In the competitive world of insurance, simply offering policies isn’t enough to secure long-term success. What truly sets a company apart, and what drives enduring loyalty, is the quality of the customer experience. Understanding how your policyholders feel about your services, from the initial consultation to claims processing and renewal, is absolutely crucial for fostering strong relationships and identifying areas for growth. Happy customers not only stay with you but also become your most powerful advocates, spreading positive word-of-mouth that can attract new business.

This is where a well-designed feedback mechanism comes into play. By actively seeking out and listening to your customers’ voices, you gain invaluable insights that can shape your strategies and refine your offerings. A comprehensive insurance customer satisfaction survey template provides the perfect framework for gathering this essential feedback efficiently and effectively, transforming abstract customer sentiment into actionable data.

Why Your Insurance Business Needs a Robust Customer Feedback Mechanism

In an industry built on trust and reliability, understanding your customers’ perceptions is not just a good idea, it’s a business imperative. A robust customer feedback mechanism allows you to pinpoint what’s working well and, more importantly, where there are opportunities for improvement. This proactive approach can prevent minor issues from escalating into major problems that could lead to customer churn. It’s about staying ahead of the curve, ensuring your services align perfectly with your policyholders’ evolving needs and expectations.

Beyond just problem-solving, gathering feedback empowers your insurance business to build deeper, more meaningful relationships. When customers feel heard and valued, their loyalty naturally increases. They see that their opinions matter, and that their chosen insurer is genuinely committed to providing the best possible experience. This sense of partnership fosters an environment of mutual trust, which is the bedrock of any successful insurance relationship. Ultimately, satisfied customers are your greatest asset, leading to higher retention rates, more referrals, and a stronger brand reputation in the marketplace.

Key Components of an Effective Insurance Survey

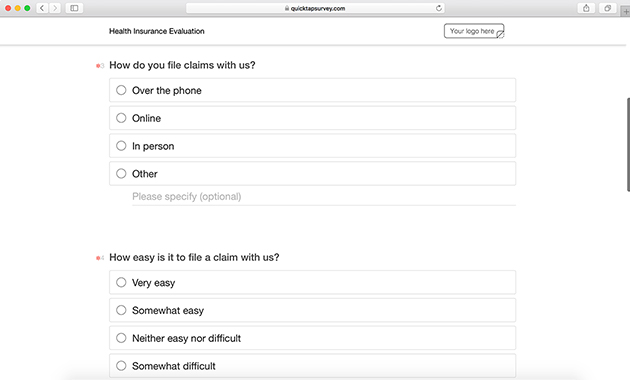

Crafting a survey that truly captures the essence of customer satisfaction requires careful thought. It’s not just about asking questions; it’s about asking the right questions in a way that encourages honest and comprehensive responses. An effective survey should be easy to navigate, respectful of the respondent’s time, and designed to yield clear, actionable data. It should cover all key touchpoints in the customer journey, from initial inquiry to policy management and claims resolution, giving you a holistic view of their experience.

Here are some essential components that contribute to a truly impactful insurance customer satisfaction survey:

- Clear Objectives: Before drafting any questions, define what you want to achieve. Are you measuring overall satisfaction, specific service aspects, or a recent interaction?

- Targeted Questions: Use a mix of rating scales (like Net Promoter Score or CSAT), multiple-choice options, and open-ended questions. Open-ended questions are particularly valuable as they allow customers to elaborate on their experiences in their own words, providing rich qualitative data.

- Concise and Logical Flow: Keep the survey as brief as possible while still gathering necessary information. Group related questions together and ensure a natural progression from one topic to the next.

- Anonymity and Confidentiality: Assure respondents that their feedback will be kept confidential, encouraging them to be more candid and honest in their responses.

- Actionable Insights: Design questions that will lead to specific, measurable, and achievable improvements. If you can’t act on the feedback, the survey’s value is diminished.

Crafting Your Ideal Insurance Customer Satisfaction Survey Template

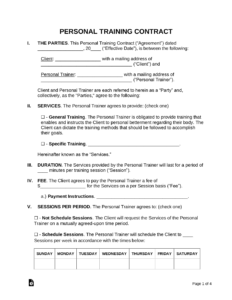

When you’re ready to put theory into practice, designing your specific insurance customer satisfaction survey template is an exciting step. This isn’t a one-size-fits-all endeavor; the most effective template will be one that you can customize to reflect your unique services, customer segments, and business goals. Start by identifying the most critical touchpoints in your customer’s journey. Is it the ease of understanding policy documents? The efficiency of the claims process? The helpfulness of your customer service representatives? Tailoring your questions to these specific interactions will provide the most relevant data.

Consider the different types of questions you can incorporate to get a comprehensive view. A Net Promoter Score (NPS) question ("How likely are you to recommend [Your Insurance Company] to a friend or colleague?") is excellent for gauging overall loyalty and potential for referrals. Customer Satisfaction (CSAT) questions ("How satisfied were you with your recent interaction?") are perfect for evaluating specific service moments. Don’t forget open-ended questions like "What could we do to improve your experience?" which offer invaluable qualitative insights and uncover issues you might not have anticipated.

Once your questions are crafted, think about the best way to distribute your survey. Email is a common and effective method, especially after a specific interaction like a claims settlement or policy renewal. You might also consider embedding a link on your website or within your customer portal. For a more immediate snapshot, a quick, one-question survey offered right after a call with customer service can be highly effective. The key is to make it easy and convenient for customers to provide their feedback when they are most likely to do so.

Remember, the survey itself is only the first step. The real power of an insurance customer satisfaction survey template lies in what you do with the responses. Regularly analyze the data, identify trends, and share insights across your teams. Use this feedback to inform training programs, refine service delivery, and even develop new products that better meet market demand. This continuous loop of listening and improving is what will truly elevate your customer experience and solidify your position as a trusted insurance provider.

Embracing the power of customer feedback is a continuous journey, not a destination. By regularly deploying well-crafted surveys and diligently analyzing the results, your insurance company can foster deeper connections with its policyholders and drive meaningful improvements across all touchpoints. This commitment to understanding and responding to your customers’ needs will not only enhance satisfaction but also build a resilient foundation for long-term growth and success in a dynamic industry. It is through this ongoing dialogue that you truly demonstrate your value and differentiate yourself, turning every interaction into an opportunity to strengthen relationships and reinforce trust.