Venturing into the world of buying or selling a home without real estate agents can be an exciting prospect, often driven by the desire to save on commission fees. While a private house sale can offer significant savings and a more direct negotiation process, it also places a greater responsibility on both the buyer and seller to ensure all legal aspects are correctly handled. One of the most critical documents in this entire process is the contract, and having access to a reliable private house sale contract template can be an invaluable starting point for drafting a legally sound agreement that protects everyone involved.

Many people assume that a handshake and a verbal agreement are sufficient, especially when dealing with someone they know or trust. However, real estate transactions are complex and involve substantial sums of money. Without a clear, written contract, disagreements can quickly escalate, leading to stress, financial loss, and even legal battles. A comprehensive contract outlines the rights and responsibilities of both parties, minimizing misunderstandings and providing a roadmap for the entire sale process.

Even if you plan to consult with a legal professional before finalizing anything, beginning with a well-structured template can help you understand the essential components of a home sale agreement. It allows you to gather necessary information, consider various clauses, and have a more informed discussion with your attorney. This proactive approach can not only save you time but also ensure that no crucial detail is overlooked when it comes to formalizing your private property transaction.

What Goes Into a Solid Private House Sale Contract?

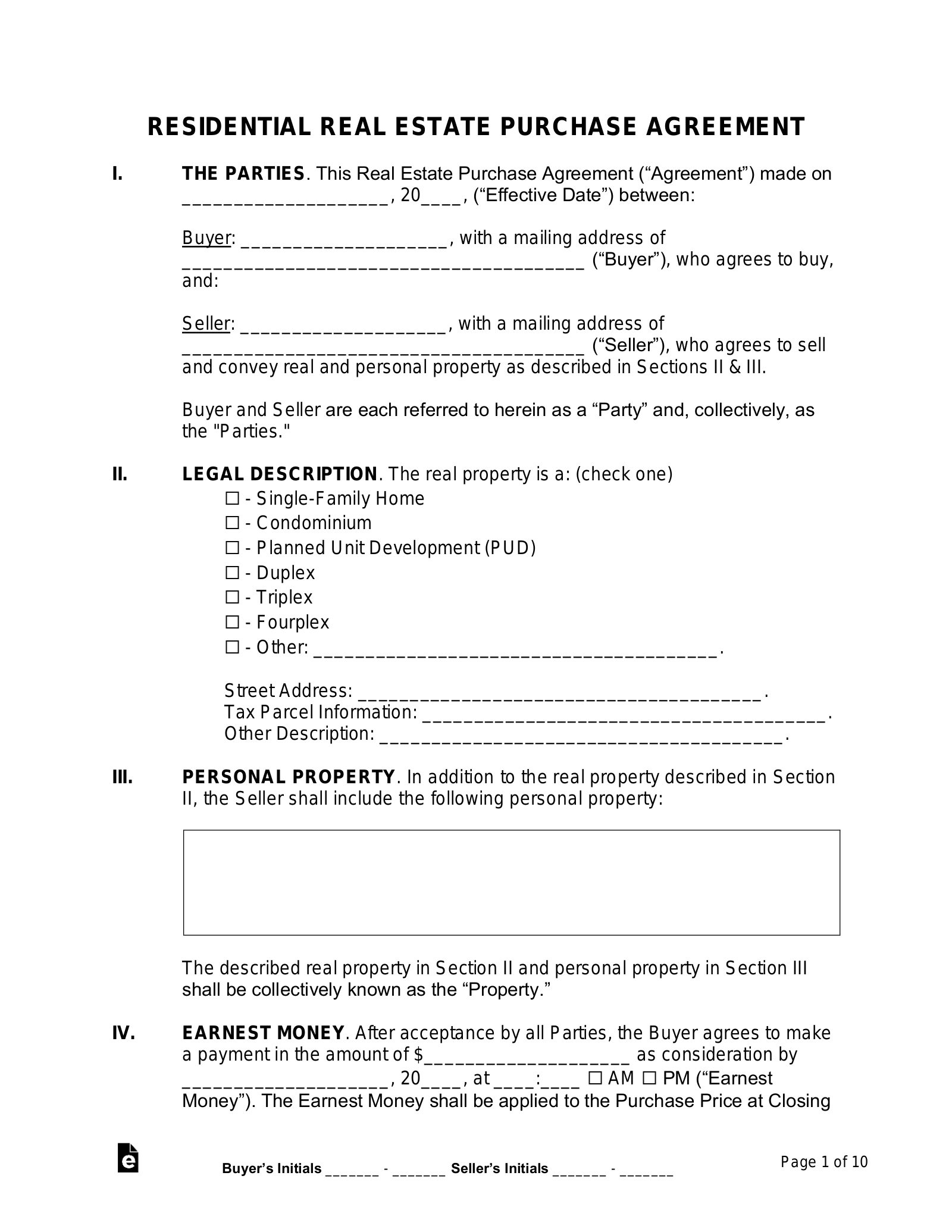

A robust private house sale contract is more than just a piece of paper; it’s the binding agreement that dictates the terms of your property transfer. It needs to be precise, comprehensive, and clear to avoid any ambiguity that could lead to future disputes. Think of it as the blueprint for your transaction, detailing every step from the initial offer to the final closing. While specific requirements can vary by location, several core elements are universally essential for a complete and effective agreement.

Parties Involved

Clearly identifying who is buying and who is selling is fundamental. The contract must state the full legal names of all buyers and sellers, along with their current mailing addresses. If any party is a trust or a corporation, their legal designation and authorized signatories must be included. This ensures there’s no confusion about who is legally bound by the agreement.

Property Description

The property itself needs to be accurately identified. This includes the full street address, city, state, and zip code. More importantly, the legal description of the property, often found on the current deed or property tax records, should be included. This might involve lot and block numbers, subdivision names, or metes and bounds descriptions, ensuring the exact piece of land being sold is unambiguous.

Purchase Price and Payment Terms

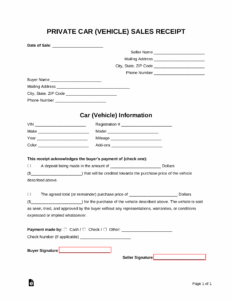

This section outlines the agreed-upon total purchase price for the property. It also details how that price will be paid, including any earnest money or deposit amount, the terms of financing (if applicable), and the remaining balance due at closing. Specifics about loan types, interest rates, and approval deadlines are crucial if the sale is contingent on the buyer securing a mortgage.

Contingencies

Contingencies are conditions that must be met for the contract to become fully binding. Common examples include a satisfactory home inspection, the buyer obtaining financing, the property appraising at or above the sale price, or even the buyer selling their current home. Each contingency should have a clear deadline and state what happens if the condition is not met (e.g., the buyer can walk away and get their earnest money back).

Closing Date and Possession

The contract must specify the date on which the sale will officially close, meaning the ownership of the property will transfer from the seller to the buyer. It should also clearly state when the buyer will take physical possession of the property, which is usually at closing but can sometimes be a few days later, depending on mutual agreement.

Fixtures and Personal Property

It’s vital to clarify what items are included in the sale and what are not. Fixtures, generally defined as items permanently attached to the property (like built-in appliances, light fixtures, or ceiling fans), are usually part of the sale. However, listing them explicitly avoids disputes. Any personal property the seller intends to leave (e.g., specific curtains, a washer/dryer) should also be itemized in the contract.

Disclosures

Sellers are typically required by law to disclose any known material defects of the property, such as lead-based paint, structural issues, or environmental hazards. The contract should reference these required disclosures and confirm that the buyer has received and acknowledged them. Local and state laws dictate the specific disclosures necessary.

Default and Remedies

This clause outlines what happens if either the buyer or seller fails to uphold their end of the agreement. It details the remedies available to the non-defaulting party, which could include keeping the earnest money (if the buyer defaults) or suing for specific performance (forcing the sale to go through). This section provides recourse and protection for both parties.

Governing Law

The contract should specify which state’s laws will govern the agreement. This is important for determining legal interpretation and jurisdiction in case of a dispute, ensuring that the contract adheres to the legal framework of the property’s location.

Why Use a Template and When to Seek Professional Help?

Utilizing a private house sale contract template can be a smart first step in a do-it-yourself real estate transaction. It provides a structured framework, ensuring that you don’t overlook common but critical clauses necessary for a complete agreement. Templates are often a cost-effective way to get started, helping both buyers and sellers understand the typical language and provisions involved in a property sale without immediately incurring significant legal fees. They serve as an excellent educational tool, familiarizing you with the process and what information you’ll need to gather.

However, it is crucial to recognize that a template, by its very nature, is generic. It cannot account for every unique circumstance, local ordinance, or specific negotiation point that might arise in your particular sale. Real estate laws vary significantly by state and even by county, and a template might not include all legally mandated disclosures or provisions specific to your jurisdiction. Relying solely on a generic template without any customization or professional review could expose both parties to unforeseen risks or legal vulnerabilities.

While a template is a great starting point, there are definite instances when professional legal assistance becomes not just advisable, but essential. Consider consulting with a real estate attorney if:

- There are complex issues with the property, such as easements, shared driveways, or boundary disputes.

- You are unsure about the specific disclosure requirements in your state or locality.

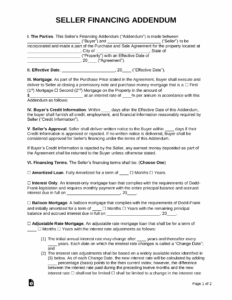

- The transaction involves unique financing arrangements or seller financing.

- Either the buyer or seller has specific, non-standard contingencies or demands.

- You feel uncomfortable interpreting any part of the contract or navigating the legalities.

- The sale involves an estate, trust, or multiple owners, adding layers of complexity.

Ultimately, a template should be viewed as a guide and a foundational document, not a substitute for tailored legal advice when dealing with an asset as significant as a home. Investing in a legal review can provide peace of mind and help ensure your private sale is executed smoothly and legally.

Engaging in a private house sale can be a rewarding experience, offering greater control and potential savings for both parties. The key to a successful transaction lies in meticulous planning and a clear, legally sound agreement. Taking the time to understand each component of a sales contract, whether through a template or direct legal consultation, will safeguard your interests and ensure a smooth transfer of property.

A well-prepared contract is the foundation upon which your entire private home sale rests. By prioritizing clarity, completeness, and adherence to legal requirements, you can navigate the process with confidence, ensuring that your significant investment or cherished home transitions to its new owner without unnecessary complications or regrets.