. It typically starts with the identification of all parties involved—full legal names, addresses, and contact information for both the seller(s) and the buyer(s).

Next, a precise and thorough description of the property being sold is paramount. This includes the full street address, the legal description of the property, and any relevant parcel identification numbers. Clarity here prevents any ambiguity about which property is being transferred.

Crucially, the contract must explicitly state the agreed-upon purchase price of the property and, separately, the exact amount of the gift of equity being provided by the seller. It should detail how this gift is to be applied, typically as a credit towards the buyer’s down payment. This clarifies the financial mechanics for both parties and for the lender.

Standard real estate contract clauses are also vital. These include details on financing contingencies (e.g., the buyer’s ability to secure a loan), closing dates, earnest money deposits (if any), title insurance requirements, and any inspections or appraisals to be conducted. Every aspect of a typical home sale needs to be addressed.

Finally, the document must include sections for signatures from all parties, along with the date of signing. It is highly recommended that both the buyer and seller seek independent legal counsel to review the gift of equity purchase contract template before signing, ensuring their interests are protected and they fully understand all terms.

Navigating the Process: Tips for a Smooth Transaction

Successfully executing a gift of equity transaction relies heavily on clear, open communication between all parties, especially when family members are involved. It’s important to discuss expectations, financial implications, and timelines candidly from the outset to prevent misunderstandings later on. Remember, while it’s a generous gesture, it’s also a significant financial and legal transaction that requires the same level of seriousness as any other home sale.

Enlisting the help of experienced professionals is not just advisable; it’s often critical. A real estate attorney can help draft or review the gift of equity purchase contract template, ensuring it complies with local laws and accurately reflects the agreement. A tax advisor will be invaluable in understanding the gift tax implications for the seller and any basis adjustments for the buyer. Additionally, finding a lender who is familiar and comfortable with gift of equity scenarios will streamline the financing process, as not all lenders handle these transactions the same way.

To help ensure a seamless closing, there are several key steps to consider:

* Get a professional appraisal: This establishes the fair market value of the property, which is essential for determining the actual gift amount and for lender requirements.

* Work with an experienced lender: Confirm your lender understands and accepts gift of equity as a form of down payment. They will require a gift letter signed by all parties.

* File IRS Form 709: The seller must file this form if the gift exceeds the annual exclusion amount, even if no tax is due.

* Clarify closing costs: Determine upfront who is responsible for various closing costs, such as title insurance, transfer taxes, and attorney fees.

By proactively addressing these areas, you can significantly reduce potential friction points and ensure that the transaction proceeds efficiently towards a successful closing.

Leveraging a well-structured contract and expert advice provides peace of mind throughout the entire process. It transforms a potentially complicated family transaction into a transparent, legally sound, and mutually beneficial agreement. This structured approach helps ensure that the gift of homeownership is delivered not just with generosity, but with complete confidence for everyone involved.