Life often presents situations where friends, family, or even business acquaintances need to borrow money. While goodwill and trust are important, relying solely on verbal agreements can lead to misunderstandings, strained relationships, and financial disputes down the line. It’s human nature to forget details or interpret things differently over time, especially when money is involved.

This is where a solid written agreement becomes invaluable. A promise to pay contract template acts as a clear, legally binding document that outlines the terms of a loan, ensuring both parties are on the same page from the start. It provides peace of mind and a clear path forward for repayment, protecting everyone involved.

Why a Promise to Pay Agreement is Essential

Think about a loan between individuals or small businesses. Without a formal document, what happens if repayment terms are forgotten, or if circumstances change? Informal agreements, while born of good intentions, often lack the necessary detail to be truly effective. A written promise to pay agreement clarifies the obligation, transforming a casual understanding into a concrete commitment.

The primary benefit of using a formal document is its legal enforceability. Should a dispute arise, or if the borrower fails to meet their obligations, a written contract serves as undeniable proof of the agreement’s existence and its specific terms. It provides a solid foundation for seeking resolution, whether through negotiation or, if necessary, through legal channels, giving the lender a much stronger position.

Moreover, these agreements offer significant advantages for both the lender and the borrower. For the person lending the money, it provides security, outlining clear repayment expectations and offering recourse if those expectations aren’t met. For the borrower, it brings clarity, ensuring they understand their responsibilities, avoiding any future claims of misunderstanding, and demonstrating their commitment to fulfilling the debt.

Key Components to Look For

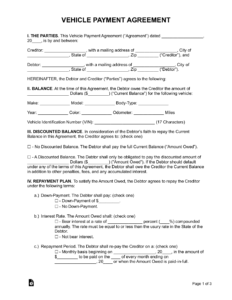

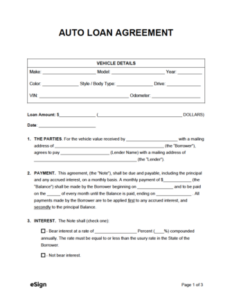

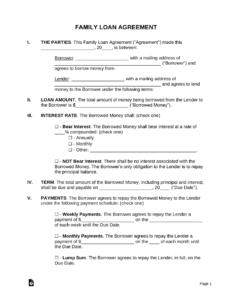

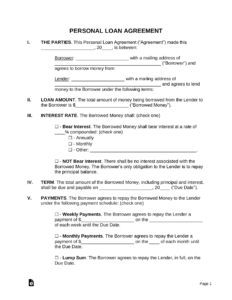

When you’re looking at a promise to pay contract template, you’ll notice it includes several critical elements designed to make the agreement comprehensive and legally sound. These aren’t just arbitrary clauses; each one plays a vital role in protecting both parties and ensuring the loan process is transparent.

- **Identification of Parties:** Clearly states the full legal names and addresses of both the lender and the borrower.

- **Loan Amount:** Specifies the exact principal sum of money being loaned, usually both in numerical and written form to prevent errors.

- **Interest Rate:** If interest is being charged, this section details the rate, how it’s calculated, and when it accrues.

- **Repayment Schedule:** Outlines how and when the loan will be repaid, whether in installments, a lump sum, or according to a specific timeline. It includes due dates and amounts.

- **Collateral (if applicable):** If the loan is secured by an asset, this section describes the collateral and the terms under which it may be claimed if the borrower defaults.

- **Default Clauses:** Explains what constitutes a default on the loan and the consequences, such as late fees, acceleration of the debt, or other actions the lender may take.

- **Governing Law:** Specifies which state’s or jurisdiction’s laws will govern the contract, important for legal enforcement.

- **Signatures and Dates:** Both parties must sign and date the agreement, often with a witness or notary public, to confirm their acceptance of the terms.

Remember, a template is a starting point. While it provides a robust framework, it’s designed to be adaptable. You’ll want to customize it with the specific details of your unique situation, ensuring every term accurately reflects your agreement. This careful attention to detail ensures the document truly serves its purpose.

Crafting Your Promise to Pay Document with Confidence

The beauty of a well-designed promise to pay contract template is that it demystifies the process of formalizing a loan. You don’t need to be a legal expert to create a robust agreement; the template guides you through the necessary steps and ensures you include all the crucial information. This simplification empowers individuals and small businesses to handle their financial arrangements professionally and effectively.

Clarity is paramount when drafting any financial agreement. Ambiguity can be a breeding ground for future disputes. Therefore, when filling out your chosen template, make sure every detail is precise. From the exact amount of the loan to the specific dates of repayment, leave no room for misinterpretation. This meticulous approach safeguards the interests of both the lender and the borrower, fostering trust and preventing later disagreements over what was or wasn’t agreed upon.

Before putting pen to paper, both parties should thoroughly review the entire document. Discuss every clause, ensure you understand the implications of each term, and be comfortable with all the conditions, especially those concerning default or late payments. It’s always better to clarify any doubts or negotiate terms before signing, rather than facing unexpected challenges down the line. A signed promise to pay contract template signifies mutual understanding and agreement.

- Ensure all identifying information for both the borrower and lender is accurate and complete.

- Clearly state the principal loan amount, interest rate (if any), and the total amount to be repaid.

- Define a precise repayment schedule, including installment amounts and due dates.

- Include clauses for late payment penalties or actions to be taken in case of default.

- Consider having the document reviewed by a legal professional, especially for complex or substantial loans.

Ultimately, a detailed and properly executed promise to pay document is a powerful tool for maintaining healthy financial relationships. It removes the guesswork from lending and borrowing, providing a clear roadmap for repayment and offering security for both parties. It’s an act of responsibility and foresight that protects friendships, family ties, and business ventures alike.

Establishing clear financial boundaries and expectations is a cornerstone of responsible financial management. By utilizing a structured document for any loan, big or small, you ensure that everyone involved has a transparent understanding of their obligations and rights. This clarity not only mitigates risks but also reinforces trust and professionalism.

Making the effort to formalize these arrangements demonstrates a commitment to fairness and accountability. It’s about protecting assets, fostering clear communication, and providing a stable framework for fulfilling financial promises, allowing you to navigate lending and borrowing situations with confidence and peace of mind.