Stepping into or out of the world of business ownership is a significant life event, often marked by excitement, a bit of apprehension, and a whole lot of paperwork. Whether you are selling your beloved venture or acquiring a new one, the process involves numerous intricate details that need to be clearly defined and legally binding. Without a robust agreement, both parties could find themselves navigating a sea of misunderstandings, potential disputes, and unforeseen liabilities.

This is precisely where a clear, comprehensive contract comes into play. It acts as the backbone of the entire transaction, ensuring that everyone involved is on the same page and that their rights and responsibilities are explicitly outlined. Having a reliable transfer of business ownership contract template can significantly streamline this complex process, providing a structured framework that guides you through the necessary legal considerations.

What Absolutely Needs To Be In Your Business Transfer Agreement

When you are looking to formally transfer ownership of a business, the contract isn’t just a formality; it’s the very foundation of the deal. Think of it as the blueprint that maps out every single aspect of the transaction, protecting both the buyer and the seller from potential pitfalls down the road. A well-drafted agreement ensures clarity, transparency, and legal enforceability, preventing disputes by clearly articulating the terms and conditions. It’s not enough to have a handshake; you need details, and lots of them.

The journey of business transfer can be tricky, filled with various legal and financial considerations. That is why it is crucial to ensure that your contract covers all bases, leaving no room for ambiguity. From identifying the exact assets being transferred to outlining payment schedules and post-sale responsibilities, every clause plays a vital role in safeguarding your interests. Skipping over seemingly minor details now can lead to major headaches later, so thoroughness is key.

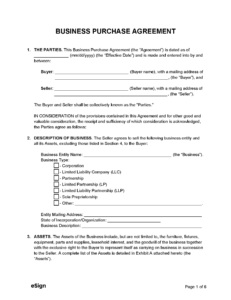

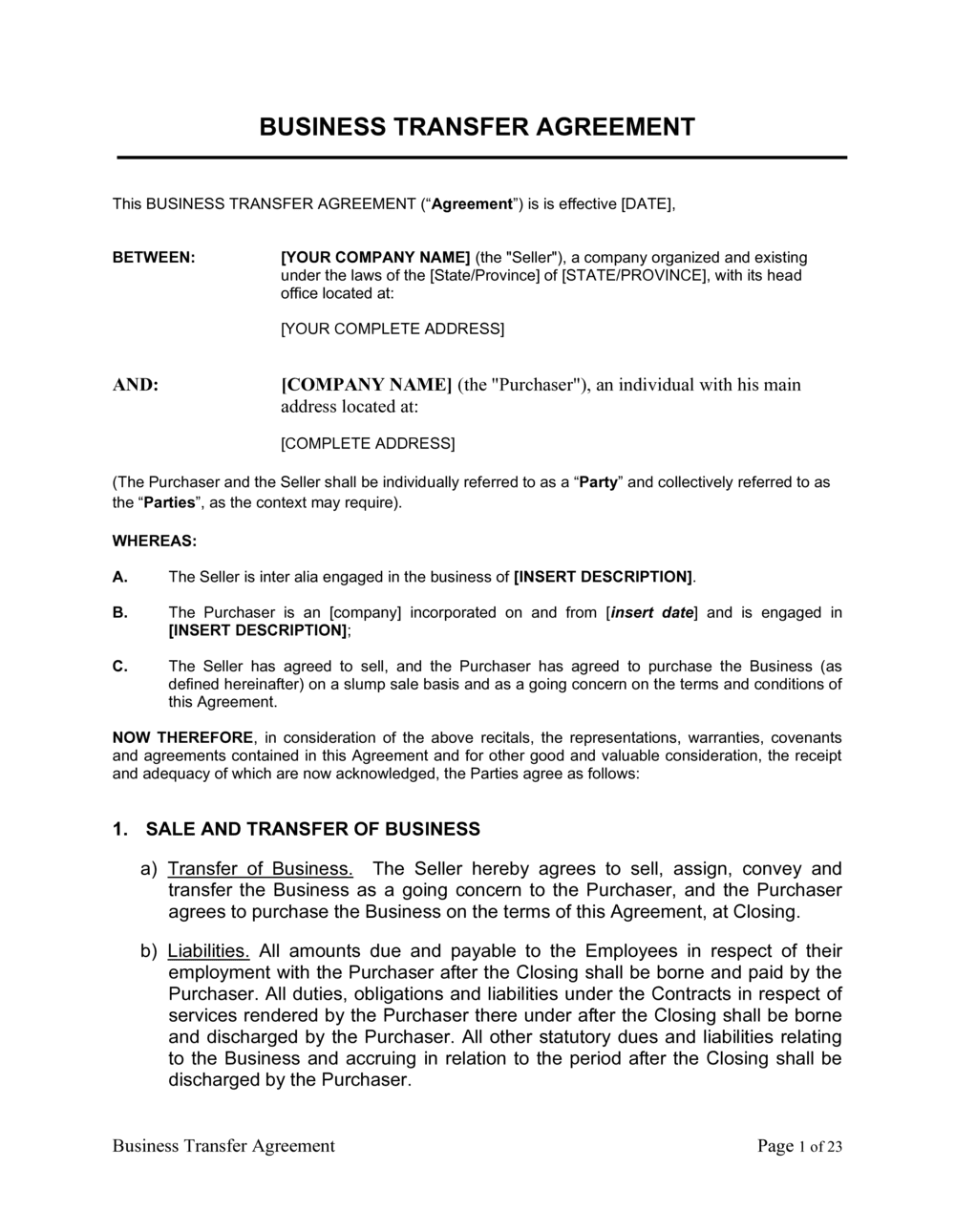

Identifying the Parties Correctly

First and foremost, the contract must accurately identify all parties involved. This means specifying the full legal names of the seller(s) and buyer(s), their respective legal structures (e.g., individual, corporation, LLC), and their official addresses. Clarity here prevents any confusion about who is legally bound by the agreement. You want to make sure the agreement is between the correct legal entities, leaving no doubt as to who is responsible for what.

Understanding the Deal Structure

One of the most critical decisions in any business transfer is how the deal is structured. This largely dictates the tax implications and legal liabilities for both parties. Your contract must explicitly state whether the transaction is an asset purchase or a stock purchase.

- Asset Purchase: This involves the buyer purchasing specific assets of the business (e.g., equipment, inventory, customer lists, intellectual property) rather than the entire legal entity. The selling entity usually retains its corporate shell and any liabilities not expressly transferred. This approach can be appealing to buyers as it allows them to pick and choose assets and potentially avoid certain liabilities of the past business.

- Stock Purchase: Here, the buyer acquires the shares or ownership interests of the selling company. This means the buyer effectively steps into the shoes of the previous owner, taking on both the assets and all existing liabilities of the business entity. For sellers, it can be simpler, as they are selling their stake in the company as a whole.

Defining the Purchase Price and Payment Schedule

Naturally, the purchase price is a central component of any business sale. The contract needs to clearly state the agreed-upon total purchase price. Beyond that, it must detail the payment terms, including any initial deposits, installment payments, financing arrangements, and conditions for release of funds. Are there earn-outs tied to future performance? Is there seller financing involved? All these financial nuances must be meticulously documented to avoid any disputes down the line.

Protecting Your Interests During The Transition And Beyond

Beyond the core financial and structural elements, a comprehensive contract goes further to protect both parties during and after the ownership transfer. It anticipates potential issues and lays out mechanisms for addressing them, ensuring a smoother transition and providing peace of mind for everyone involved. Think about what could go wrong, and then write clauses that mitigate those risks.

A crucial aspect of this protection comes from the representations and warranties section. Here, the seller makes specific factual statements about the business’s condition, finances, and legal standing as of a certain date. For example, the seller might warrant that all financial statements provided are accurate or that there are no undisclosed legal disputes. If these statements turn out to be false, the buyer typically has recourse.

Equally important is the indemnification clause. This specifies how losses or damages arising from certain events (like breaches of representations and warranties, or pre-existing liabilities) will be allocated between the buyer and seller. It’s essentially a promise by one party to compensate the other for specified costs or damages, providing a critical layer of protection against unforeseen issues.

Key Protective Clauses to Consider

- Representations and Warranties: These are crucial assurances from the seller about the business’s condition, including financial health, assets, liabilities, and legal compliance.

- Indemnification: This clause outlines how one party will compensate the other for losses or damages resulting from specific events or breaches of the agreement.

- Non-Compete and Confidentiality Agreements: Often, the buyer will want the seller to agree not to start a competing business for a certain period and geographical area, and to keep confidential proprietary business information.

- Dispute Resolution and Governing Law: These clauses specify how any disagreements will be resolved (e.g., mediation, arbitration, litigation) and which jurisdiction’s laws will govern the contract.

Finally, the transfer of business ownership contract template should address crucial post-closing responsibilities. This might include clauses about employee retention, how outstanding debts will be handled, or even a transition assistance period where the seller helps the buyer get up to speed. Having these elements clearly defined ensures a smooth handover and helps the new owner hit the ground running without unnecessary complications.

The journey of transferring business ownership, whether you are the buyer or the seller, is multifaceted and demanding. While the thought of crafting a perfect legal document might seem daunting, utilizing a well-structured contract template can provide an invaluable starting point. It helps ensure that all critical components are considered and included, safeguarding the interests of all parties involved and paving the way for a successful transition.

Remember, a template is a foundational tool, not a substitute for tailored legal advice. Once you have a working draft using a robust transfer of business ownership contract template, it is always wise to consult with a legal professional. They can help customize the document to your specific circumstances, ensuring it fully complies with all relevant laws and adequately protects you from any unique risks associated with your particular business transaction.