Navigating the world of car financing can be a complex journey, especially when traditional lenders are not an option. For many, a buy here pay here dealership offers a viable path to vehicle ownership. A crucial element in this process is the contract itself, and understanding a robust buy here pay here contract template is essential for both buyers and sellers to ensure a fair and legally sound transaction. This document outlines the terms of your agreement, protecting everyone involved and setting clear expectations for the road ahead.

Buy here pay here dealerships cater to individuals who might have less-than-perfect credit, no credit history, or other financial challenges that make securing a loan from a bank or credit union difficult. These dealerships often provide in-house financing, meaning they are both the seller of the car and the lender for the loan. While this offers accessibility, it also means the terms can differ significantly from traditional loans, making the contract an even more vital tool for clarity.

This article will guide you through the key components typically found within such a contract, highlighting what to look for and why each section is important. Our goal is to empower you with the knowledge to approach a buy here pay here agreement with confidence, ensuring you understand every detail before putting pen to paper and driving off the lot.

What Makes a Solid Buy Here Pay Here Contract?

A comprehensive buy here pay here contract is more than just a piece of paper; it’s the foundation of your agreement, clearly defining the rights and responsibilities of both the buyer and the dealership. When reviewing any template or actual contract, several core components must be present and understood to avoid future misunderstandings or disputes. Clarity in these areas is paramount for a smooth transaction.

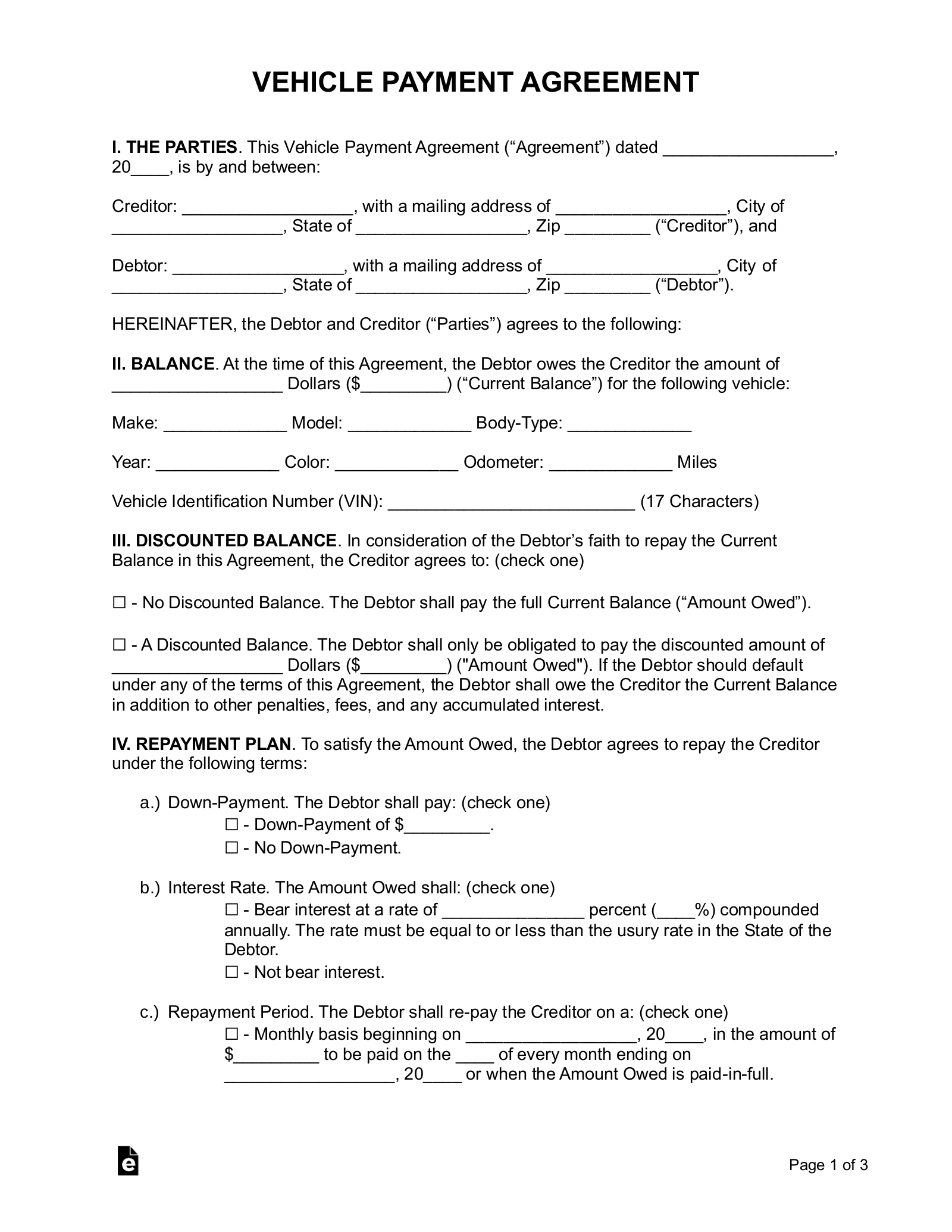

Firstly, the contract must meticulously identify all parties involved and the specific vehicle being purchased. This includes the full legal names and addresses of the buyer(s) and the dealership, as well as detailed information about the car such as its make, model, year, Vehicle Identification Number (VIN), and odometer reading. This ensures there’s no ambiguity about who is buying what from whom.

Secondly, the financial terms are arguably the most critical section. This part will detail the vehicle’s cash price, any down payment made, and if a trade-in vehicle was part of the deal, its agreed-upon value. It’s also where the total amount financed, the annual percentage rate (APR), the total number of payments, and the total amount of all payments will be clearly laid out. Understanding these figures is crucial, as they determine the true cost of your loan.

Beyond the core price, a good contract will specify the payment schedule, including the frequency (weekly, bi-weekly, or monthly) and the exact amount of each installment. It should also outline any late payment penalties, detailing the grace period, the amount of the late fee, and how these fees accrue. This transparency helps buyers manage their budget and avoid unexpected charges.

Furthermore, a comprehensive contract will address default clauses and repossession terms. This section explains what constitutes a default (e.g., missing a certain number of payments) and the dealership’s legal rights if a default occurs, including the right to repossess the vehicle. Knowing these terms beforehand can help buyers understand the serious consequences of not adhering to the payment schedule.

Additionally, the contract should clearly state whether the vehicle is sold “as-is” or if any warranties (implied or extended) are provided. Many buy here pay here vehicles are sold without a warranty, meaning the buyer assumes responsibility for any repairs after purchase. If a warranty is included, its duration, coverage, and any exclusions should be fully detailed.

Lastly, insurance requirements are a vital component. Most buy here pay here dealerships will require the buyer to carry comprehensive and collision insurance on the vehicle for the duration of the loan. The contract should specify the minimum coverage required and who is responsible for providing proof of insurance, often listing the dealership as an additional insured party.

The Benefits of Using a Well-Structured Buy Here Pay Here Contract Template

Adopting a meticulously crafted buy here pay here contract template offers significant advantages for both dealerships and customers. For dealerships, it provides a standardized legal framework that ensures consistency across all transactions, minimizing the risk of errors or omissions that could lead to legal complications. It acts as a blueprint, guiding sales personnel through the necessary disclosures and agreements, ensuring every customer receives the same comprehensive set of terms.

From a compliance perspective, a robust template helps dealerships adhere to relevant state and federal regulations, such as the Truth in Lending Act, which mandates specific disclosures regarding loan terms. By using a pre-vetted template, dealerships can confidently know they are meeting their legal obligations, which is crucial in an industry often subject to scrutiny. This proactive approach to legal compliance safeguards the business from potential fines and reputational damage.

For buyers, the benefits are equally compelling. A well-structured template promotes transparency, laying out all the terms and conditions in a clear, organized manner. This allows buyers to easily review and understand their financial obligations, interest rates, payment schedules, and what happens in case of default, before committing. It empowers buyers with the information needed to make an informed decision and ensures they are fully aware of what they are signing. The clarity provided by a comprehensive contract template fosters trust and protects the consumer, making the vehicle purchasing experience less intimidating and more straightforward.

Ensuring a Smooth Transaction

Ultimately, a detailed and transparent contract is the cornerstone of any successful buy here pay here transaction. It serves as a protective shield for both parties, clarifying expectations and outlining responsibilities. Taking the time to thoroughly read and understand every clause before signing is not just advisable; it’s essential.

If you ever find yourself uncertain about any term or condition, do not hesitate to ask questions or even seek independent legal advice. The goal is to drive away with confidence, knowing that your agreement is fair, fully understood, and legally sound, ensuring a positive experience for everyone involved in your journey to vehicle ownership.