Navigating the complexities of Medicare Part D, which covers prescription drugs, can often feel like deciphering a challenging puzzle. For many individuals transitioning into retirement or simply becoming eligible for Medicare, understanding how their current health coverage interacts with these new benefits is crucial. One of the most important pieces of information they’ll need to receive relates to what’s known as “creditable coverage.”

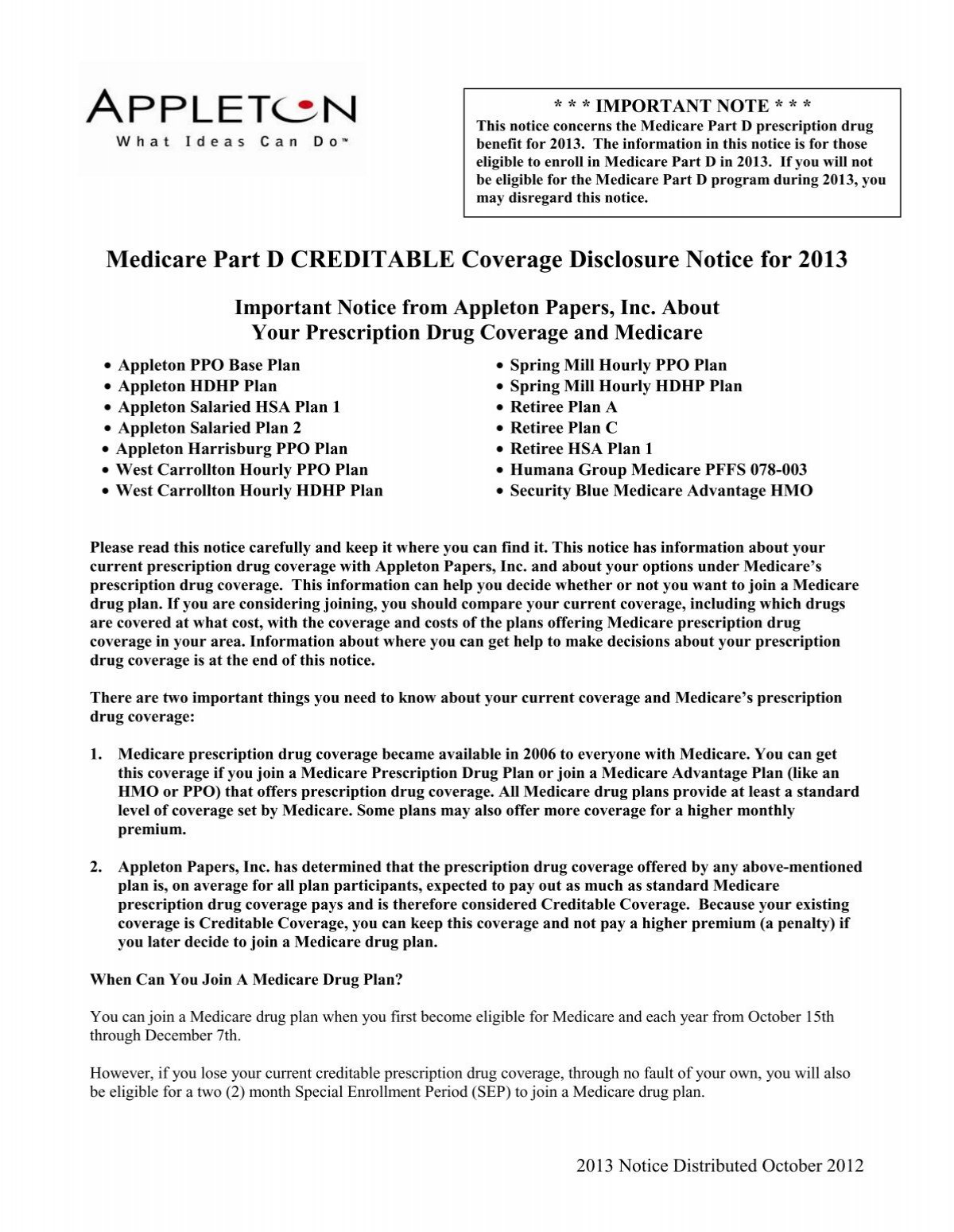

Simply put, creditable coverage means your existing health plan offers prescription drug benefits that are at least as good as the standard Medicare Part D plan. Employers, unions, or other plan sponsors who provide prescription drug coverage to their employees or members have a vital responsibility to inform these individuals annually whether their coverage is considered creditable. This communication helps beneficiaries make informed decisions and avoid potential late enrollment penalties down the line. That’s where a clear and accurate medicare creditable coverage notice templa becomes incredibly useful.

This article aims to demystify the creditable coverage notice, explaining its significance, what it should contain, and how plan administrators can effectively use a template to fulfill their compliance obligations and ensure their members are well-informed. We will explore the nuances of these notices and provide guidance on best practices for their distribution.

Understanding Creditable Coverage and Its Importance for Your Future

When you become eligible for Medicare, particularly Part D prescription drug coverage, the government wants to ensure you maintain adequate drug coverage. If you delay enrolling in Medicare Part D and do not have other “creditable” prescription drug coverage, you could face a lifelong late enrollment penalty once you do decide to sign up. This penalty, which is added to your Part D premium, continues for as long as you have Part D coverage and can add up significantly over the years. This is precisely why the creditable coverage notice is such a critical document.

For individuals, receiving a notice stating their current employer-sponsored or other health coverage is “creditable” means they can defer enrolling in Medicare Part D without incurring a penalty. Their existing plan is deemed to provide at least the same level of benefits as a standard Part D plan. Conversely, if the notice indicates the coverage is “non-creditable,” it’s a clear signal that they should consider enrolling in Medicare Part D during their initial enrollment period to avoid future penalties.

Employers, unions, and other entities that offer prescription drug coverage to Medicare-eligible individuals are legally required by the Centers for Medicare and Medicaid Services (CMS) to provide this notice. This isn’t just a suggestion; it is a mandate designed to protect beneficiaries and ensure they understand their options. The notice must be provided before the Medicare annual enrollment period, which typically runs from October 15th to December 7th each year.

Key Elements of a Creditable Coverage Notice

A creditable coverage notice isn’t just a simple letter; it’s a formal communication with specific information required by CMS. For a notice to be effective and compliant, it must clearly and concisely convey essential details.

Here are some fundamental components that should always be present:

* A clear statement indicating whether the employer’s prescription drug coverage is or is not creditable.

* An explanation of what “creditable coverage” means in the context of Medicare Part D.

* A comparison of the actuarial value of the employer’s coverage versus standard Medicare Part D.

* Information about the Medicare Part D late enrollment penalty and how it applies to individuals without creditable coverage who delay enrollment.

* Contact information for questions regarding the notice or the employer’s health plan.

* Instructions on what the recipient should do based on whether their coverage is creditable or non-creditable.

Beyond the content, the timing and method of delivery are also paramount. Notices must be sent annually to all Medicare-eligible individuals receiving coverage under the plan. This includes employees, retirees, spouses, and other dependents. The deadline for sending these notices is typically prior to October 15th each year, and also at other specific times, such as when an individual first enrolls in the plan or when their coverage terminates. Ensuring these requirements are met is vital for avoiding compliance issues and ensuring recipients have ample time to make informed decisions before the Medicare annual enrollment period.

Finding and Customizing a Medicare Creditable Coverage Notice Templa

For plan administrators, drafting a compliant and clear creditable coverage notice from scratch every year can be a time-consuming task. Fortunately, resources are available to simplify this process. The Centers for Medicare and Medicaid Services (CMS) itself provides model notices on its website, which serve as excellent starting points. These model notices are designed to be compliant with federal regulations and cover all the necessary legal language and disclosures. Beyond CMS, many insurance carriers, third-party administrators, and HR software providers also offer their own versions of a medicare creditable coverage notice templa.

Once you have a suitable template, the next step is customization. While the core language regarding Medicare regulations remains consistent, certain sections will need to be tailored to your specific plan. This includes details about your organization’s name, the specific health plan’s name, and whether your plan’s drug coverage meets the creditable standard based on an actuarial determination. You’ll also need to input relevant contact information for members who have questions about their benefits or the notice itself.

When customizing and distributing your notices, attention to detail is key. Double-check all dates, plan names, and contact information for accuracy. Consider adding a cover letter or an introductory paragraph that clearly explains the purpose of the notice in simple terms, especially for those who may find the technical language challenging. Ensuring your notice is easy to understand and readily accessible will empower your members to make the best choices for their healthcare coverage and avoid potential pitfalls with Medicare Part D.

Understanding and effectively communicating about creditable coverage is a fundamental responsibility for any entity offering prescription drug benefits to Medicare-eligible individuals. It serves as a crucial bridge, helping beneficiaries navigate the transition to Medicare Part D without confusion or penalties. By providing timely, clear, and accurate notices, organizations can ensure their members are well-informed and able to make confident decisions about their healthcare future.

Ultimately, the goal is to protect beneficiaries from late enrollment penalties and ensure seamless access to necessary prescription drug coverage. Utilizing robust templates and adhering to CMS guidelines simplifies the administrative burden while upholding the commitment to employee and member well-being. This diligent approach benefits everyone involved, fostering trust and clarity in the often-complex world of health benefits.