Navigating the world of credit and financing can often feel like a complex maze, especially when it comes to understanding why you might receive certain rates or terms. Financial institutions frequently use what’s known as “risk-based pricing,” where the interest rates and other conditions offered to a consumer are directly influenced by their perceived credit risk. This approach allows lenders to tailor offers, providing more favorable terms to those with strong credit histories and adjusting them for individuals who might represent a higher lending risk.

While this system helps lenders manage risk, it also places a responsibility on them to be transparent with consumers. This is where the importance of a well-crafted risk based pricing notice template comes into play. Federal regulations, particularly the Fair Credit Reporting Act (FCRA), mandate that creditors provide a notice to consumers when they are offered less favorable terms because of information in their credit report. This notice isn’t just a formality; it’s a crucial consumer protection, informing individuals about the factors influencing their credit offers and their rights to access and dispute credit report information.

Understanding these requirements and having a clear, compliant notice is vital for any business extending credit. A robust template not only ensures you meet your legal obligations but also fosters trust and clarity with your customers. Let’s delve into what makes an effective notice and how you can develop one that serves both your business and your clientele.

Understanding the Essentials of a Risk Based Pricing Notice

When a lender decides to offer credit terms that are “materially less favorable” than those offered to other consumers, based even in part on a credit report, a risk-based pricing notice becomes a non-negotiable requirement. This isn’t necessarily an outright denial of credit, but rather an indication that the consumer’s creditworthiness, as reflected in their credit report, has led to less advantageous rates, higher fees, or other less desirable terms compared to what might be available to someone with a stronger credit profile. The purpose of this notice is to empower consumers with knowledge, prompting them to review their credit report for accuracy and take steps to improve their financial standing if necessary.

The core philosophy behind this regulation is transparency. Consumers have a right to understand the information used to make decisions about their financial products. Without such a notice, individuals might remain unaware that their credit report played a role in receiving a higher interest rate on a car loan or a credit card, for example. This transparency allows for a fair and equitable credit marketplace, enabling consumers to challenge inaccuracies and address legitimate concerns.

Moreover, providing a comprehensive and clear notice helps businesses maintain compliance with federal law, avoiding potential penalties and fostering a reputation for ethical lending practices. It demonstrates a commitment to consumer rights and responsible business operations. A well-designed risk based pricing notice template is therefore not just a compliance tool, but also a bridge for better consumer relations.

The regulations governing these notices are precise about what information must be conveyed. Omitting key details or presenting them in a confusing manner can lead to non-compliance, even if a notice was technically issued. Therefore, attention to detail is paramount when constructing or customizing your template.

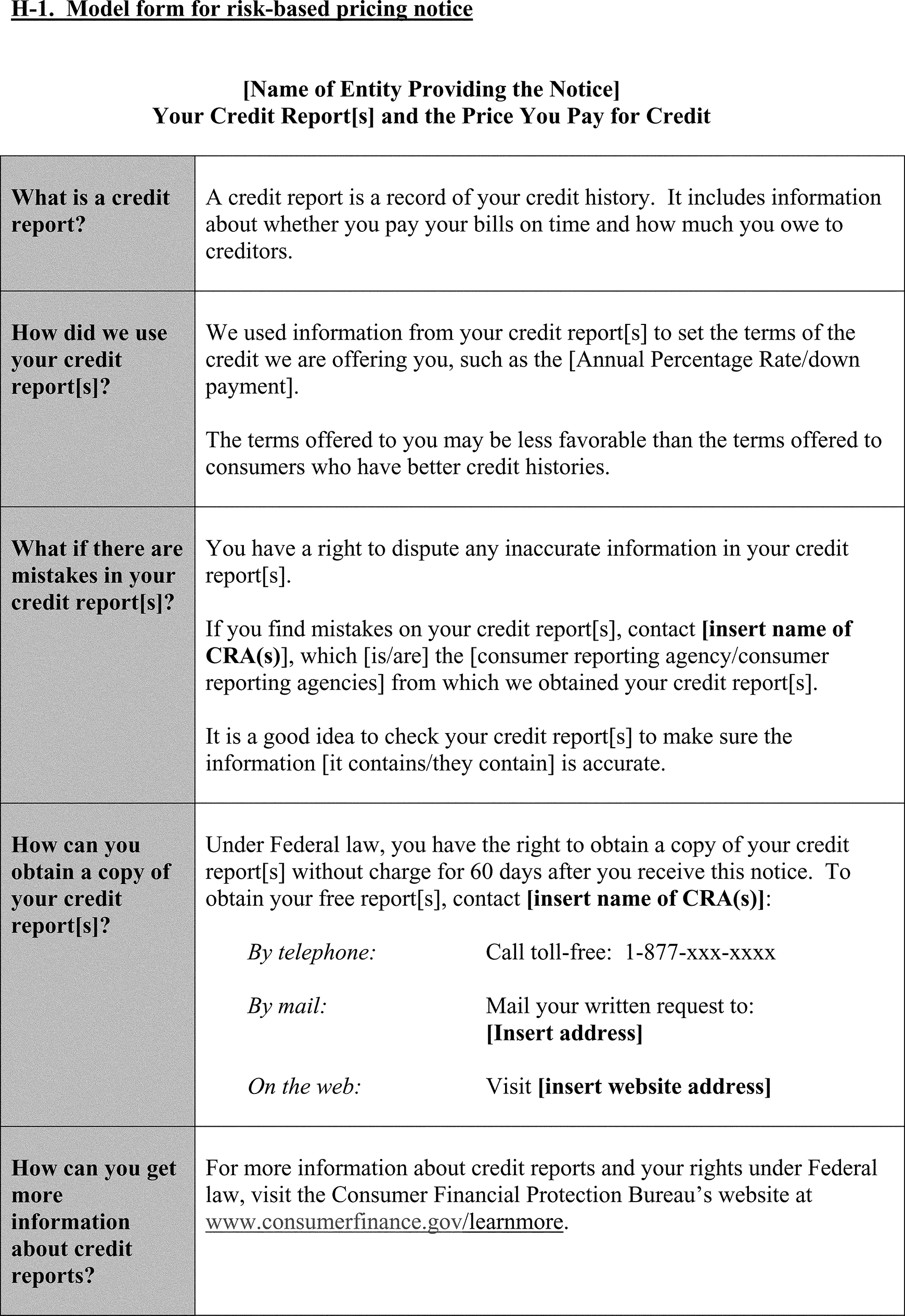

Key Components Your Notice Must Include

- A clear statement that the terms offered are less favorable than those offered to some other consumers and that this decision was based on information from a consumer report.

- Identification of the consumer reporting agency (CRA) from which the information was obtained, including its name, address, and toll-free telephone number.

- A statement that the consumer reporting agency did not make the decision to offer less favorable terms and cannot provide the consumer with specific reasons for that decision.

- Information about the consumer’s right to obtain a free copy of their consumer report from the CRA within 60 days.

- Details about the consumer’s right to dispute the accuracy or completeness of any information in the consumer report furnished by the CRA.

- A statement encouraging the consumer to obtain and review their consumer report to verify the accuracy of the information presented.

Beyond these mandatory elements, an effective notice should also be written in plain language, avoiding jargon that might confuse the average consumer. The easier it is for someone to understand their rights and the information presented, the more effective the notice will be in achieving its regulatory goals.

Crafting Your Own Risk Based Pricing Notice Template

Developing a robust risk based pricing notice template requires careful consideration of both legal requirements and user-friendliness. While various sample templates exist, customizing one to fit your specific business processes and branding is often the best approach. Begin by ensuring that all the federally mandated disclosures are present and correctly worded. This is your foundation for compliance.

Think about the tone and clarity of your language. A conversational and empathetic tone, while still being professional, can make the notice less intimidating for consumers. Avoid overly legalistic phrasing where possible, opting instead for straightforward explanations. Remember, the goal is to inform, not to confuse or alarm. Consider how the notice will be delivered – whether electronically or via mail – and design it to be easily readable in both formats. For example, using clear headings, bullet points, and ample white space can significantly improve readability.

Regularly review and update your template. Laws and regulations can change, and your business practices might evolve. Establishing a periodic review process ensures that your risk based pricing notice template remains compliant and relevant. This proactive approach helps mitigate risks associated with non-compliance and reinforces your commitment to transparent and fair dealings with your customers.

Ensuring your team is well-trained on when and how to issue these notices is also crucial. A perfectly drafted template is only effective if it’s used correctly and consistently. Develop clear internal guidelines for staff to follow, detailing the triggers for issuing a notice and the precise method of delivery. This consistency not only protects your business but also ensures a uniform and fair experience for all your customers.

Ultimately, a well-implemented notice system fosters trust and open communication between financial institutions and their customers. It provides consumers with the tools they need to understand their financial standing and empowers them to take action if they believe their credit report contains inaccuracies, leading to a more informed and equitable financial ecosystem for everyone involved. Investing time in developing and maintaining an excellent template is an investment in both compliance and customer relations.