Dealing with property damage is never fun. Whether it’s a leaky roof, storm damage, or even something as small as a burst pipe, the aftermath can be stressful and overwhelming. On top of the immediate repairs, you’re faced with the daunting task of filing a property insurance claim. And that’s where the importance of proper documentation comes in. The key to a smooth and successful claim process lies in having your ducks in a row – or rather, your documents in order.

Think of your insurance claim as a story you need to tell. You’re painting a picture for the insurance adjuster, and the clearer the picture, the better. Without adequate documentation, that picture becomes blurry, leading to delays, denials, or underpaid settlements. Imagine trying to explain the extent of water damage without photos or a detailed inventory of damaged items. It’s like trying to build a house without a blueprint – you might get somewhere, but it’s unlikely to be what you envisioned.

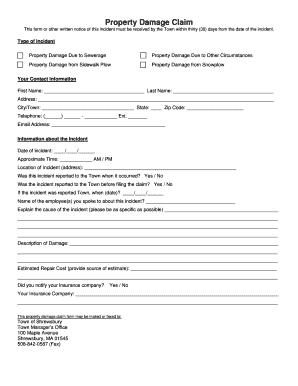

This is where a solid property claim documentation template can be a real lifesaver. It provides a structured framework for gathering and presenting all the necessary information to your insurance company. It helps you stay organized, avoid missing crucial details, and ultimately, maximize your chances of a fair and timely settlement. Let’s dive deeper into what this template entails and how it can simplify the often-complex claims process.

Why a Comprehensive Property Claim Documentation is Essential

A well-structured property claim documentation template acts as your guide through the often-turbulent waters of insurance claims. It ensures you systematically collect and present all pertinent information, leaving no room for ambiguity or misinterpretation. It’s more than just a checklist; it’s a tool that empowers you to navigate the process confidently and effectively.

One of the primary benefits is clarity. Insurance adjusters handle numerous claims simultaneously. A disorganized presentation of information can easily get lost in the shuffle or, worse, be misinterpreted. A template ensures that all essential details – from the date of the incident to the estimated cost of repairs – are presented in a clear, concise, and easily digestible format. This significantly reduces the likelihood of delays caused by requests for additional information.

Moreover, a comprehensive documentation template serves as your personal record. In the event of disputes or disagreements with the insurance company, you have a reliable and verifiable account of the damage and related expenses. This can be invaluable during negotiations or even if you need to escalate the claim to a higher authority. It provides a solid foundation for your position and strengthens your chances of a favorable outcome.

Beyond clarity and record-keeping, a template promotes efficiency. It streamlines the documentation process, saving you valuable time and effort. Instead of scrambling to gather information haphazardly, you have a structured framework that guides you through each step. This is particularly beneficial in the aftermath of a damaging event when you’re already dealing with a multitude of challenges and responsibilities.

Finally, using a property claim documentation template can potentially lead to a more accurate settlement. By meticulously documenting all damages, expenses, and related losses, you ensure that you are fully compensated for everything you are entitled to under your insurance policy. Leaving out details, even unintentionally, can result in an underpaid settlement, leaving you with a financial burden you shouldn’t have to bear.

Key Elements of an Effective Property Claim Documentation Template

Now that we’ve established the importance of a comprehensive template, let’s examine the key elements that make it effective. These components ensure you capture all the necessary information to support your claim and present it in a clear and compelling manner. Each element plays a crucial role in building a strong case for your claim.

First and foremost, the template should include detailed information about the insured property. This encompasses the property address, policy number, and a comprehensive description of the property itself, including its age, construction type, and any unique features. A clear understanding of the property’s characteristics helps establish the baseline before the damage occurred.

Next, the template must provide a dedicated section for documenting the incident itself. This includes the date and time of the incident, a detailed description of what happened, and the cause of the damage. Include any relevant police reports, fire department reports, or other official documents that support your account. Witness statements, if available, can also strengthen your claim.

Perhaps the most critical component is a thorough inventory of all damaged items. This should include a detailed description of each item, its estimated value, and any supporting documentation such as receipts or photographs. Consider taking video footage of the damaged property as well, providing a visual record of the extent of the damage. Be as specific as possible, as generic descriptions can lead to undervaluation by the insurance company.

Furthermore, the template should include a section for documenting all related expenses. This includes the cost of temporary repairs, cleaning services, and any additional living expenses incurred as a result of the damage. Keep receipts for all expenses, as these will be required to substantiate your claim. Don’t forget to document any lost income if the damage has rendered your property uninhabitable or unusable.

Finally, the template should provide a space for documenting all communication with the insurance company. This includes the date and time of each contact, the name of the person you spoke with, and a summary of the conversation. Maintaining a detailed record of all interactions can be invaluable if disputes arise or if you need to track the progress of your claim. By incorporating these key elements, your property claim documentation template becomes a powerful tool for navigating the insurance claim process and securing a fair settlement. Using a property claim documentation template ensures a much smoother process for you.

Navigating the complexities of property damage and insurance claims can feel overwhelming. But remember, preparation is key. Gathering your documents, understanding your policy, and communicating effectively with your insurance company are essential steps toward a successful resolution.

While it might seem like a lot of work upfront, the time and effort you invest in meticulous documentation will pay off in the long run. It empowers you to advocate for your rights, negotiate effectively, and ultimately, restore your property and your peace of mind.