Imagine you’re on the cusp of launching something truly innovative, a product you’ve poured your heart and soul into. Before that grand unveiling, there’s a crucial step that can make all the difference: truly understanding your potential customers. This isn’t just about guessing; it’s about gathering solid, actionable insights. That’s precisely where a well-structured market research survey comes into play, especially when you’re dealing with something entirely new.

A thoughtfully designed survey can illuminate customer needs, gauge interest, and even help pinpoint the ideal pricing strategy. But where do you even begin with crafting such a powerful tool? It can feel a bit overwhelming, right? Well, that’s why having a solid framework, like a new product market research survey template, is incredibly helpful. It guides you through the process, ensuring you ask the right questions to get the answers you need for a successful launch.

Crafting Your Ideal New Product Market Research Survey

Building an effective survey isn’t just about listing questions; it’s about constructing a narrative that gently leads your respondents through their thoughts and opinions. You want them to feel comfortable sharing, and that means starting with broader concepts before diving into specifics. Think about the journey your potential customer takes when considering a new solution. What problems are they trying to solve? How might your product fit into their lives?

The goal is to extract valuable insights that will either validate your product idea or highlight areas for necessary adjustments. This includes understanding their current behaviors, their pain points with existing solutions, their desires for a better alternative, and their willingness to pay. Without this foundational knowledge, you’re essentially launching into the unknown, hoping for the best.

Key Components of an Effective Survey

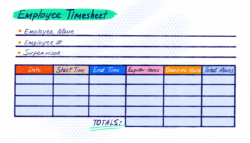

When you’re putting together your new product market research survey template, it’s wise to categorize your questions. This helps you cover all your bases and makes the data analysis much smoother later on. Starting with general demographic questions can help you segment your audience, allowing you to see if different groups have different needs or preferences.

Following demographics, you’ll want to explore their current challenges and how they might currently address them. Then, introduce your product concept. Don’t just describe it; try to paint a picture of how it solves their problems. Follow up with questions about their initial reactions, perceived value, and potential usage scenarios. Crucially, don’t forget to ask about pricing expectations and purchase intent.

- Demographic information: Who are your potential customers? (Age, location, income, etc.)

- Problem identification: What challenges do they face that your product aims to solve?

- Current solutions: How are they currently addressing these problems? What are the shortcomings?

- Product concept feedback: Initial reactions to your product idea, perceived benefits and drawbacks.

- Feature prioritization: Which features are most appealing or essential to them?

- Pricing sensitivity: What would they expect to pay, and what would be too much or too little?

- Purchase intent: How likely are they to purchase this product once it’s available?

Leveraging Your Survey Results for Product Success

So, you’ve distributed your survey, and the responses are pouring in. This is where the real magic happens, as you transform raw data into actionable insights. It’s not enough to simply look at percentages; you need to dig deeper into the “why” behind the numbers. Are there consistent themes emerging? Are certain demographics more enthusiastic or skeptical?

Analyzing the data from your new product market research survey template allows you to identify trends and patterns that might not have been obvious before. For instance, you might discover that while your product appeals broadly, a specific age group values a particular feature much more than others. Or perhaps, the perceived value is higher than you anticipated, suggesting an opportunity to adjust your pricing strategy.

This data-driven approach means you can make informed decisions rather than relying on guesswork or assumptions. If a significant number of respondents indicate a desire for a particular feature you hadn’t considered, that’s a strong signal to explore incorporating it. Conversely, if a feature you thought was crucial isn’t resonating, you can pivot and reallocate resources.

Think of this process as a continuous feedback loop. The initial survey helps you refine your product concept, and subsequent surveys, perhaps during beta testing or after an initial launch, can help you iterate and improve. This ensures that your product continues to evolve in a way that truly meets market demand and maintains its competitive edge. It’s about building a product for your customers, not just at them.

Taking the time to conduct thorough market research with a structured approach, like utilizing a comprehensive survey, is an investment that pays dividends. It significantly reduces the risk associated with new product launches and increases the likelihood of widespread adoption. Understanding your audience deeply before you even launch helps you tailor your product, messaging, and overall strategy for maximum impact.

Ultimately, success in today’s competitive landscape isn’t just about having a great idea; it’s about validating that idea with real customer feedback and continuously adapting. By embracing this proactive approach, you’re not just launching a product; you’re launching a solution that truly resonates, setting the stage for long-term growth and customer loyalty.