So, you’re diving into the world of R&D tax credits, that’s fantastic! It’s a potentially huge benefit for companies investing in innovation. But let’s be honest, the process can feel a bit like navigating a maze. One of the trickiest parts? Getting your documentation in order. Uncle Sam wants to see proof that your activities really qualify, and that means having solid records. That’s where having a reliable r&d credit documentation template can be a lifesaver. Think of it as your roadmap through that maze – a structured way to capture all the essential information you need to support your claim.

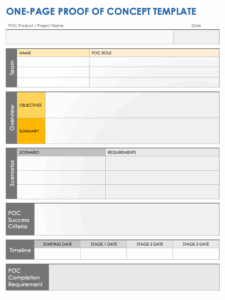

Essentially, an r&d credit documentation template is a pre-built structure designed to help you systematically record all the details of your qualifying research activities. It acts as a guide, prompting you to capture specifics like the project goals, the technical challenges you faced, the solutions you explored (even the ones that didn’t work!), and the overall impact of your work. It’s about demonstrating, in a clear and organized way, that your activities meet the IRS’s four-part test for qualified research.

Without a good template, you’re essentially leaving yourself open to potential issues during an audit. You might struggle to recall important details, miss documenting crucial information, or simply present your case in a way that’s not as compelling to the IRS. Using a structured approach not only makes the process easier, but it also increases your chances of successfully claiming the credits you deserve. Let’s explore why having a well-defined process and a solid r&d credit documentation template is paramount.

Why a Comprehensive R&D Credit Documentation System is Essential

Let’s face it, claiming R&D tax credits can seem daunting. The IRS has specific criteria, and failing to meet them can lead to a denied claim or even penalties. That’s why meticulously documenting your research activities is absolutely vital. Think of your documentation as the evidence you’ll present to support your claim – the stronger the evidence, the better your chances of success.

A comprehensive documentation system goes beyond just tracking expenses. It’s about telling the story of your research. It’s about showing how your activities meet the four-part test, which essentially asks: Was the purpose of the activity to create new or improved business component? Was there uncertainty concerning the capability or method of developing or improving the business component? Did you intend to discover information that would eliminate that uncertainty? And did substantially all of the research activities constitute elements of a process of experimentation?

Think about it this way: the IRS isn’t just interested in the fact that you spent money on research. They want to know what you were trying to achieve, what challenges you encountered, and how you systematically worked to overcome those challenges. This includes documenting your hypotheses, your experiments, the results you obtained (both positive and negative), and the conclusions you drew. Even failures are valuable because they demonstrate that you were genuinely engaged in a process of experimentation.

Furthermore, well-organized documentation makes the entire claims process smoother and more efficient. When you have a clear record of your research activities, you’ll be able to easily answer questions from the IRS, respond to requests for information, and demonstrate the validity of your claim. This can save you time, money, and a lot of stress in the long run.

In essence, a robust R&D credit documentation system is an investment in your company’s financial future. It’s about protecting your eligibility for valuable tax credits and ensuring that you can confidently claim the benefits you deserve. A template will guide this process, helping you stay organized and on track.

Key Elements of a Successful R&D Credit Documentation Template

So, what exactly should your r&d credit documentation template include? Here are some key elements to consider: Project Description: A detailed description of the project, including its goals, objectives, and intended outcomes. This should provide a clear understanding of the purpose of the research activity. Technical Challenges: A description of the technical challenges or uncertainties that the project aimed to address. This is crucial for demonstrating that the research involved a genuine attempt to overcome a technological hurdle.

Experimental Process: A detailed account of the experimental process, including the hypotheses, experiments, results (both positive and negative), and conclusions drawn. This should demonstrate that the research involved a systematic and iterative process of experimentation. Supporting Documents: Copies of relevant documents, such as design specifications, lab notebooks, test results, and reports. These documents provide concrete evidence to support your claim.

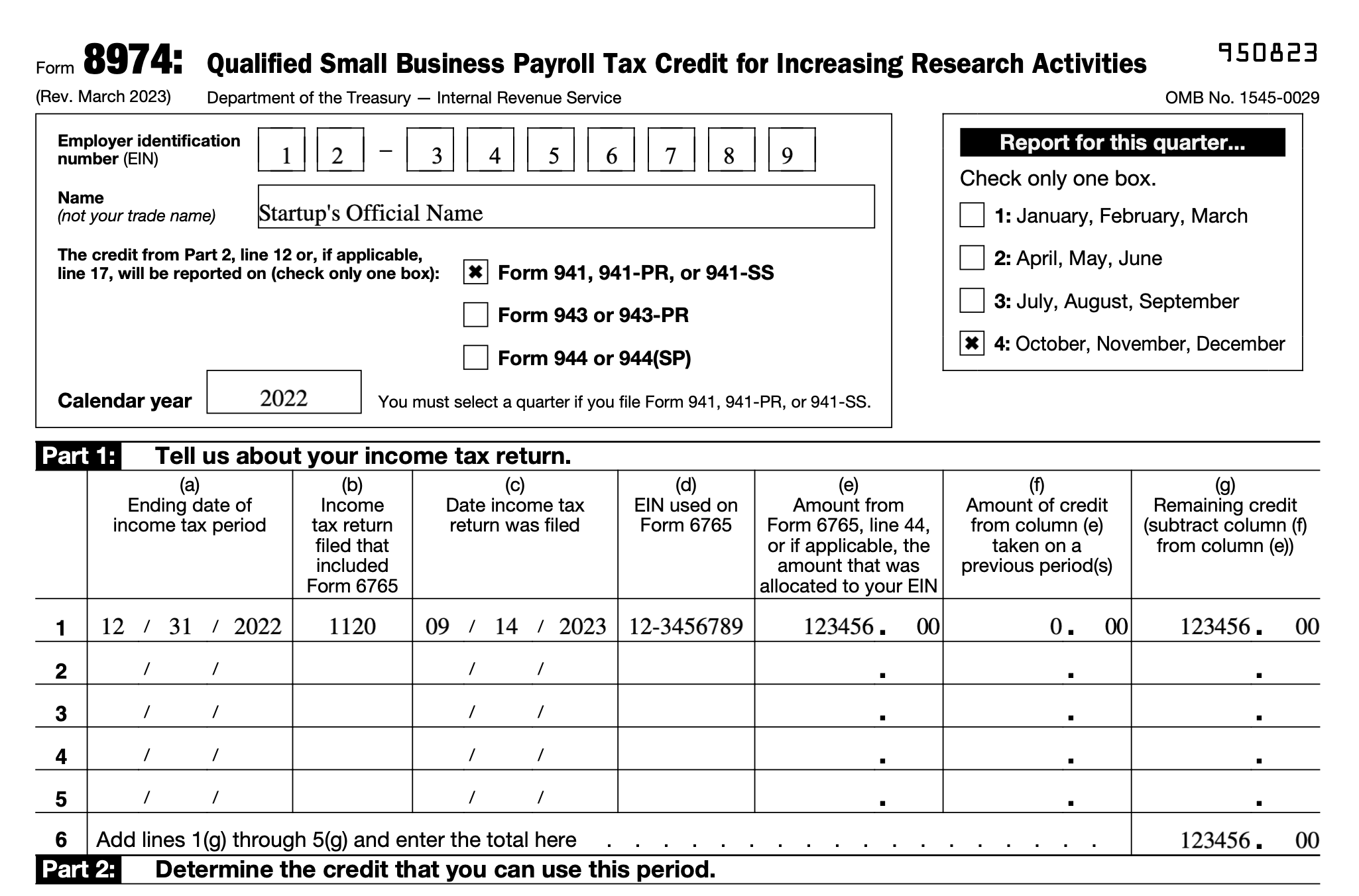

Employee Time Tracking: Records of the time spent by employees on qualified research activities. This is important for calculating the qualified research expenses (QREs). Financial Records: Documentation of the expenses incurred on qualified research activities, such as wages, supplies, and contract research expenses. These records provide a clear audit trail of the costs associated with the research.

Practical Tips for Using an R&D Credit Documentation Template Effectively

Choosing the right r&d credit documentation template is just the first step. To maximize its effectiveness, you need to use it consistently and strategically. Here are some practical tips to help you get the most out of your template:

Start Early and Be Consistent: Don’t wait until the end of the year to start documenting your research activities. Implement your template from the outset of each project and make it a habit to update it regularly. Consistency is key – the more consistent you are, the easier it will be to track your progress and maintain accurate records.

Assign Responsibility: Designate specific individuals or teams to be responsible for documenting research activities. This ensures that someone is actively tracking and updating the template, and that the responsibility doesn’t fall through the cracks. Provide training to these individuals to ensure that they understand the requirements and how to use the template effectively.

Integrate with Existing Systems: Whenever possible, integrate your r&d credit documentation template with your existing accounting and project management systems. This can streamline the process and reduce the risk of errors. For example, you can link your template to your time tracking system to automatically capture employee time spent on qualified research activities.

Review and Update Regularly: Set aside time to review and update your template regularly. This will help you identify any gaps in your documentation and ensure that it remains accurate and up-to-date. It’s also a good idea to periodically review your template with a qualified tax professional to ensure that it meets the IRS’s requirements.

Seek Expert Advice: Don’t hesitate to seek expert advice from a qualified tax professional specializing in R&D tax credits. They can provide valuable guidance on how to document your research activities effectively and ensure that you’re maximizing your credit potential. They can also help you navigate the complexities of the tax laws and regulations.

With the right strategies, you can confidently navigate the R&D tax credit landscape and claim the benefits you’re entitled to. By prioritizing documentation and implementing a well-structured r&d credit documentation template, you’ll be well-positioned to support your claim and maximize your return on investment.