So, you’ve taken the plunge and joined the ranks of the self-employed! Congratulations! It’s a thrilling journey, full of freedom and the chance to build something truly your own. But, let’s be honest, it also comes with its fair share of administrative tasks. One of the most crucial, yet often overlooked, aspects of self-employment is keeping meticulous records. This is where a good self employment documentation template can become your best friend.

Think of it this way: you’re not just doing the work; you’re also running a business. And every business, no matter how small, needs to track its income, expenses, and other important details. Proper documentation isn’t just about staying organized (though that’s definitely a bonus); it’s about protecting yourself, ensuring accurate tax filings, and making smart business decisions.

This article will guide you through the world of self-employment documentation, explaining why it’s so important and how a well-structured template can save you time, money, and a whole lot of headaches down the road. We’ll explore the key elements to include in your documentation, helping you create a system that works for your unique business needs.

Why Proper Documentation is Crucial for Self-Employed Individuals

Being your own boss is fantastic, but it also means you’re responsible for everything – including keeping track of all the paperwork. It might seem tedious, but the benefits of diligent documentation are far-reaching. For starters, accurate records are essential for filing your taxes correctly. As a self-employed individual, you’re responsible for paying self-employment taxes, and you’ll need detailed records of your income and expenses to calculate your tax liability accurately. Without proper documentation, you risk overpaying or, even worse, facing penalties for underreporting your income.

Beyond taxes, documentation plays a vital role in managing your finances effectively. By tracking your income and expenses, you gain a clear picture of your business’s financial health. You can see where your money is coming from, where it’s going, and identify areas where you can cut costs or increase revenue. This knowledge empowers you to make informed decisions about your business’s future, whether it’s investing in new equipment, hiring help, or adjusting your pricing strategy.

Consider also the potential for audits. While nobody wants to think about it, audits can happen to anyone. If you’re ever audited, having well-organized and complete documentation is your best defense. It allows you to quickly and easily provide the necessary information to the authorities, demonstrating that you’ve been operating your business in a legitimate and transparent manner. Trying to reconstruct records after the fact is a nightmare, so it’s always best to be prepared.

Furthermore, documentation is crucial for securing loans or investments. If you ever need to borrow money or attract investors, they’ll want to see evidence of your business’s financial performance. Detailed records of your income, expenses, and assets will give them confidence in your business’s potential and increase your chances of securing the funding you need.

In short, proper documentation is not just a chore; it’s an investment in the long-term success and stability of your self-employment venture. It provides a solid foundation for managing your finances, complying with tax regulations, and making informed decisions about your business’s future. So, embrace the power of documentation and set yourself up for success.

Key Elements of a Self Employment Documentation Template

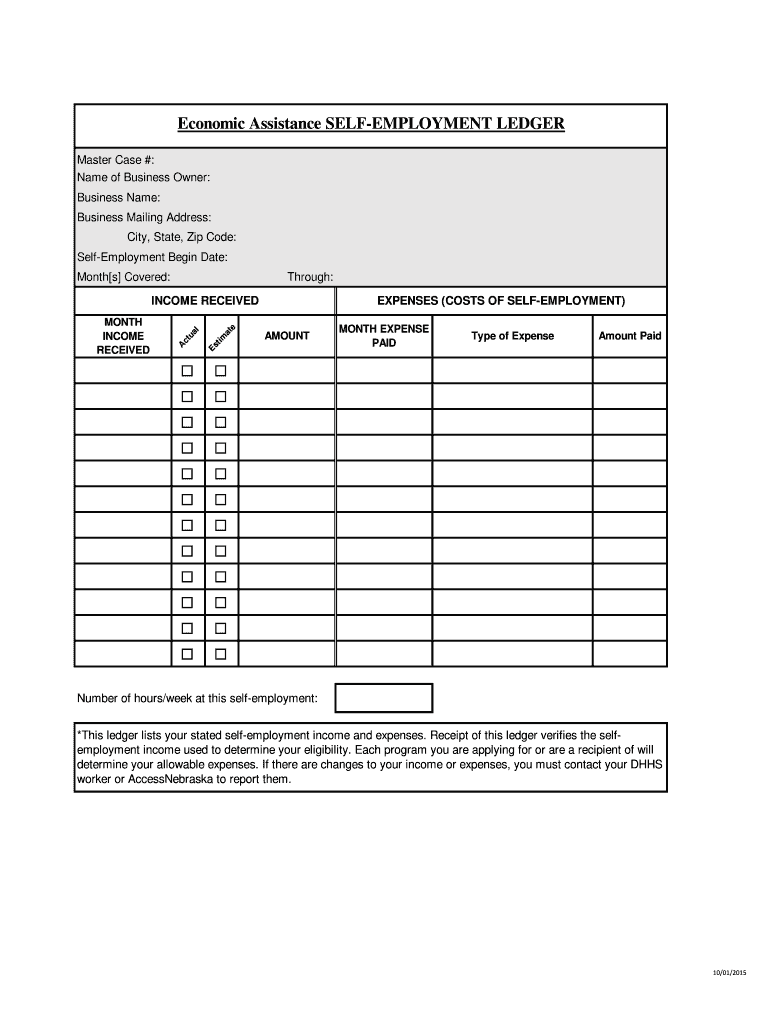

A good self employment documentation template should be comprehensive yet easy to use. It should cover all the essential aspects of your business’s finances and operations, allowing you to track your income, expenses, and other important details efficiently. Here are some key elements to include:

Income Tracking: This is where you record all the money you earn from your business. For each transaction, you should document the date, source of income (client name, etc.), description of the services or products provided, and the amount received. Consider categorizing your income streams to identify your most profitable areas.

Expense Tracking: Just as important as tracking your income is tracking your expenses. This includes everything you spend on your business, from office supplies and equipment to marketing and travel. For each expense, document the date, vendor, description of the expense, and the amount paid. Categorize your expenses to help you identify areas where you can save money.

Mileage Tracking: If you use your personal vehicle for business purposes, you can deduct a portion of your vehicle expenses. To do this, you need to keep a detailed record of your business mileage, including the date, destination, purpose of the trip, and the number of miles driven. There are apps available that can automate this process, making it much easier to track your mileage accurately.

Invoice Management: Keep copies of all invoices you send to clients. This helps you track payments received and follow up on overdue invoices. Include the invoice number, date, client name, description of services, amount due, and payment terms on each invoice.

Tax Documentation: Retain all documents related to your taxes, including tax returns, payment receipts, and any correspondence with the tax authorities. This will be invaluable if you ever get audited or need to amend your tax return. Utilizing a self employment documentation template can streamline this process by prompting you to save needed items.

Implementing a robust documentation system may seem daunting at first, but it’s an investment that pays off in the long run. By tracking your income, expenses, and other important details, you’ll gain a clear understanding of your business’s financial health and be well-prepared for tax season and any other financial challenges that may arise.

Ultimately, embracing organization and accurate record-keeping will give you peace of mind and empower you to make sound business decisions.