In today’s fast-paced digital world, internet banking has become an indispensable part of our daily lives, transforming how we interact with our finances. Financial institutions are constantly striving to enhance their online platforms, but how do they truly know if they’re meeting user expectations or if there are areas that need improvement? The answer often lies in directly asking the users themselves. Understanding their experiences, preferences, and frustrations is key to building a robust and user-friendly digital banking ecosystem.

This is where a well-designed survey comes into play. By gathering feedback from your customers, you can gain invaluable insights that drive product development, refine user interfaces, and ultimately improve customer satisfaction and loyalty. Whether you’re a bank looking to launch new features or an existing platform aiming for optimization, a structured questionnaire provides the data you need to make informed decisions.

The Importance of Understanding Your Internet Banking Users

Understanding your users is not just a good practice; it’s a strategic imperative for any financial institution operating in the digital space. The online banking landscape is highly competitive, and customer expectations are continually evolving. Without direct feedback, you might be investing resources into features or improvements that aren’t actually what your users value most, or worse, overlooking critical pain points that are driving customers away. A comprehensive survey can illuminate these blind spots, offering a clear roadmap for enhancements.

Think about it: your internet banking platform is often the primary point of contact for many customers. Their experience here significantly shapes their perception of your entire institution. Issues with navigation, security concerns, or a lack of desired features can quickly lead to frustration and a search for alternatives. Proactively seeking input through a questionnaire demonstrates that you value their opinion and are committed to providing the best possible service. This builds trust and strengthens the customer relationship.

Beyond just identifying problems, surveys can also highlight what’s working well. Positive feedback reinforces successful design choices and features, giving you confidence to expand upon them. Moreover, gathering demographic information alongside usage patterns can help you segment your user base and tailor future offerings to specific groups, leading to more personalized and effective banking solutions. It’s about creating a service that genuinely resonates with its users.

Key Areas to Cover in Your Survey

When designing your survey, consider these vital categories to ensure a holistic understanding of user experience:

- Usability and Navigation: How easy is it for users to find what they need and complete tasks?

- Feature Satisfaction: Are users happy with existing features, and what new ones would they like to see?

- Security and Trust: How confident do users feel about the security of their transactions and data?

- Customer Support: If they’ve needed help, how was their experience with online support channels?

- Overall Satisfaction and Likelihood to Recommend: Gauging general sentiment and loyalty.

By delving into these areas, you can construct a robust feedback mechanism that captures a broad spectrum of user sentiment, moving beyond anecdotal evidence to data-driven decision-making.

Crafting Your Effective Internet Banking Survey Questions

Creating effective survey questions is an art and a science. It’s not just about asking; it’s about asking the right questions in the right way to elicit honest and actionable responses. The language should be clear, concise, and unambiguous, avoiding jargon that might confuse participants. Remember, your goal is to gather genuine insights, not to lead respondents to a particular answer. Open-ended questions are particularly valuable as they allow users to express thoughts and suggestions that might not fit into predefined categories, often revealing unexpected but crucial information.

Consider the flow of your questionnaire. Start with general questions before moving into more specific or sensitive topics. This helps ease respondents into the survey and keeps them engaged. For instance, you might begin by asking about their frequency of internet banking use before delving into detailed questions about specific features or security protocols. Keep the survey length reasonable; a lengthy questionnaire can lead to respondent fatigue and incomplete submissions, compromising the quality of your data.

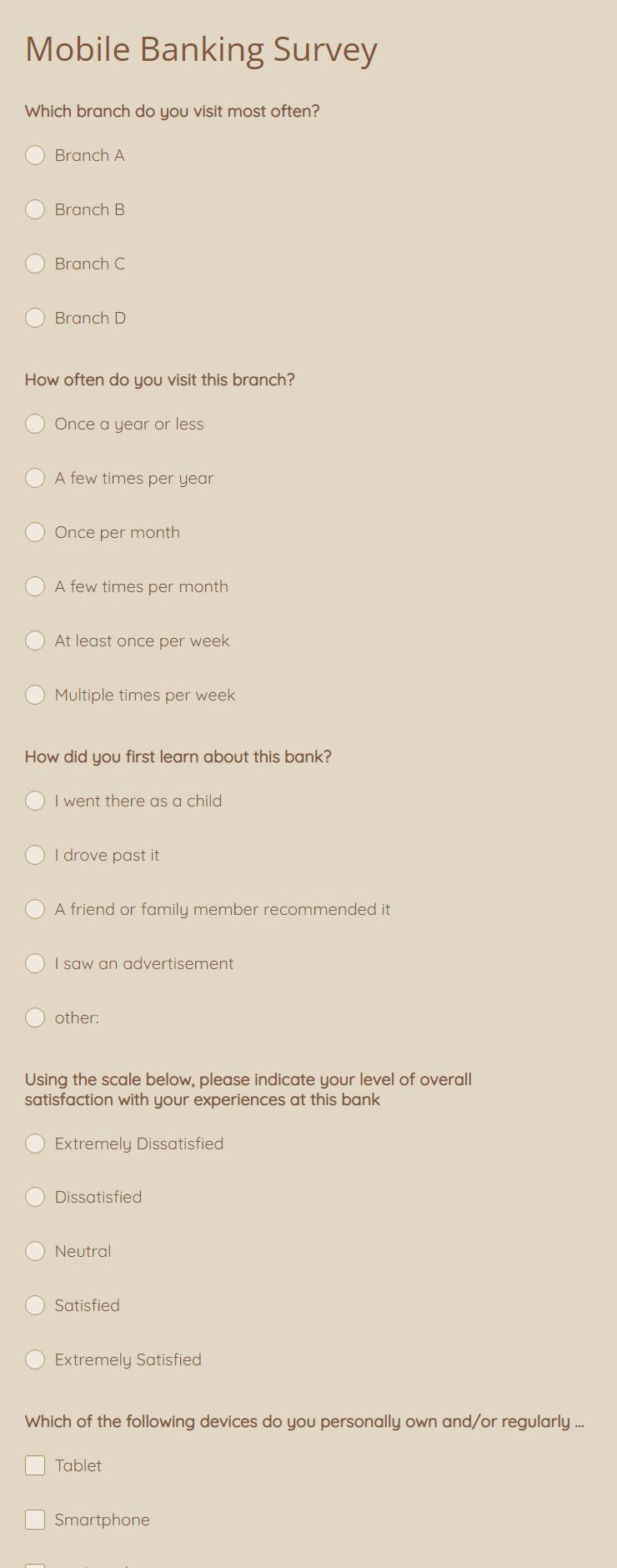

When designing your internet banking questionnaire sample survey template, think about the different types of questions you can employ. Likert scales are excellent for measuring satisfaction or agreement levels (e.g., “On a scale of 1 to 5, how satisfied are you with our mobile deposit feature?”). Multiple-choice questions work well for demographic data or feature preferences, while yes/no questions can quickly ascertain basic usage habits. Combining these types ensures a rich dataset that provides both quantitative metrics and qualitative feedback.

- Keep questions focused on one idea at a time to avoid confusion.

- Use simple, accessible language rather than technical jargon.

- Offer a “Not applicable” or “Prefer not to answer” option where appropriate.

- Test your survey with a small group before a full launch to catch any issues.

Regularly reviewing and updating your survey template based on emerging trends and internal priorities will also ensure its continued relevance and effectiveness in capturing user sentiment.

Leveraging the power of a well-designed internet banking questionnaire sample survey template is more than just collecting data; it’s about fostering a dialogue with your customers. The insights gained from such surveys are invaluable, offering a direct line to understanding what your users truly need and desire from their digital banking experience. By actively listening and responding to this feedback, financial institutions can continuously refine their platforms, ensuring they remain competitive, secure, and genuinely user-centric in an ever-evolving digital landscape. This ongoing commitment to improvement not only enhances the user experience but also reinforces customer loyalty and drives long-term success.