Navigating the world of sales, especially when dealing with significant purchases, often involves more than just a simple exchange of goods for cash. For many businesses and consumers, a structured payment plan is essential. This is precisely where a retail installment sales contract template becomes an invaluable tool. It provides a clear, legally sound framework for agreements where a buyer makes regular payments over time for a product or service, rather than paying the full amount upfront.

These contracts are incredibly common in various industries, ranging from car dealerships and furniture stores to electronics retailers and even some service providers. They allow consumers to acquire items they need or desire without straining their immediate finances, making larger purchases more accessible. For sellers, it opens up a broader customer base, enabling them to close sales that might otherwise be out of reach for cash-strapped buyers.

However, simply having an agreement isn’t enough. The devil is in the details, and a poorly drafted or incomplete contract can lead to disputes, legal headaches, and financial losses for either party. That’s why understanding the components of such a contract and having a reliable template to start from is not just convenient; it’s a critical step in ensuring fair and transparent transactions for everyone involved.

Understanding the Core of Your Retail Installment Agreement

A retail installment sales contract is essentially a financing agreement between a buyer and a seller for the purchase of goods or services. Unlike a traditional loan from a bank, the financing is provided directly by the seller, or through a third-party financer arranged by the seller. The buyer takes possession of the item immediately but agrees to pay the purchase price, plus any interest and fees, in a series of scheduled payments over a specified period.

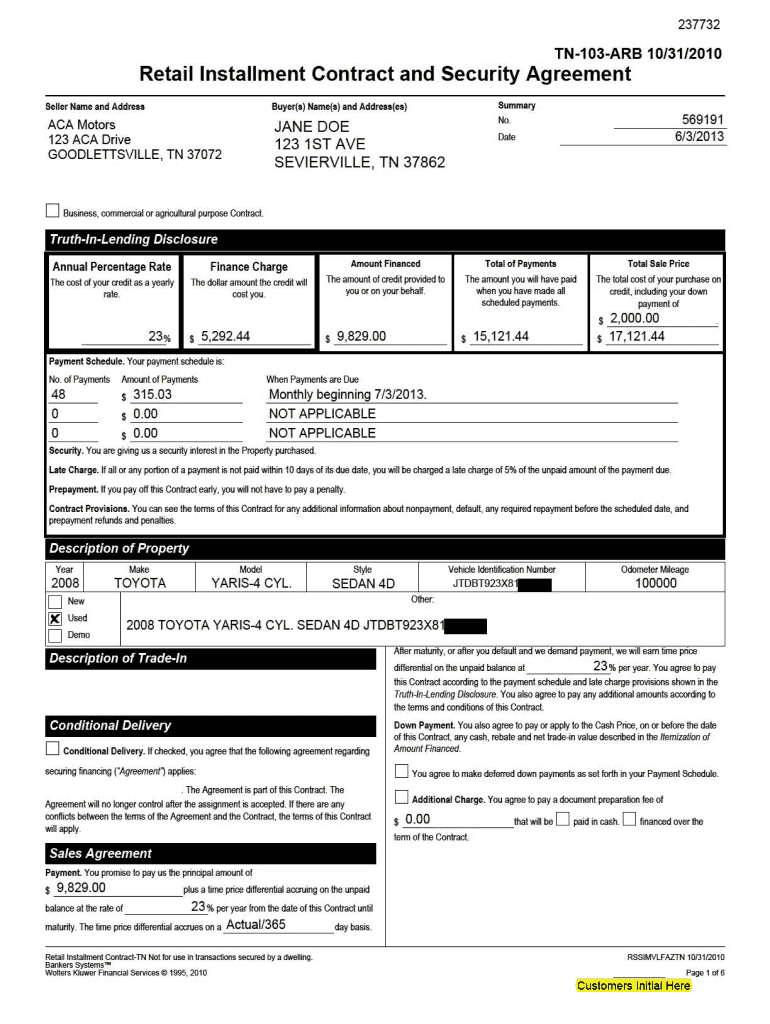

At its heart, the contract clearly identifies the parties involved: the buyer (or buyers, if there are multiple), the seller (the business providing the goods or services), and sometimes a creditor if the seller assigns the contract to a third-party lender. Each party’s legal name and contact information must be explicitly stated to avoid any ambiguity about who is bound by the terms of the agreement.

The contract must also provide a precise and detailed description of the goods or services being purchased. This isn’t just a basic mention; it should include make, model, serial numbers, quantity, and any unique identifiers. This level of detail helps prevent misunderstandings about what exactly the buyer is committing to pay for over time.

Crucially, the financial terms are the backbone of this type of agreement. This includes the total purchase price, any down payment made at the time of sale, the amount financed, the annual percentage rate (APR) of interest, the total finance charge, and the total number of payments. Each scheduled payment’s amount and due date must be laid out, giving the buyer a clear roadmap of their financial obligations and when they are expected.

Beyond the payment schedule, a robust contract includes provisions addressing what happens in various scenarios. Clauses about late payment penalties, default conditions, and remedies available to the seller if the buyer fails to meet their obligations are standard. It also typically outlines the buyer’s rights, such as the right to prepay the balance without penalty, which is often a significant consideration for consumers.

Finally, state and federal laws heavily regulate retail installment sales contracts, particularly consumer protection statutes. These laws dictate what must be included in the contract, how interest rates are calculated, and what disclosures are required. Therefore, any template you use must be adaptable to specific jurisdictional requirements to ensure it remains legally sound and enforceable.

The Practical Benefits of Using a Reliable Template

Opting for a well-designed template when drafting your retail installment sales contract can save an immense amount of time and resources. Instead of starting from scratch and trying to remember every single legal requirement and necessary clause, a template provides a professional, structured foundation. This allows businesses to quickly generate compliant contracts for each sale, significantly streamlining their sales process and improving operational efficiency.

Furthermore, using a consistent template helps ensure uniformity across all your sales agreements. This consistency not only projects a professional image but also minimizes the risk of inadvertently omitting critical information or clauses that could lead to legal vulnerabilities down the line. A standardized approach means that both your staff and your customers become familiar with the format and content, making the contracting process smoother and more transparent for everyone.

While a template provides a strong starting point, it’s essential to customize it to fit the specific details of each transaction and the particular laws of your jurisdiction. This might involve adjusting payment schedules, adding specific warranties, or including unique terms related to the goods or services being sold. Always review the complete document before signing, making sure all blanks are filled accurately and that both parties fully understand and agree to all the terms. A comprehensive retail installment sales contract template is a foundational element for secure and compliant transactions.

For both businesses and consumers, clarity and legal compliance are paramount when entering into an installment agreement. Businesses benefit from protected interests and a clear path for recourse, while consumers gain transparency regarding their financial commitments and rights. A well-constructed contract fosters trust and ensures that everyone understands their role and responsibilities throughout the payment term.

Therefore, whether you’re a seller regularly offering installment plans or a buyer looking to understand the fine print of your next big purchase, having access to and knowledge about a solid contract is incredibly empowering. It sets the stage for a smooth, dispute-free transaction, allowing both parties to move forward with confidence in their agreement.