Embarking on any significant business transaction, whether it is an acquisition, a merger, or even a strategic partnership, requires a meticulous deep dive into a company’s inner workings. At the heart of this investigative process, known as due diligence, lies the often daunting task of reviewing countless contracts. These legal documents are the backbone of any business, outlining obligations, rights, and potential liabilities, making their thorough examination absolutely critical to understanding the true value and risks of a deal.

Navigating this intricate web of agreements without a structured approach can lead to overlooked risks, wasted time, and ultimately, poor decision-making. That is precisely where a well-designed tool can make all the difference. Imagine a systematic framework that guides you through every essential clause, highlights potential red flags, and ensures consistency across all reviewed documents. This invaluable resource is a comprehensive due diligence contract review template.

Why a Structured Approach to Contract Review is Non-Negotiable

In the complex landscape of corporate transactions, relying on ad hoc methods for contract review is akin to navigating a minefield blindfolded. A structured approach, often facilitated by a robust template, transforms this high-stakes activity from a chaotic scramble into an organized, efficient process. It provides a consistent methodology, ensuring that no critical stone is left unturned and that all stakeholders are evaluating information from the same foundational perspective. This consistency is vital not only for identifying risks but also for accurately valuing the target entity and understanding its operational capabilities.

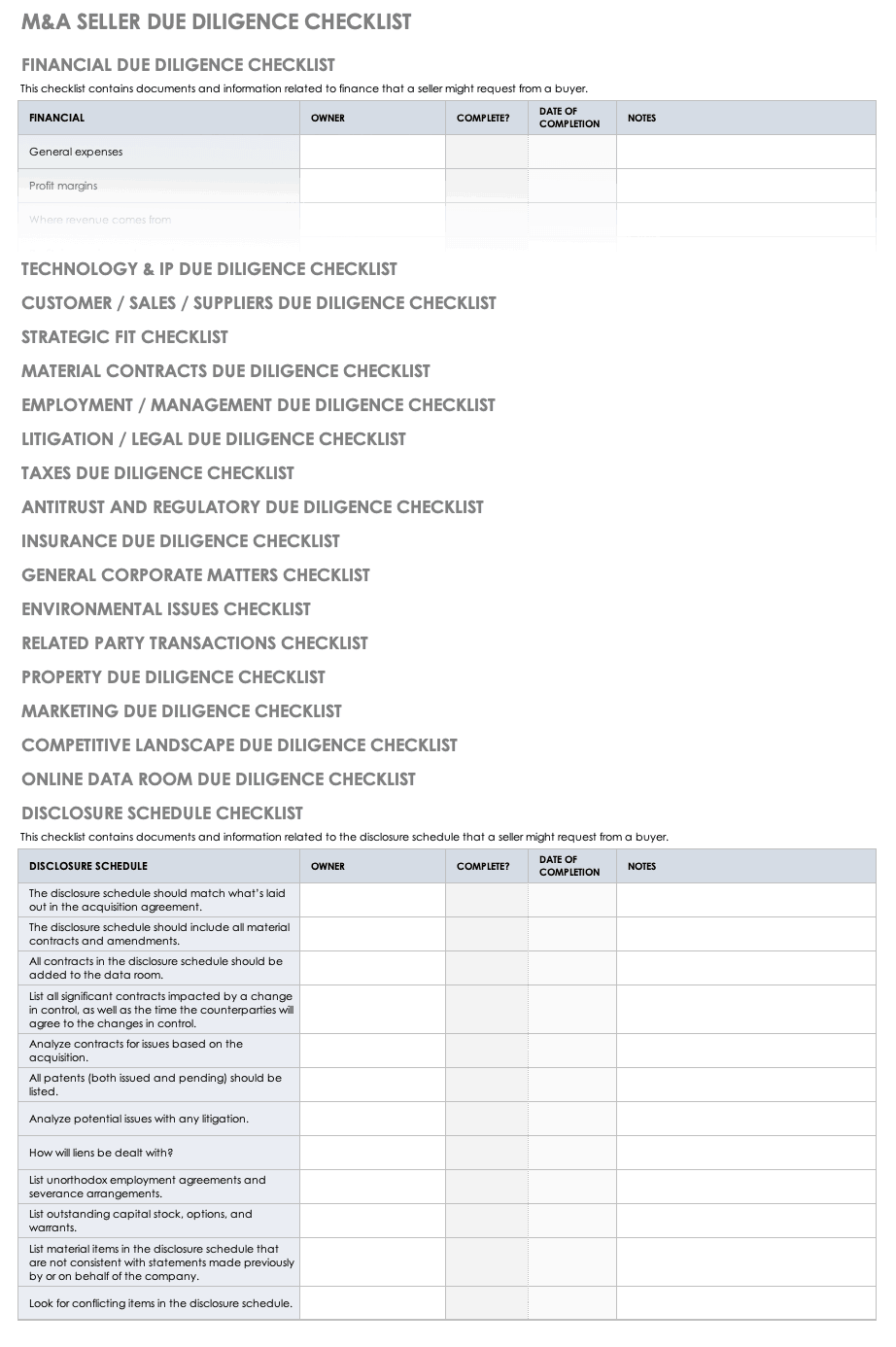

Furthermore, the sheer volume of contracts involved in even a moderately sized transaction can be overwhelming. From supplier agreements and customer contracts to employment pacts and intellectual property licenses, the paperwork can stack up quickly. Without a predefined structure, reviewers might inadvertently prioritize certain contract types over others, leading to an incomplete picture. A template acts as a checklist and a guide, enforcing discipline and ensuring comprehensive coverage across the entire contractual portfolio. It empowers your team to extract relevant information, highlight potential deal breakers, and summarize key terms efficiently.

Beyond mere organization, a structured review helps in mitigating future legal and financial surprises. Every clause, every term, has implications. For instance, understanding the termination clauses across major customer contracts can reveal potential revenue vulnerabilities post-acquisition. Similarly, reviewing indemnification clauses in vendor agreements can shed light on unforeseen liabilities. A template systematically prompts the reviewer to consider these aspects, making the invisible visible.

Identifying Key Risk Areas

One of the primary goals of due diligence is risk identification. A well-crafted due diligence contract review template guides reviewers directly to the clauses and provisions that typically harbor the most significant risks. This could include understanding change of control provisions that might allow a counterparty to terminate an agreement upon acquisition, or identifying onerous indemnification obligations that could burden the acquiring entity with substantial future costs. It ensures that the team is proactively looking for potential issues rather than just passively reading through documents.

Ensuring Regulatory Compliance

Beyond commercial risks, regulatory compliance is a colossal concern. Failure to adhere to industry-specific regulations or general data privacy laws like GDPR can result in severe penalties and reputational damage. A template can integrate specific checkpoints for regulatory compliance, prompting reviewers to look for particular clauses related to data handling, environmental standards, labor laws, and industry-specific certifications. This proactive approach ensures that the acquired entity is not a ticking time bomb of non-compliance.

- Reviewing data privacy clauses to ensure alignment with current regulations.

- Checking for adherence to environmental protection laws and waste disposal agreements.

- Examining labor contracts for compliance with local employment laws and collective bargaining agreements.

- Verifying licenses and permits essential for ongoing operations.

Valuation and Future Implications

Contracts are not just about risk; they are also about value. Long-term customer contracts, favorable supplier agreements, and robust intellectual property licenses all contribute significantly to a company’s valuation. A structured review helps quantify these assets and liabilities, painting a clearer picture of the target’s true worth. It allows the acquiring party to understand recurring revenue streams, identify potential synergies, and forecast future financial performance with greater accuracy, laying the groundwork for integration and post-deal success.

Building Your Essential Due Diligence Contract Review Template

Crafting an effective due diligence contract review template is an iterative process, but it begins with understanding the core components that consistently arise in business agreements. This template should serve as a practical checklist and a data extraction tool, allowing your team to methodically dissect each contract and pull out the most pertinent information. Think of it as a standardized microscope, ensuring every reviewer focuses on the same crucial details, regardless of the contract type or complexity.

The true power of a template lies in its adaptability. While a foundational template provides a solid starting point, the most effective versions are customized for each unique transaction. An acquisition in the tech sector will require different specific checkpoints than one in manufacturing or real estate. Therefore, ensure your template is flexible enough to incorporate deal-specific concerns, allowing you to add or remove categories as necessary to match the unique characteristics of the target company and the transaction’s objectives.

A robust template acts as a central repository for key findings, making it easier to compare and contrast terms across multiple contracts. This systematic approach not only saves an immense amount of time but also significantly reduces the risk of overlooking critical provisions. It transforms a potentially chaotic review into a streamlined process, enabling your legal and financial teams to work in concert, confident that they are capturing all essential data points for analysis.

Here are some essential categories and points to consider when constructing your comprehensive template:

- Basic Contract Information: Document title, parties involved, effective date, and expiration date.

- Key Terms and Conditions: Term length, renewal options, termination rights and obligations, notice periods.

- Financial Obligations and Liabilities: Payment schedules, royalties, indemnification clauses, guarantees, warranties.

- Intellectual Property Rights: Ownership, licensing agreements, infringement clauses, confidentiality provisions.

- Assignment and Change of Control: Clauses dictating conditions under which the contract can be assigned or terminated upon a change of ownership.

- Governing Law and Dispute Resolution: Applicable jurisdiction, arbitration clauses, litigation provisions.

- Compliance and Regulatory Matters: Adherence to specific laws, industry standards, environmental regulations.

- Red Flags and Action Items: A dedicated section for flagging immediate concerns, potential deal breakers, or items requiring further investigation.

By integrating these elements, your due diligence contract review template becomes more than just a document; it transforms into a strategic tool. It ensures that every contractual nuance is explored, risks are accurately assessed, and opportunities are fully understood, setting the stage for confident decision-making throughout the entire transaction lifecycle.

The comprehensive review process, guided by a well-structured due diligence contract review template, stands as a cornerstone of successful transactions. It equips decision-makers with a clear, consolidated understanding of the legal and financial landscape, translating complex contractual language into actionable insights. This systematic approach dramatically reduces exposure to unforeseen liabilities and enhances the overall clarity of the deal.

Ultimately, by leveraging such a template, businesses are not just performing a task; they are building a foundation of informed consent and strategic foresight. It empowers parties to negotiate from a position of strength, secure in the knowledge that they have thoroughly examined the contractual underpinnings of their prospective venture, protecting their investments and fostering long-term success.