Understanding and complying with labor laws is a critical responsibility for any employer. Wage theft, unfortunately, remains a prevalent issue, impacting countless employees and carrying significant legal consequences for businesses that fail to adhere to proper wage and hour regulations. These laws are designed to protect workers from unfair pay practices, ensuring they receive the compensation they’ve earned, precisely when they expect it.

To combat this, many states have enacted robust legislation, such as the Wage Theft Prevention Act (WTPA), which places specific requirements on employers regarding how they inform their employees about their wages, paydays, and other essential employment terms. A clear and comprehensive wage theft prevention act notice template is not just a helpful tool; it’s often a legal necessity that serves as a cornerstone of transparent and compliant employment practices.

This article will guide you through the intricacies of these acts, explain what you need to include in your notices, and help you understand how to effectively use a standardized template to protect both your business and your employees from potential misunderstandings and legal pitfalls.

Understanding the Wage Theft Prevention Act and Your Responsibilities

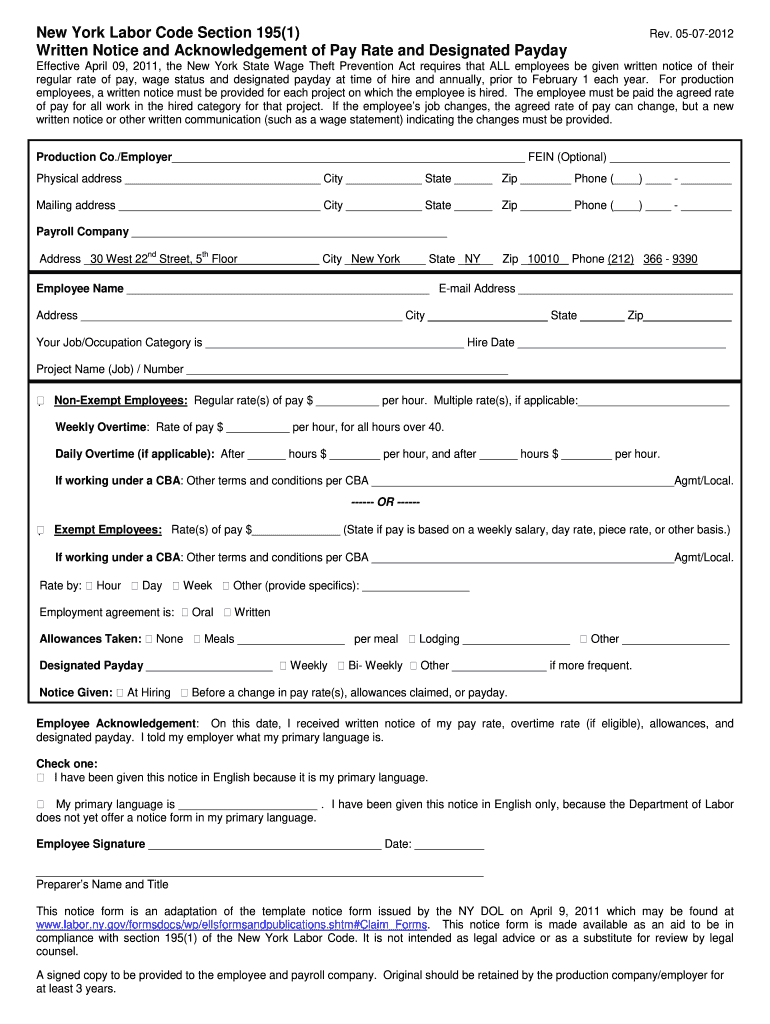

The Wage Theft Prevention Act, often abbreviated as WTPA, is a critical piece of legislation primarily known through its enactment in states like New York, though similar laws exist across the country. Its core purpose is to increase transparency between employers and employees regarding wage information, aiming to reduce instances of wage theft, which can include issues like unpaid overtime, illegal deductions, or not paying minimum wage. For employers, this means a set of specific obligations that, if not met, can lead to substantial penalties.

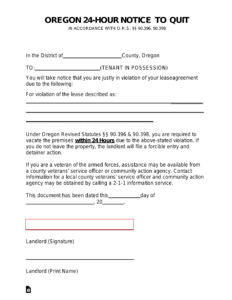

One of the most significant requirements under the WTPA is the mandatory written notice to employees. This isn’t just a friendly heads-up; it’s a formal document that must be provided at the time of hiring and often again when any changes occur to the employee’s pay rate, payday, or other specific details. The idea behind this is to ensure every employee clearly understands their terms of employment from day one, leaving no room for ambiguity or disputes down the line.

Employers are also typically required to provide detailed wage statements with each paycheck. These statements must itemize hours worked, pay rates, deductions, and gross and net wages. Maintaining accurate records for several years is another common component, allowing authorities to verify compliance if an issue arises. The burden of proof often falls on the employer to demonstrate that they have met all their legal obligations.

Failing to comply with the WTPA can have severe repercussions. These can range from monetary penalties and fines for each violation to having to pay back wages, liquidated damages, and even attorney’s fees to affected employees. Beyond the financial implications, non-compliance can significantly damage a company’s reputation, making it harder to attract and retain talent in the future.

Given the complexities and strict requirements, relying on a well-structured and legally sound template is incredibly beneficial. It ensures that all necessary information is consistently provided, reducing the risk of accidental omissions or errors that could lead to non-compliance. It serves as a consistent framework that streamlines the onboarding process and helps maintain accurate records.

Key Elements of a Compliant Wage Notice

A robust wage notice template must cover several essential pieces of information to be considered compliant under most Wage Theft Prevention Acts. While specific requirements can vary slightly by state, generally, your notice should include:

* The employee’s rate or rates of pay, and the basis thereof, whether paid by the hour, shift, day, week, salary, piece, commission, or other.

* Any allowances claimed as part of the minimum wage, such as tips, meal credits, or lodging credits.

* The regular payday for the employee.

* The employer’s name, doing business name (if different), physical address, and telephone number.

* The employee’s name and address.

* The effective date of the notice.

* The overtime rate of pay, if applicable.

* Space for both the employer and employee signatures to acknowledge receipt.

Crafting Your Own Wage Theft Prevention Act Notice Template

Developing a reliable wage theft prevention act notice template for your business is a proactive step that offers numerous benefits. It not only helps you meet legal obligations but also fosters a transparent and trusting relationship with your employees. A well-designed template ensures consistency across your workforce, making it easier to manage payroll and avoid potential disputes stemming from misunderstandings about pay or working conditions.

When creating your template, the first and most crucial step is to research your specific state’s Wage Theft Prevention Act or similar wage and hour laws. While there are common elements, each state may have unique requirements regarding what must be included, how it’s presented, and when it needs to be delivered. You might find state-provided samples or guidelines that can serve as an excellent starting point for customization.

Beyond legal compliance, consider the practical aspects of using your template. It should be easy to fill out, clearly formatted, and use plain language that all employees can understand. Think about how you will distribute these notices—electronically or in paper form—and how you will securely store signed copies for your records. Providing notices in multiple languages may also be a legal requirement or a best practice if you have a diverse workforce.

Ensuring your business adheres to all aspects of the Wage Theft Prevention Act is more than just ticking a box; it’s about building a foundation of fairness and clarity within your organization. A thoughtfully prepared and consistently used notice template safeguards your company against legal challenges while demonstrating your commitment to ethical employment practices.

By taking the time to understand the requirements and implement robust internal processes, you create a workplace where employees feel valued and secure in their compensation. This proactive approach not only helps you avoid potential legal issues but also contributes significantly to a positive and productive work environment for everyone involved.