So, you’re keen on understanding what your customers truly think about your product, right? It’s one thing to launch a fantastic new feature or an entire product, but it’s another to know if it’s genuinely resonating with the people who matter most – your users. This is where the Net Promoter Score (NPS) comes in, offering a simple yet powerful way to gauge customer loyalty and satisfaction. It’s an indispensable tool for any product team aiming for continuous improvement and sustainable growth.

An effective product net promoter score survey template isn’t just about asking “How likely are you to recommend us?”. While that’s the core question, a truly insightful survey goes deeper, helping you uncover the “why” behind the scores. It’s about collecting actionable feedback that can directly inform your product roadmap, prioritize features, and ultimately, build a product that customers not only use but enthusiastically champion. Let’s dive into how you can craft such a template to get the most out of your customer feedback.

Building Your Core Product NPS Question and Follow-Ups

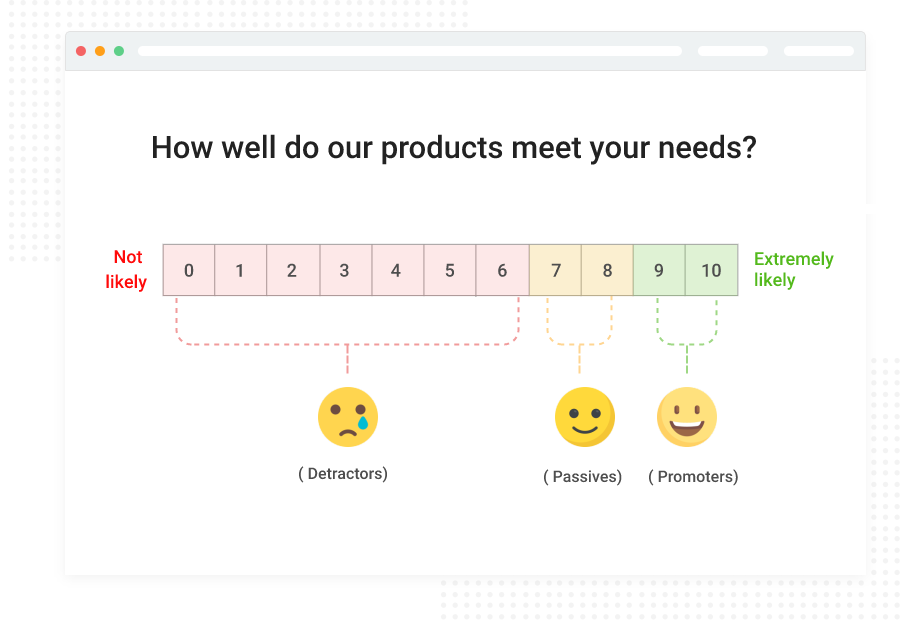

When you’re looking to understand customer sentiment, the core of any product net promoter score survey template revolves around one central question. This is the classic “likelihood to recommend” question, usually on a scale of 0 to 10. A score of 9-10 identifies your Promoters, 7-8 are Passives, and 0-6 are Detractors. The beauty of this question lies in its simplicity and its ability to act as a strong indicator of customer loyalty and potential for word-of-mouth growth. But just getting a number isn’t enough; the real gold is in the context.

To truly leverage the power of NPS, you need to go beyond the score. Imagine knowing someone gave you a 3, but not why. Or a 10, but again, no explanation. This is where follow-up questions become absolutely critical. They turn a mere metric into a rich source of qualitative data, helping you understand the specific reasons behind customer scores. This feedback is invaluable for pinpointing areas of strength and, more importantly, areas needing immediate attention or improvement within your product.

Crafting Specific Follow-Up Questions

The follow-up questions should be tailored based on the initial score provided. This personalization makes the survey feel more relevant to the user and encourages more detailed responses. For instance, you wouldn’t ask a Promoter the same question as a Detractor. Their motivations and experiences are likely vastly different, and your goal is to extract the most relevant insights from each segment. Thinking strategically about these questions ensures you get actionable feedback.

- For Promoters (9-10): “What did you like most about [Product Name]?” or “What’s the one thing you’d tell a friend about [Product Name]?” These help you identify your product’s core strengths and unique selling propositions.

- For Passives (7-8): “What could we do to improve your experience with [Product Name]?” or “What’s missing or could be better?” This helps pinpoint areas for incremental improvement that could shift them into the Promoter category.

- For Detractors (0-6): “What disappointed you about [Product Name]?” or “What aspects of [Product Name] need the most improvement?” These are crucial for identifying critical pain points, bugs, or missing features that are causing dissatisfaction and churn.

Adding an open-ended “Is there anything else you’d like to tell us?” question at the end is always a good idea. It provides an opportunity for users to share any thoughts that weren’t captured by the previous questions, sometimes revealing unexpected insights or edge cases. This comprehensive approach ensures you’re gathering a holistic view of the customer experience with your product.

Implementing and Acting on Your Survey Feedback

Once you’ve designed your product net promoter score survey template with compelling questions, the next big step is deciding when and how to deploy it, and crucially, what to do with the responses. The timing of your survey can significantly impact the quality and relevance of the feedback you receive. For instance, surveying a user immediately after they’ve used a key feature might yield very specific insights about that feature, whereas surveying them after a few weeks of consistent use might provide a broader perspective on overall product value.

Consider triggering surveys at specific points in the customer journey: after onboarding is complete, after a significant new feature release, or even on a recurring basis (e.g., quarterly) to track trends over time. The method of delivery also matters, whether it’s an in-app prompt, an email, or a link shared through customer support channels. The goal is to make it as easy and unobtrusive as possible for your users to provide their valuable input. A seamless survey experience can greatly increase your response rates.

Collecting the data is only half the battle; the real work begins when you analyze and act on the insights. Segmenting your NPS scores and feedback by user type, product feature, or even geographic location can reveal patterns that a simple aggregate score might miss. For example, you might find that your enterprise users are promoters for a certain feature, while small business users are detractors for the same feature, indicating different needs or usage patterns. This level of granularity is essential for targeted product improvements.

Finally, closing the feedback loop is paramount. This means not only acknowledging the feedback but also communicating how you’re using it to improve the product. When customers see their suggestions being implemented or even just hear that their input was heard, it builds trust and fosters a stronger relationship. This transparency can turn Detractors into Passives, Passives into Promoters, and reinforce the loyalty of your existing Promoters. It transforms the NPS survey from a mere data collection exercise into a powerful tool for customer engagement and product development.

Continuously refining your product based on this direct customer input ensures your offerings remain relevant and highly valued. It’s a cyclical process: design, deploy, analyze, act, and then reiterate. By truly listening to your customers through well-crafted surveys and dedicated follow-up, you empower your product to evolve in ways that genuinely serve your user base, leading to greater satisfaction and, ultimately, more enthusiastic advocates for your brand. This proactive approach to product development, driven by real user sentiment, is the hallmark of truly successful products.