Considering a path to homeownership that doesn’t involve the traditional upfront down payment and immediate mortgage? Rent to own agreements have become a popular and flexible option for many aspiring homeowners and property sellers alike. This unique arrangement allows a tenant to lease a property for a set period with the option to purchase it before the lease term expires, often crediting a portion of their rent towards the eventual down payment. It bridges the gap between renting and buying, offering a stepping stone to property ownership.

However, the success and fairness of such an agreement hinge entirely on a clear, comprehensive, and legally sound document. Without a properly drafted contract, both parties can find themselves in uncertain territory, leading to potential disputes and misunderstandings. That’s why having a robust rent to own contract template is not just helpful, but absolutely essential for a smooth and beneficial transaction for everyone involved.

Understanding the Basics of a Rent To Own Agreement

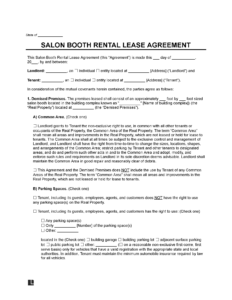

A rent to own agreement, sometimes called a lease option or lease purchase agreement, is essentially two contracts rolled into one. First, there’s a standard lease agreement, which outlines the terms of the tenancy, including rent payments, maintenance responsibilities, and the duration of the lease. Second, there’s an option to purchase agreement, which gives the tenant the exclusive right to buy the property at a predetermined price within a specific timeframe. This dual nature makes it a unique and powerful tool in the real estate market.

For tenants, this arrangement offers several appealing advantages. It provides an opportunity to live in the home they plan to buy, allowing them to truly test it out before committing to a purchase. It can be particularly beneficial for those who need time to improve their credit score, save for a larger down payment, or simply navigate a fluctuating housing market. Plus, with rent credits often accumulating, tenants are effectively building equity even while renting.

Landlords also find rent to own agreements attractive. They can secure a tenant who is more invested in the property’s upkeep, knowing they might eventually own it. It can also open up a wider pool of potential renters, including those who may not qualify for a traditional mortgage immediately but are strong candidates for eventual homeownership. Furthermore, landlords can often command a slightly higher rent or a premium purchase price, offsetting the time the property is off the market.

However, the flexibility of a rent to own arrangement also means there are more moving parts than a standard lease or purchase. This complexity underscores the critical need for a clear, well-structured contract that anticipates potential issues and protects the interests of both the landlord (seller) and the tenant (buyer). Without such a document, misunderstandings about responsibilities, financial commitments, and the purchase process are almost inevitable.

Key Components of Your Rent To Own Contract Template

When putting together a rent to own contract template, it’s vital to ensure every crucial aspect of the agreement is meticulously detailed. This prevents ambiguities and provides a clear roadmap for both parties. Here are some of the essential sections that should be included:

- Parties Involved: Clearly identify the full legal names of both the landlord/seller and the tenant/buyer.

- Property Description: A precise legal description of the property, including the full address.

- Lease Term and Rent Amount: Specify the duration of the lease agreement and the monthly rent payment.

- Option Fee: Detail the non-refundable fee the tenant pays for the exclusive right to purchase the property. State clearly if and how this fee will be credited towards the purchase.

- Purchase Price: Clearly state the agreed-upon purchase price of the property. It’s often set at the beginning of the agreement.

- Rent Credits: Explain what portion of each monthly rent payment, if any, will be credited towards the down payment or purchase price.

- Maintenance Responsibilities: Outline who is responsible for routine maintenance, major repairs, property taxes, and insurance during the lease term. This is often a point of contention if not clearly defined.

- Default Clauses: Define what constitutes a default by either party and the remedies available, including what happens to the option fee and rent credits.

- Closing Costs: Specify who is responsible for various closing costs if the option to purchase is exercised.

- Inspection Rights: Grant the tenant the right to conduct a home inspection before exercising the option to purchase.

- Signatures: All parties involved must sign and date the agreement, preferably witnessed and notarized.

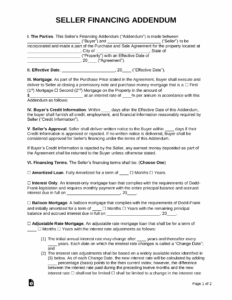

The option fee and rent credits are particularly important financial elements that demand careful attention. The option fee, typically a percentage of the purchase price, secures the tenant’s right to buy the property and is usually non-refundable. Rent credits, on the other hand, are the amounts from the monthly rent that accumulate towards the purchase. Precisely defining these terms ensures both parties understand their financial obligations and benefits.

Always remember that while a comprehensive rent to own contract template is a solid foundation, seeking legal counsel from an attorney specializing in real estate law is highly recommended before finalizing any agreement. This ensures compliance with local and state laws and safeguards your interests.

Navigating the Legalities and Practicalities

Even with a detailed rent to own contract template, understanding the legal and practical nuances is paramount. Real estate laws can vary significantly from state to state and even city to city, impacting everything from landlord-tenant rights to property disclosure requirements. What might be standard practice in one area could be legally invalid or require additional clauses in another. This makes local legal review an indispensable step.

Disclosures are another critical aspect. Sellers are often legally required to disclose known defects of the property, lead paint hazards, or other material facts that could influence a buyer’s decision. Even if the buyer is initially a tenant, these disclosures are usually applicable once the option to purchase is in play. Neglecting proper disclosures can lead to serious legal repercussions down the line.

From a practical financial perspective, tenants utilizing a rent to own agreement need to remain diligent in their financial planning. The agreement offers time to save for a down payment and improve credit, but it’s up to the tenant to take advantage of that window. Working with a mortgage lender early in the process can help establish a clear financial path and ensure the tenant is ready to secure financing when the time comes to exercise the purchase option.

Both parties must be acutely aware of potential pitfalls. For the tenant, if they fail to qualify for a mortgage or decide not to purchase, they typically forfeit the option fee and any accumulated rent credits. For the landlord, if the tenant doesn’t exercise the option, they might have to restart the selling process, though they do retain the option fee and potentially premium rent payments. A well-drafted contract anticipates these scenarios and provides clear guidance on how to proceed, mitigating risk for everyone involved.

- Considerations for Tenants:

- Thoroughly understand the non-refundable nature of the option fee and ensure you’re committed to the purchase path.

- Clarify maintenance responsibilities, especially for major repairs that could arise during the lease term.

- Ensure the purchase price is firmly locked in, protecting you from market fluctuations.

- Obtain a professional home inspection to understand the property’s condition before committing to purchase.

- Considerations for Landlords:

- Conduct thorough tenant screening, even more so than a standard rental, given the long-term nature of the agreement.

- Establish clear terms for default and non-exercise of the option.

- Consult with a tax professional to understand the tax implications of a rent to own agreement.

- Be prepared for the possibility that the tenant may not ultimately purchase the property.

Embarking on a rent to own journey can be a highly rewarding experience for both parties when handled correctly. It offers a flexible and alternative route to property ownership or sale, opening doors that traditional transactions might keep closed. The key to unlocking this potential lies in a meticulously prepared and understood agreement.

A solid rent to own contract template serves as the bedrock for a successful and transparent transaction. It clarifies expectations, defines responsibilities, and protects the interests of everyone involved, fostering trust and minimizing potential disputes. By taking the time to understand each clause and seeking professional advice, both aspiring homeowners and property sellers can confidently navigate this exciting path to achieving their real estate goals. This diligent approach ensures a smooth transition from tenancy to ownership, benefiting all parties involved.