Understanding what your customers truly think about your business is fundamental to growth. It is not just about knowing if they are happy, but truly understanding their likelihood to recommend your product or service to others. This insight, often captured through a simple yet powerful question, forms the backbone of the Net Promoter Score system, a metric widely used across industries to gauge customer loyalty and satisfaction.

A well-crafted survey is your direct line to this invaluable customer feedback. While the core question is straightforward, the surrounding context and follow-up questions are what transform raw data into actionable insights, helping you pinpoint areas for improvement and identify your most enthusiastic advocates. Let’s explore how to build a survey that truly delivers.

What Makes a Great Net Promoter Score Survey Template?

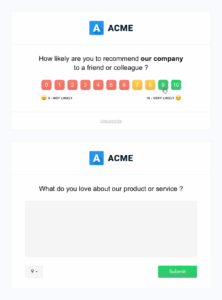

A successful Net Promoter Score survey template goes beyond just asking “How likely are you to recommend us?”. It’s about creating a smooth, engaging experience for the respondent while gathering comprehensive, actionable feedback. The best templates balance brevity with depth, ensuring you get the information you need without overwhelming your customers. They encourage honest responses and provide context for the numerical rating.

The structure is key. You want to start with the main NPS question, as it’s the core of the measurement. Following this, thoughtful open-ended questions are crucial. These qualitative responses are where the real gold lies, explaining the ‘why’ behind the ‘what’. Without these follow-ups, you’d only have a number, which while useful for tracking trends, offers little in the way of specific feedback for improvement.

Essential Elements to Include

When you’re designing your net promoter score survey template, make sure it covers these vital components to give you a complete picture:

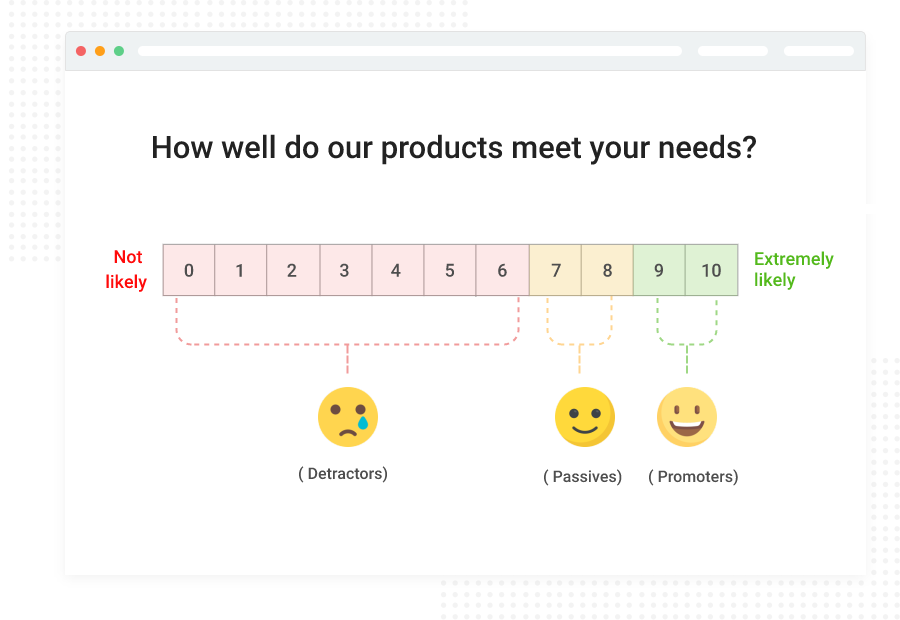

- The Core NPS Question: “On a scale of 0 to 10, how likely are you to recommend [Your Company/Product/Service] to a friend or colleague?” This is the foundational question that categorizes respondents into Promoters (9-10), Passives (7-8), and Detractors (0-6).

- Follow-Up Question for Detractors: “What was the primary reason for your score?” or “How could we improve your experience?” This helps you pinpoint critical issues and address dissatisfaction directly.

- Follow-Up Question for Passives: “What could we do to improve your experience?” or “What was missing from your experience?” This provides insights into how to convert indifferent customers into loyal promoters.

- Follow-Up Question for Promoters: “What did you like most about your experience?” or “What was the most valuable aspect of [Your Product/Service]?” This helps you understand your strengths and leverage them in marketing and product development.

- Optional Demographic Questions: If relevant, brief questions about the customer’s role, industry, or how long they’ve been a customer can add valuable context to their feedback.

Remember to keep the survey concise. Respecting your customers’ time is paramount. A long, complicated survey is likely to have a high drop-off rate, meaning you won’t get the feedback you need. Aim for completion within a couple of minutes.

Crafting Your Own Net Promoter Score Survey Template: Tips and Best Practices

Beyond the essential elements, there are several best practices that can significantly enhance the effectiveness of your Net Promoter Score survey template. Think about the overall user experience and how you can encourage as many meaningful responses as possible. This involves considering the channel, timing, and how you communicate the purpose of the survey.

Firstly, consider the delivery method. Email is a common choice, but in-app surveys, website pop-ups, or even transactional surveys immediately after a key interaction can yield higher response rates and more relevant feedback. The key is to choose a method that seamlessly integrates with your customer’s journey and is least disruptive. Personalizing the survey invitation can also make a big difference in encouraging participation.

Next, think about the timing. When is the best moment to ask for feedback? For product-focused businesses, it might be after a customer has used a new feature or completed an onboarding process. For service-oriented businesses, it could be shortly after a support interaction or a completed project. Timely surveys often result in more accurate and detailed responses because the experience is still fresh in the customer’s mind.

Finally, remember that collecting feedback is only half the battle. The true value comes from analyzing the responses and taking action. Categorize the open-ended feedback, look for recurring themes, and identify areas of concern or praise. Share these insights with relevant teams within your organization, from product development to customer support, to drive continuous improvement and demonstrate to your customers that their voice matters.