Thinking about selling your small business or perhaps buying one? It’s an exciting time, full of potential, but also packed with important details that can’t be overlooked. One of the most critical elements you’ll need is a comprehensive legal agreement, and often, starting with a robust sale of small business contract template can make all the difference. This document lays out the entire framework of the transaction, protecting both the buyer and the seller from misunderstandings and future disputes.

Navigating the complexities of business transactions can feel overwhelming, especially when it comes to the legalities. From defining what assets are included to setting payment terms and outlining post-sale responsibilities, there are countless provisions to consider. Without a clear and detailed contract, you risk leaving crucial aspects open to interpretation, which can lead to costly problems down the line.

This article aims to demystify the process, guiding you through the essential components of a small business sale contract. We’ll explore what makes a contract solid, the benefits of using a well-crafted template as your foundation, and how to approach this significant step with confidence.

The Anatomy of a Solid Small Business Sale Contract

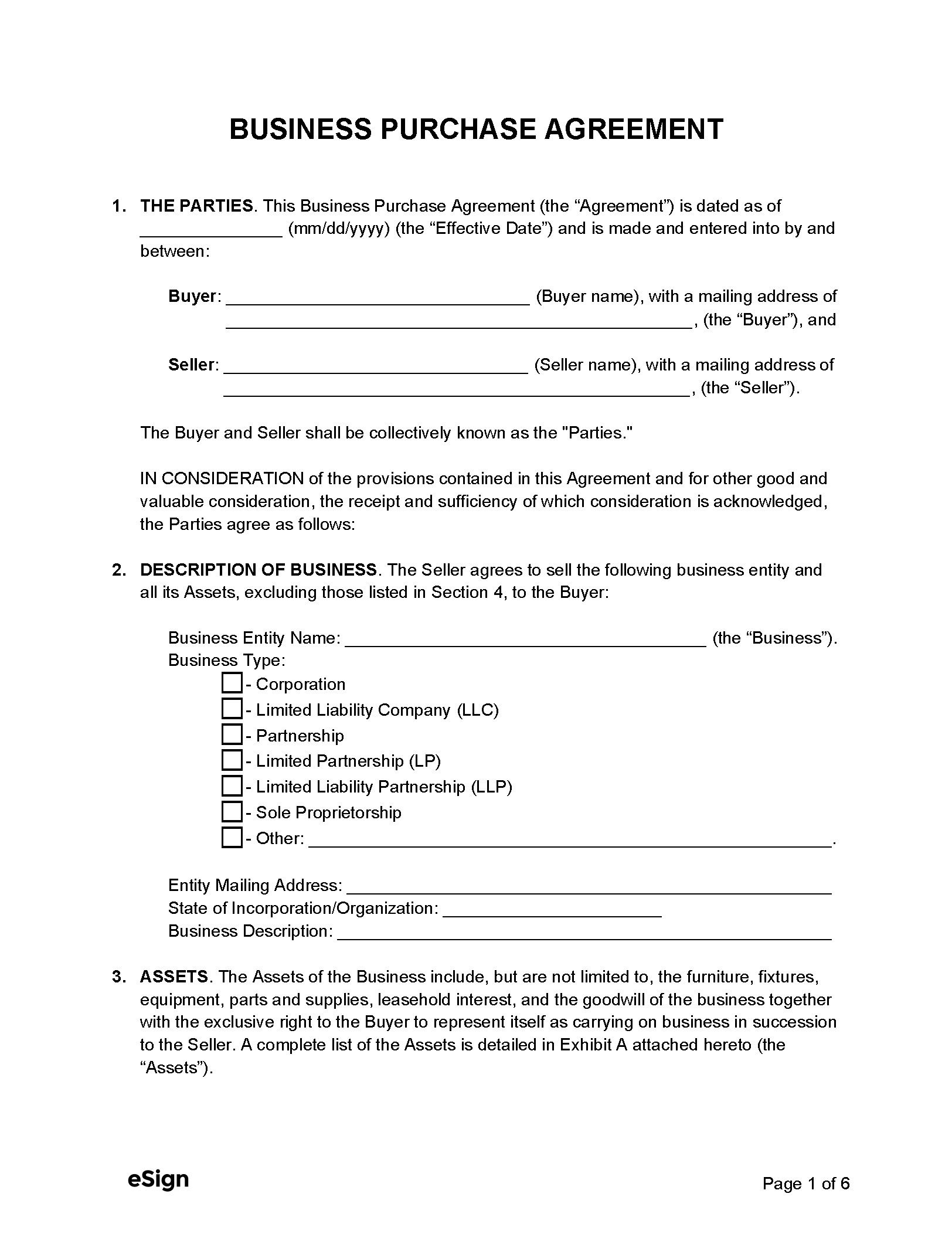

When it comes to transferring ownership of a business, the contract is much more than just a piece of paper; it’s the legal blueprint for the entire deal. A thorough contract ensures that both parties clearly understand their rights, obligations, and the agreed-upon terms. Let’s delve into the key sections that typically make up such a vital document.

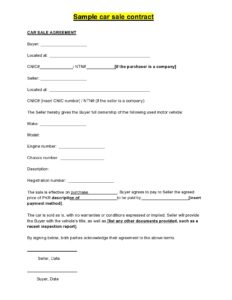

One of the first things a contract establishes are the parties involved and the effective date. This might seem basic, but clearly identifying the buyer and seller, including their legal names and addresses, prevents any ambiguity. The effective date is also crucial, as it often dictates when certain obligations begin or end. Without this fundamental clarity, the rest of the agreement can lose its footing.

Key Financials and Payment Structure

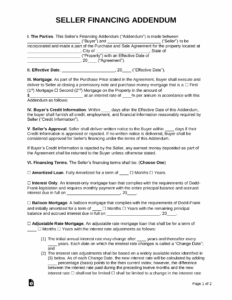

Next up is the purchase price and how it will be paid. This is often the heart of the negotiation. The contract must explicitly state the total sale price, but it doesn’t stop there. It should detail the payment terms, such as any down payment required, whether payments will be made in installments, and if so, the schedule and interest rates. Sometimes, part of the payment might be contingent on future business performance, known as an earn-out, which also needs meticulous outlining. Escrow arrangements, where a third party holds funds until certain conditions are met, are also common and need to be clearly defined.

Understanding Assets and Liabilities

What exactly is being sold? This section itemizes all assets included in the sale. This isn’t just about tangible items like equipment, inventory, and real estate. It also encompasses intangible assets, which are often the true value of a small business. Think customer lists, intellectual property (trademarks, copyrights, patents), goodwill, existing contracts, and software licenses. Just as important is clarifying which liabilities, if any, the buyer will assume. This could include outstanding debts, pending lawsuits, or existing lease agreements. Explicitly listing what is included and excluded prevents future disputes.

Seller’s Promises and Post-Sale Agreements

Representations and warranties are essentially promises made by the seller about the state of the business. These could cover everything from the accuracy of financial statements to the absence of undisclosed lawsuits or environmental issues. If these representations turn out to be false, the buyer typically has legal recourse. Covenants, on the other hand, are promises about what both parties will or won’t do, either before or after the closing date. Common covenants include non-compete clauses, confidentiality agreements, and promises to continue operating the business in a specific manner until the sale is finalized.

Closing conditions specify what needs to happen before the deal can officially close. This might include obtaining necessary permits, securing financing, or receiving third-party consents. Indemnification clauses protect one party from financial loss caused by the other, often relating to breaches of the contract or misrepresentations. Finally, details regarding dispute resolution (arbitration, mediation, or litigation) and the governing law (which state’s laws will apply) are vital for resolving any disagreements that might arise. Each of these components, when carefully crafted, builds a robust foundation for the transition of ownership.

Why a Template Might Be Your Best Starting Point

Embarking on the journey of buying or selling a small business can be incredibly demanding, and legal fees can quickly add up. This is precisely why a well-structured sale of small business contract template can be an invaluable asset. It’s not about cutting corners on legal advice, but rather about streamlining the initial process and ensuring all critical bases are covered from the outset.

Think of a template as a comprehensive checklist and a pre-built framework. It provides you with a clear outline of all the essential clauses and provisions that are typically found in such agreements. This saves you significant time and effort compared to starting from a blank page, ensuring you don’t inadvertently overlook crucial legal language or specific requirements that are common in business transactions. It helps you organize your thoughts and prepare for discussions with the other party and your legal counsel.

Here are some of the practical advantages of beginning with a template:

- **Cost-Effectiveness:** Reduces the amount of time your attorney needs to draft the document from scratch, potentially lowering legal fees.

- **Time-Saving:** Provides a ready-made structure, allowing you to focus on customizing the specific terms of your deal rather than building the document from the ground up.

- **Comprehensive Coverage:** Most reputable templates are designed by legal professionals and cover a broad spectrum of common scenarios and legal requirements, ensuring key aspects aren’t missed.

- **Negotiation Aid:** Serves as an excellent tool for initiating discussions and negotiations, clearly outlining points that need to be addressed and agreed upon.

While a template is a fantastic starting point, it’s crucial to remember that it should always be customized to fit the unique specifics of your transaction. No two business sales are exactly alike, and what works for one might not be suitable for another. It is always recommended to have a qualified legal professional review and adapt the template to your particular circumstances, ensuring it fully protects your interests and complies with all relevant laws.

A carefully drafted and executed contract is the cornerstone of any successful small business transaction. It acts as a clear roadmap, guiding both buyer and seller through the complexities of ownership transfer with transparency and mutual understanding. Taking the time to get this document right can prevent countless headaches and ensure a smooth transition, allowing both parties to move forward confidently with their respective plans.

Ultimately, whether you’re a seasoned entrepreneur or a first-time business owner, approaching the sale or purchase of a business with a well-thought-out legal agreement is paramount. It provides the necessary security and clarity, ensuring that the exciting journey of business ownership transfer is as seamless and legally sound as possible.