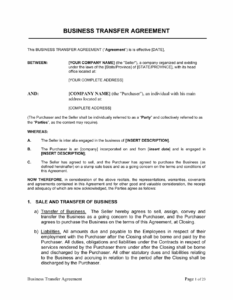

Considering buying or selling a business can feel like navigating a complex maze, especially when it comes to the financial side of things. Traditional bank loans aren’t always a perfect fit for every deal, leading many entrepreneurs to explore alternative arrangements. This is where seller financing steps in, offering a flexible and often mutually beneficial path forward for both parties involved. It’s essentially when the person selling the business acts as the lender, helping the buyer acquire the company without needing to secure full external funding right away.

This arrangement, while incredibly useful, absolutely hinges on having a clear, comprehensive agreement in place. Without a robust contract, both seller and buyer are exposed to significant risks. It’s not just about agreeing on a price; it’s about meticulously detailing the terms, conditions, and contingencies that will govern the transaction and the ongoing payment relationship. A well-drafted document provides the necessary framework for a smooth transition and ensures everyone understands their rights and obligations throughout the financing period.

Key Components of a Robust Seller Financing Business Contract Template

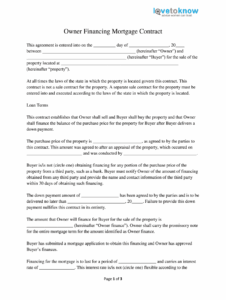

When you’re dealing with seller financing, the contract isn’t just a formality; it’s the backbone of the entire agreement. A strong seller financing business contract template needs to cover every possible scenario and clearly define the roles and responsibilities of both the buyer and the seller. Skipping crucial details here can lead to misunderstandings, disputes, and potentially costly legal battles down the line. It’s about protecting both parties and ensuring a fair and transparent process.

Firstly, the contract must meticulously identify the parties involved – the legal names and addresses of both the buyer and the seller – and provide a comprehensive description of the business being sold. This includes its assets, liabilities, intellectual property, and any specific exclusions. Clarity here prevents future arguments about what exactly was part of the deal. Without this foundational understanding, the rest of the contract stands on shaky ground.

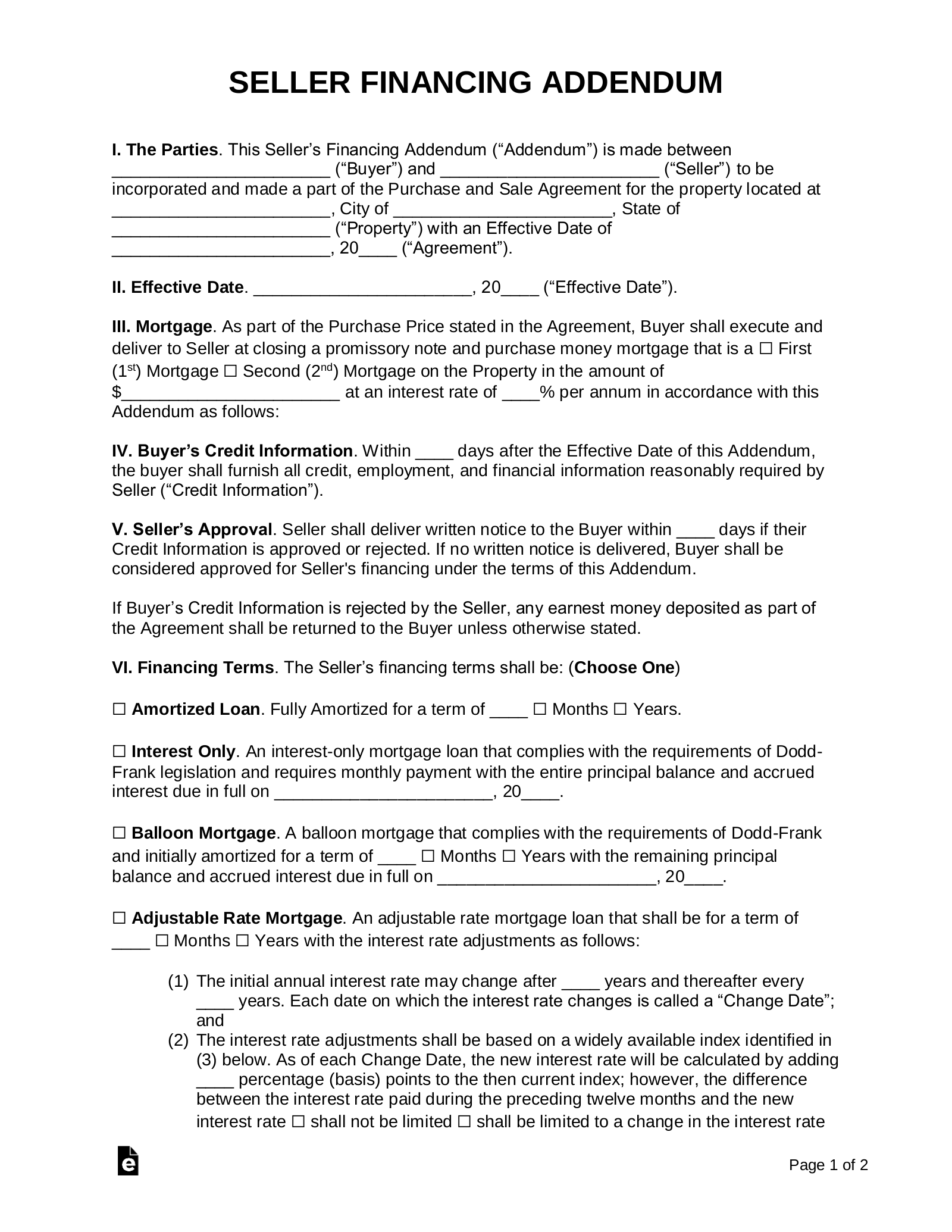

Purchase Price and Payment Terms

This is arguably the most critical section. The contract must clearly state the total purchase price of the business, the amount of the down payment, and the specific portion being financed by the seller. Beyond the numbers, it needs to detail the payment schedule: whether payments are monthly, quarterly, or another interval, the exact due dates, and the method of payment. Ambiguity in payment terms is a recipe for disaster.

Interest Rates and Amortization Schedule

If interest is being charged on the financed amount, the annual interest rate must be explicitly stated. Furthermore, a detailed amortization schedule, showing how each payment is allocated between principal and interest, is incredibly helpful. This provides transparency and allows both parties to track the loan’s progress accurately. It’s also important to specify whether there are any prepayment penalties or discounts for early payoff.

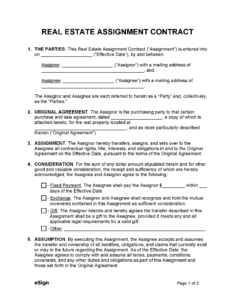

Collateral and Security

In most seller financing arrangements, especially for the seller’s protection, there will be collateral. This could be the business’s assets themselves, personal guarantees from the buyer, or other forms of security. The contract must clearly define what constitutes collateral and outline the seller’s rights in the event of a default, such as the ability to repossess assets or call on a personal guarantee.

Default Clauses and Remedies

No one wants to think about things going wrong, but a good contract anticipates it. This section defines what constitutes a “default” – missing payments, bankruptcy, breach of other covenants – and outlines the specific remedies available to the non-defaulting party. This might include acceleration clauses (making the entire remaining balance due immediately) or the right to pursue legal action.

Covenants and Representations

Both parties will make certain promises and statements of fact. The seller might represent that the financial statements are accurate or that there are no undisclosed liabilities. The buyer might covenant to operate the business in a certain way or maintain specific insurance policies. These clauses ensure that both sides are transparent and committed to the integrity of the deal.

Navigating the Benefits and Pitfalls of Seller Financing

Seller financing, when structured correctly using a comprehensive seller financing business contract template, offers compelling advantages for both sellers and buyers. For sellers, it can significantly broaden the pool of potential buyers, as it reduces the upfront capital requirement for the purchaser. This often translates into a quicker sale and, sometimes, even a higher overall selling price, as sellers can command a premium for offering flexible terms. Furthermore, it allows the seller to spread out capital gains over several years, which can have favorable tax implications depending on their individual financial situation.

Buyers, on the other hand, benefit immensely from the reduced barrier to entry. They might not qualify for traditional bank loans or may simply prefer a more flexible repayment structure. Seller financing often comes with more accommodating terms than conventional lenders, potentially lower interest rates, and a faster closing process since fewer third parties are involved. It also demonstrates the seller’s confidence in the business’s future success, as their financial stake is tied to the buyer’s ability to generate revenue and make payments. This alignment of interests can foster a collaborative relationship during the transition period.

However, it’s crucial to acknowledge the potential downsides for both parties. For sellers, the primary risk is the buyer defaulting on payments. This can lead to a lengthy and expensive process of recovering the business or the outstanding debt. While collateral helps mitigate this, it doesn’t eliminate the hassle or potential loss of income. Sellers also need to be comfortable with their capital being tied up in the business loan, rather than being immediately liquid.

Buyers also face their own set of risks. If the business doesn’t perform as expected, they are still obligated to make payments, potentially straining their finances. The terms of the seller financing might also be less favorable than anticipated, or the seller might retain too much control through restrictive covenants. Therefore, meticulous due diligence and careful negotiation of every clause within the seller financing business contract template are absolutely essential.

- For Sellers:

- Wider buyer pool

- Potentially higher sale price

- Tax deferral opportunities

- Risk of buyer default

- Capital tied up in loan

- For Buyers:

- Easier access to capital

- Flexible terms and lower closing costs

- Faster transaction process

- Risk of business underperformance

- Potentially restrictive covenants

Entering into a seller financing agreement is a significant step that can be incredibly rewarding when handled thoughtfully. The cornerstone of any successful arrangement lies in the thoroughness and clarity of the legal document governing it. By carefully crafting and reviewing every clause, both buyers and sellers can ensure their interests are protected and the transaction proceeds smoothly, paving the way for a successful transition and future for the business.

Ultimately, a detailed agreement sets the stage for a strong, amicable relationship between the parties long after the ink has dried. It minimizes misunderstandings and provides a clear roadmap for addressing any challenges that may arise, ensuring that the dream of business ownership or a successful divestment can truly become a reality.