Ever found yourself in a situation where a client backs out at the last minute, leaving you with lost time, resources, or even missed opportunities? It’s a frustrating scenario many businesses face, and it highlights the crucial need for proper protection. Taking a deposit is a common and effective way to mitigate this risk, securing a commitment from your client and providing some financial reassurance for your efforts.

But not just any deposit will do. To truly protect your interests, you often need a non-refundable deposit. This ensures that even if plans change, your business isn’t left completely in the lurch. This is where a clear, legally sound non refundable deposit contract template becomes an indispensable tool in your business arsenal.

Understanding the Power of a Non-Refundable Deposit

A non-refundable deposit isn’t just a fancy term; it’s a specific agreement between two parties where a portion of the total payment is made upfront, with the understanding that this initial payment will not be returned under any circumstances outlined in the contract. For service providers and businesses, it acts as a safeguard, compensating for the resources, time, and potential business opportunities foregone while reserving services or products for a client.

Think about it from your perspective. When you book a date for an event, order custom materials, or allocate significant time to a project, you’re making a commitment. If the client then cancels, you might struggle to fill that slot or be stuck with bespoke items. The non-refundable deposit helps cover these immediate losses and disincentivizes last-minute cancellations. It creates a stronger commitment from the client, knowing their initial investment is at stake.

From the client’s side, paying a non-refundable deposit signifies a serious commitment to securing your services or product. It ensures they get the desired date, item, or attention, knowing that you, as the provider, are also committed to delivering. It sets clear expectations from the outset, which is a cornerstone of any good business relationship.

However, the power of such a deposit lies entirely in how clearly and legally it’s defined in writing. A verbal agreement simply won’t cut it when it comes to enforcing non-refundability. That’s why a comprehensive contract is so vital. It removes ambiguity and provides a clear reference point should any disputes arise down the line.

Key Elements of an Effective Deposit Clause

- Clearly State the Deposit Amount: Specify the exact monetary value or percentage required upfront.

- Explicitly Define Non-Refundability: Use unambiguous language stating that the deposit is non-refundable under all or specific conditions.

- Outline What the Deposit Covers: Explain whether it secures a date, covers initial consultation fees, materials, or acts as a cancellation fee.

- Specify Cancellation Policy: Detail the conditions and notice period for cancellation, and reiterate the non-refundable nature of the deposit.

Common Scenarios Where Deposits Shine

- Event Planning and Venue Bookings: Securing a date and time for weddings, parties, or corporate events.

- Custom Orders: For products that are custom-made and difficult to resell if the client backs out.

- Rental Agreements: Reserving equipment, properties, or specialized tools.

- Consulting and Professional Services: Covering initial research, setup, or the reservation of a professional’s time.

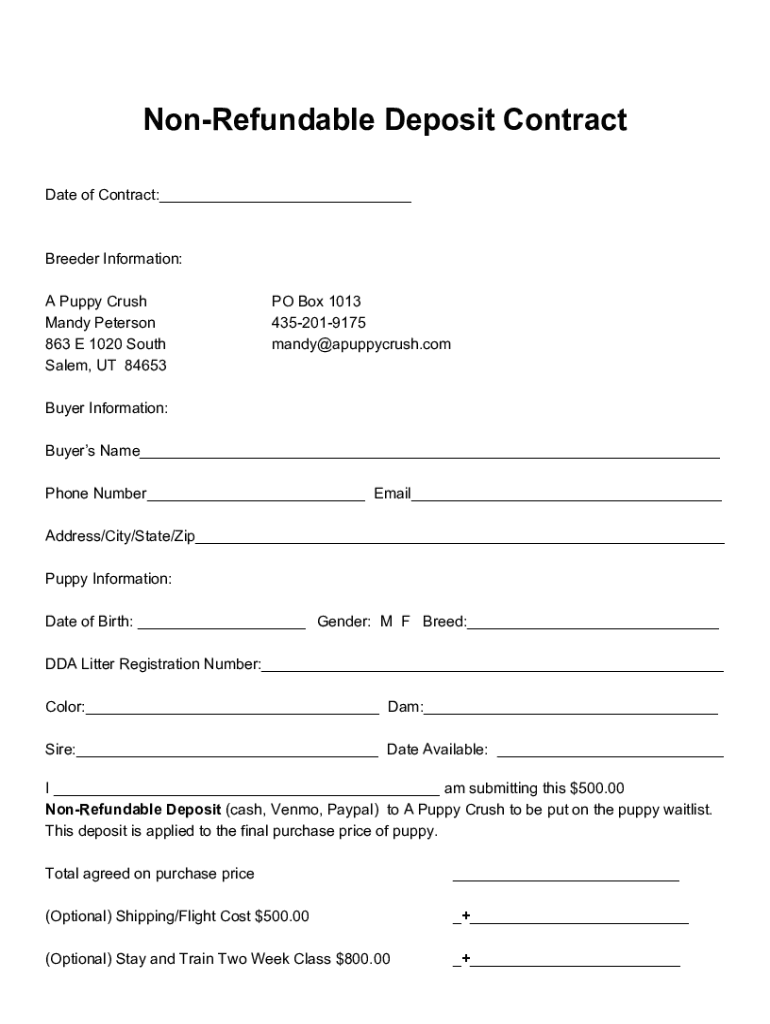

Crafting Your Own Non Refundable Deposit Contract Template

While many generic templates are available online, the real strength comes from tailoring a non refundable deposit contract template to fit the unique nuances of your business and the services or products you offer. Every business has different operational costs, cancellation impacts, and client expectations. A “one size fits all” approach might leave critical gaps in your protection or cause unnecessary confusion.

Begin by identifying the specific reasons you require a non-refundable deposit. Is it to cover the cost of materials ordered specifically for a client? To compensate for the loss of booking another client on a specific date? Or perhaps to account for administrative time spent on initial consultations? Clearly understanding your own needs will help you draft a clause that is both fair and effective.

Next, focus on clear and straightforward language. Avoid legal jargon where simpler terms will suffice. Both you and your client should be able to understand the terms without needing a law degree. Ambiguity is the enemy of a good contract; every party should know exactly what they are agreeing to regarding the deposit’s non-refundable nature, the conditions under which it applies, and what it covers.

Finally, while using a template as a starting point is highly practical, it is always a wise investment to have a legal professional review your customized non refundable deposit contract template. They can ensure that your contract complies with local laws and regulations, is legally enforceable, and adequately protects your interests without being overly burdensome or unfair to the client. This professional review can save you a significant amount of hassle and potential legal disputes down the road.

Essential Sections to Include

- Identification of Parties: Full legal names and contact information of both the service provider and the client.

- Description of Services/Products: A clear and detailed explanation of what is being provided.

- Deposit Amount and Payment Terms: The exact non-refundable amount, how it should be paid, and the due date.

- Non-Refundability Clause: Explicit language stating the deposit is non-refundable and under what circumstances.

- Cancellation Policy: Procedures for cancellation by either party and the consequences for the deposit.

- Force Majeure Clause: What happens if unforeseen circumstances (like natural disasters) prevent the service.

- Governing Law: Which state’s or country’s laws will govern the contract.

Having a well-drafted contract that includes a clear non-refundable deposit clause offers incredible peace of mind. It fosters professionalism, sets expectations upfront, and protects your business from the financial repercussions of last-minute cancellations or changes of heart. This proactive approach helps build trust and ensures that both parties understand their commitments and responsibilities from the very beginning.

Embrace the power of clear agreements. By investing time in creating or customizing a robust deposit contract, you are not just protecting your finances; you are laying a strong foundation for successful client relationships and a more secure business future. It’s a testament to good business practice and a vital step in mitigating common risks.