Navigating the world of hedge accounting can feel like traversing a complex maze. One wrong turn, and you could find yourself lost in a labyrinth of regulations and compliance issues. That’s where a solid hedge accounting documentation template comes into play. Think of it as your trusty map and compass, guiding you through the intricacies of documenting your hedging strategies and ensuring you’re on the right track with financial reporting standards.

But what exactly *is* a hedge accounting documentation template, and why is it so vital? Essentially, it’s a pre-structured framework designed to help you meticulously record all the essential details of your hedging activities. This includes everything from identifying the hedged item and hedging instrument to outlining the risk management strategy and demonstrating the effectiveness of the hedge. It’s not just about ticking boxes; it’s about creating a clear, transparent, and auditable record of your hedging program.

This article dives deep into the importance of having a robust hedge accounting documentation template and how it can simplify your compliance efforts. We’ll explore the key components that should be included, offer practical tips for creating your own template, and discuss the benefits of using one to maintain accuracy and efficiency in your hedge accounting processes. Ready to get started? Let’s unravel the mysteries of hedge accounting documentation together.

Why a Comprehensive Hedge Accounting Documentation Template is Non-Negotiable

In the realm of finance, precise documentation is paramount, and this holds especially true for hedge accounting. A well-crafted hedge accounting documentation template isn’t merely a helpful tool; it’s an absolute necessity for organizations engaged in hedging activities. Why? Because it provides a clear, auditable trail of the hedging strategy, its execution, and its ongoing effectiveness. Without this documentation, companies risk non-compliance, inaccurate financial reporting, and potential scrutiny from auditors and regulators.

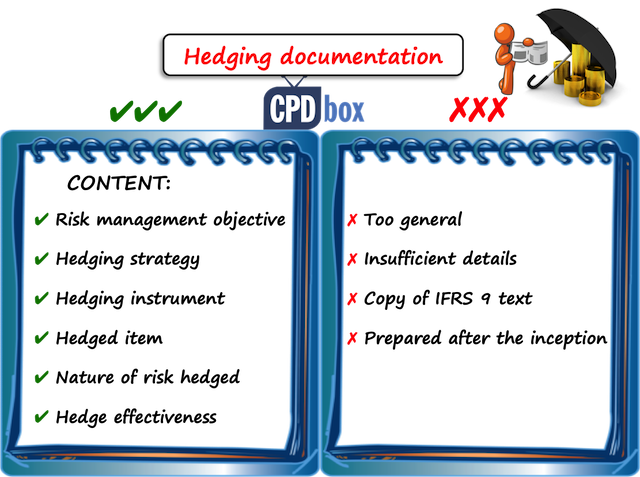

Think about it: hedging strategies are designed to mitigate risk. But if those strategies aren’t properly documented, how can you prove they were effective in achieving that goal? How can you demonstrate that your accounting treatment aligns with the relevant accounting standards, such as IFRS 9 or ASC 815? The answer lies in comprehensive documentation. A good template ensures that all critical information is captured, including the nature of the risk being hedged, the relationship between the hedging instrument and the hedged item, the method for assessing hedge effectiveness, and the ongoing monitoring of the hedge relationship.

Furthermore, a hedge accounting documentation template promotes consistency and efficiency within your organization. When everyone follows the same standardized process for documenting hedging activities, it reduces the risk of errors and inconsistencies. It also makes it easier for different teams or individuals to understand and review the hedging strategy. This is particularly important in larger organizations where multiple individuals may be involved in the hedging process.

Moreover, remember that accounting standards are constantly evolving. What was acceptable documentation yesterday might not be sufficient tomorrow. A well-maintained template can be easily updated to reflect changes in accounting standards or regulatory requirements. This ensures that your organization remains compliant and avoids potential penalties or restatements.

In essence, a robust hedge accounting documentation template is the foundation of a sound hedging program. It provides the evidence needed to support your accounting treatment, promotes consistency and efficiency, and helps you stay compliant with ever-changing regulations. Don’t underestimate its power – it’s an investment that can save you time, money, and headaches in the long run. Using a high quality hedge accounting documentation template will provide peace of mind during an audit.

Key Elements of a Successful Hedge Accounting Documentation Template

Now that we’ve established the importance of a hedge accounting documentation template, let’s delve into the key elements that should be included to ensure its effectiveness. A successful template is comprehensive, yet user-friendly, and tailored to the specific needs of your organization. While the exact components may vary depending on the complexity of your hedging activities, there are several core elements that should always be present.

First and foremost, the template should clearly identify the hedged item or transaction. This includes a detailed description of the asset, liability, or forecasted transaction being hedged, along with its fair value or notional amount. It should also specify the nature of the risk being hedged, such as interest rate risk, foreign exchange risk, or commodity price risk.

Secondly, the template should provide a comprehensive description of the hedging instrument. This includes details about the type of derivative being used (e.g., interest rate swap, foreign currency forward contract), its terms and conditions, and its fair value. It should also clearly identify the counterparty to the hedging instrument.

Thirdly, the template must articulate the risk management strategy for the hedge. This section should explain how the hedging instrument is expected to reduce the risk associated with the hedged item. It should also describe the organization’s risk management objectives and the rationale for entering into the hedging relationship.

Fourthly, a critical component is the method for assessing hedge effectiveness. The template should outline the specific method used to determine whether the hedge is highly effective in offsetting changes in the fair value or cash flows of the hedged item. This could involve using statistical analysis, regression analysis, or other quantitative techniques. The template should also specify the frequency with which hedge effectiveness will be assessed.

Finally, the template should include a section for documenting the ongoing monitoring of the hedge relationship. This includes tracking the fair values of the hedged item and hedging instrument, documenting the results of hedge effectiveness assessments, and identifying any events that could impact the hedging relationship. It should also include a process for addressing any hedge ineffectiveness that may arise.

By incorporating these key elements into your hedge accounting documentation template, you can create a robust framework that supports your hedging activities and ensures compliance with accounting standards. Remember, the goal is to create a clear, transparent, and auditable record of your hedging program.

Ultimately, a well-structured approach provides a valuable resource for organizations seeking to navigate the intricate world of hedge accounting. The presence of a hedge accounting documentation template not only aids in compliance but also streamlines the entire process, ensuring accuracy and clarity in financial reporting.

Creating and maintaining a comprehensive hedge accounting documentation template is an investment that yields significant returns in terms of accuracy, efficiency, and compliance. By embracing this best practice, organizations can confidently manage their hedging activities and maintain the integrity of their financial statements.