Lending money to a friend can feel like navigating a minefield of good intentions and potential awkwardness. While the desire to help someone you care about is completely natural and commendable, the absence of clear boundaries can strain even the strongest friendships. That’s where a friend to friend loan contract template comes in handy, transforming a potentially uncomfortable situation into a clear, professional, and respectful agreement that protects both parties and, crucially, the friendship itself.

Many people hesitate to formalize a loan between friends, fearing it might imply a lack of trust. However, the opposite is often true. A written agreement demonstrates a mutual respect for the seriousness of the financial transaction and an understanding that clarity benefits everyone involved. It removes ambiguity, sets expectations, and provides a roadmap for repayment, preventing misunderstandings down the line that could lead to resentment or an uncomfortable silence.

This article will explore why taking the step to formalize a loan is a smart move, what essential elements a good loan contract should include, and how to approach the conversation with your friend in a way that reinforces trust rather than eroding it. By using a simple template, you can ensure that your act of kindness remains just that, without turning into a source of stress or conflict.

Why Formalizing a Loan Between Friends is a Smart Move

We’ve all been there, or at least imagined it: a friend needs help, and you’re in a position to offer it. Maybe it’s for an unexpected car repair, a temporary gap in income, or a small business venture they’re trying to get off the ground. Your heart says yes, and your wallet might agree. However, without a clear understanding of the terms, what starts as a generous gesture can quickly evolve into a source of anxiety for both the lender and the borrower.

Informal loans often rely on vague promises and memory, which are notoriously unreliable when money is involved. One person might remember a conversation as a gift, while the other considers it a short-term loan with no interest. Repayment schedules might be assumed rather than agreed upon, leading to missed payments, awkward reminders, and a growing sense of discomfort that can poison the well of even the oldest friendships.

This is precisely where a written contract steps in, not as a sign of distrust, but as a tool for mutual respect and clarity. It acts as a safety net, ensuring that the details of the loan are explicitly stated and agreed upon by both parties. It transforms a casual agreement into a professional understanding, laying out the terms in a way that leaves no room for misinterpretation.

Clarity Over Confusion

A formal agreement ensures that both the lender and the borrower are on the same page regarding every aspect of the loan. This includes the exact amount borrowed, whether interest will be charged, how and when the money will be repaid, and what happens if a payment is missed. This level of detail prevents assumptions and ensures that the financial arrangement is transparent and fair to all parties.

Protecting the Bond

Perhaps the most compelling reason to formalize a loan between friends is to protect the friendship itself. Money matters, if handled poorly, can cause irreparable damage to personal relationships. A written contract helps to depersonalize the financial transaction, moving it out of the emotional realm and into a practical one. It provides a reference point if either party forgets the details, avoiding potentially difficult or embarrassing conversations down the road. It shows that you value both your friendship and your financial well-being enough to handle the situation responsibly.

Moreover, having a formal agreement can empower the borrower to take their repayment obligations more seriously, knowing there’s a document outlining their commitment. It also gives the lender peace of mind, knowing that their act of generosity has a clear framework for resolution. In essence, it helps to keep the friendship about friendship, and the loan about business, but done with kindness and understanding.

Key Elements to Include in Your Friend to Friend Loan Agreement

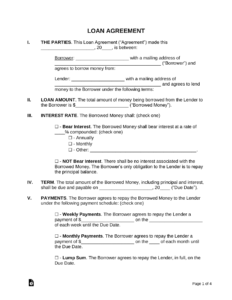

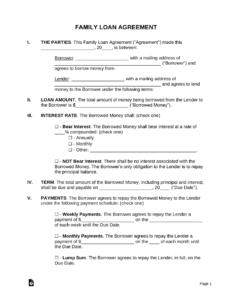

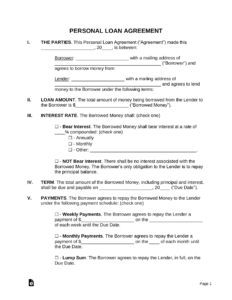

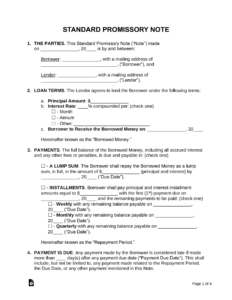

When you’re ready to put together your friend to friend loan contract template, think about it as setting clear expectations for everyone involved. It doesn’t have to be overly complicated or use dense legal jargon. The goal is simply to outline the key aspects of the loan in an easy-to-understand format that both you and your friend can agree upon and sign.

The contract should cover all the fundamental details of the financial arrangement, ensuring that nothing is left to assumption. This clarity is crucial for preventing future disputes and maintaining the integrity of your friendship. By addressing these points upfront, you create a foundation of transparency and mutual understanding.

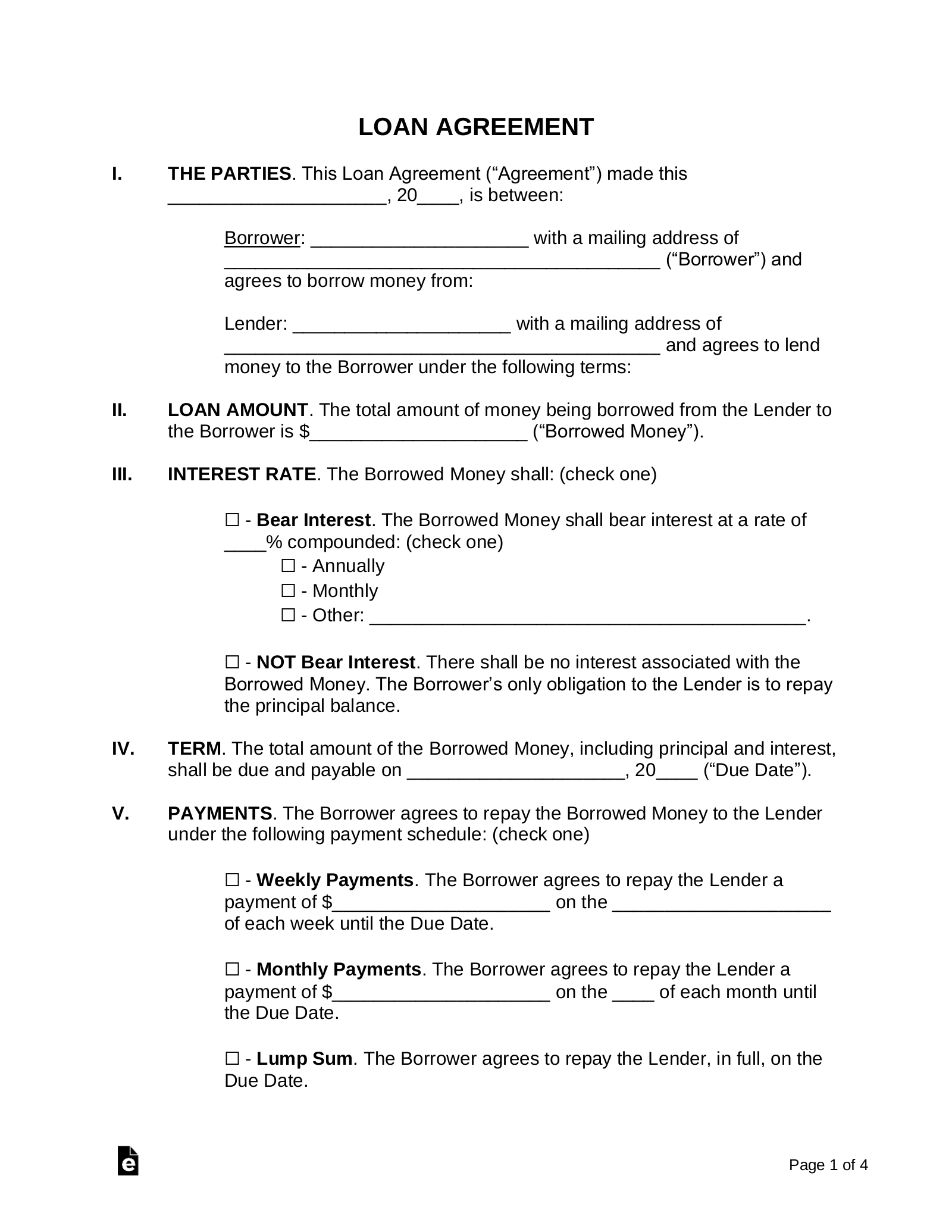

Here are some essential components to include in your loan agreement:

- Names and Contact Information: Clearly state the full legal names, addresses, and contact details of both the lender and the borrower.

- Loan Amount: Specify the exact sum of money being loaned, both in numerical and written form, to avoid any misinterpretation.

- Interest Rate: Determine if interest will be charged and, if so, what the annual percentage rate (APR) will be. Even a small or zero-interest rate should be explicitly stated.

- Repayment Schedule: Detail how and when the loan will be repaid. This could be in regular installments (e.g., monthly), a lump sum by a specific date, or a flexible schedule agreed upon by both parties. Include specific due dates for payments.

- Consequences of Late Payment: Outline what happens if a payment is missed or delayed. Will there be a late fee? A grace period? How will communication occur if a payment is late?

- Collateral (Optional): While less common in friend loans, if any assets are being put up as security for the loan, these should be clearly described.

- Date of Agreement: Include the date the agreement is officially made and signed.

- Signatures: Both the lender and the borrower should sign and date the document, ideally with a witness present if possible, though not strictly necessary for validity. Each party should receive a copy of the signed agreement.

Taking the initiative to draft a clear, simple agreement demonstrates maturity and forethought, reinforcing the idea that this isn’t just a casual exchange but a significant commitment. It allows both parties to proceed with confidence, knowing exactly what is expected of them, thereby safeguarding both the funds and the bond.

Ultimately, approaching a friend loan with a clear, written agreement isn’t about distrust; it’s about responsible friendship and clear communication. It’s an act of care that ensures financial matters don’t overshadow the warmth and history you share. By setting up a proper friend to friend loan contract, you’re not just lending money; you’re investing in the longevity and health of your relationship.